How iPhones will absolutely change the insurance industry

GetSafe puts you in control of your insurance coverage and costs

iPhones continue to cut the cost of insurance with a wave of agile developers now working to transform how the industry works. The latest app-based insurance solution from Getsafe is a fantastic illustration of insurance will change.

What is Getsafe?

Now available in Germany and the UK, Getsafe describes itself as a neo-insurer.

It offers you the chance to get the contents insurance coverage you need up to the value you want, when you want, using your iPhone.

Instead of a fixed contract with rigid conditions, Getsafe offers a modular insurance that customers can choose individually according to their needs and cancel on a monthly basis.

Both personal possessions and home content insurance are being made available. These include contents, bike, liability, drone insurance, legal and dental protection.

Real insurance with real backing

This is real insurance and is backed by trusted names from the traditional insurance industry: the award-winning Hiscox in the UK and Munich Re and AXA in Germany.

(AXA already uses iOS devices across the company).

The company has set out to rethink insurance and build one of the world’s leading digital insurers. To do so, it has used technology and machine learning to create a completely new insurance experience.

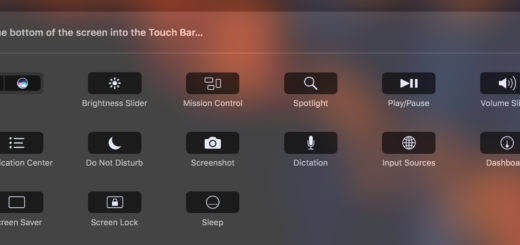

This means that with just a few clicks customers can take out insurance and also view and change any of their personal or insurance details at any time.

There’s also a 24/7 chatbot (Carla) to answer questions and report claims, making it far easier to file these.

The guys behind the service, Christian and Marius

Insurance for digital generation

Every report tells us Millennials (who are now the biggest group in the employment market) are already prepared to use new digital banking services, such as Revolut, N26 or TransferWise.

We also know they are embracing health insurance deals that track activity using Apple Watch.

Getsafe is applying a similar philosophy. “We want to create a new smartphone-based insurance experience for Millennials,” the company told me today.

It seems to be working. The company is already the fastest growing insurance provider for Millennials in Germany. CEO and founder Christian Wiens said:

“We have shown that our product meets a core need for the young, tech-savvy generation. With our insurance delivered through your smartphone, we are developing a product that fits perfectly with the living and communication habits of this generation.”

The ability to alter the insurance provided is a perfect illustration of the Millennial focus. It means young people, who often have fast-changing lives, can get the personal possessions insurance they need for where they are, and switch this off at will with no penalty.

Checking insurance cover? There’s an app for that

The insurance is provided by an app, and it is interesting how engaged the company’s customers have become with that app.

“Over a third of them return to our app every month to get information and to organize and protect what is most important to them in life. Such a high level of engagement has never been seen before in the insurance industry,” explains Wiens.

The company is also continuously developing its range of insurance products: the first fully digital life insurance policy for German customers will follow this year.

A quick checklist of service features

- Buy your insurance in the app, you can also cancel and extend it.

- Access documents anywhere.

- Share insurance with family.

- Interact with the chatbot.

- Get paid to recommend the service.

Up next:

I believe Getsafe is the thin end of what will become a very big wedge.

The insurance market is characterized by lack of trust – no one really likes their insurers and there are plenty of stories in which people didn’t necessarily get the protection they thought they were paying for. In addition, dealing with insurers remains a little like dealing with traditional banks – formal, distant, and a little unapproachable.

And this means the industry is ripe for seismic change.

Digitally-savvy people really value connections, and the idea that you can control your insurance using a smartphone is really appealing. Just like the legal service, it seems pretty clear that this industry is changing. And it should be for the better…

Please also read: How iOS can help you reduce your insurance premiums.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.