A Few Things About The Apple Credit Card Might Surprise You

It goes without saying that Apple is an industry leader when it comes to consumer technology. Apple products have led the way in terms of innovation and elegance, and it’s not surprising to see that the company is branching out.

The Apple Card is one of the company’s latest offerings — an attempt to reinvent the credit card and make it simpler, sleeker, and more efficient. According to industry experts like J.D. Power, the Apple Card is one of the best U.S. credit cards, and has ranked high in credit card satisfaction surveys even in the middle of the pandemic.

Thanks to Apple’s out-of-the-box designs, picking up an Apple Card might be a more astonishing experience than you think. Here are a few things about this new credit card that might surprise you.

It’s Online and Offline

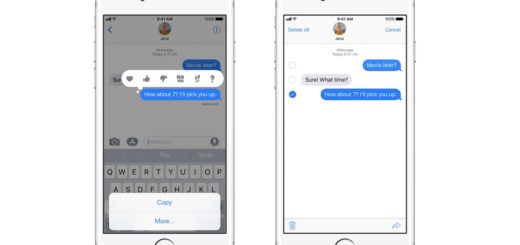

The Apple Card exists in two worlds: the online, and the offline. Offline, you have a sleek, titanium card that looks and feels expensive. Online, a virtual image of the card lives in your Apple Wallet, and you can pay with your iPhone and Apple Pay.

What does this mean, exactly? If you’re making purchases offline, you can simply swipe your Apple Card like a regular credit card and complete the transaction that way. But if you’re buying something online, all of your card information is in your Apple Wallet, and there’s no need to bring the physical card out at any point. It’s pretty much the best of both worlds.

It Has No CVV

If you’re not quite familiar with them, CVVs are defined by AskMoney as an extra layer of protection for credit card owners. These are numbers found on the back of your card that can be used as a second verification step, especially if the card itself is not present at the time of purchase.

CVV means card verification value, and it’s especially useful for keeping online purchases secure. Surprisingly enough, the Apple Card doesn’t actually have a CVV — or any numbers at all.

Instead, security codes are available to the card owner through the Apple Wallet. This way, there’s no useable information on the card itself, so you don’t have to worry if it ever gets lost or falls into the wrong hands.

Better Finance

In terms of user experience, the Apple Card and Apple Wallet are all about making finances easier. In fact, the Apple Card is touted as being the first credit card that actually discourages you from paying interest. How so? In this overview by Business Insider, we see that the Apple Card and Apple Wallet actually function as a pretty good finance management app.

Not only does the Apple Card not charge any annual fees, foreign transaction fees, or late fees, but when you open your Apple Wallet you’ll see your projected interest rates in real time. This makes it easier for you to plan out payments and manage your finances.

Apple also provides users with a weekly or monthly overview of their spending habits. You can thus track your spending and even separate expenses into different categories like Food or Entertainment. The Apple Card is pretty much an all in one experience that makes using a credit card look and feel completely stress-free.