Adobe Data Hints Apple Pay Later Had a Happy Thanksgiving

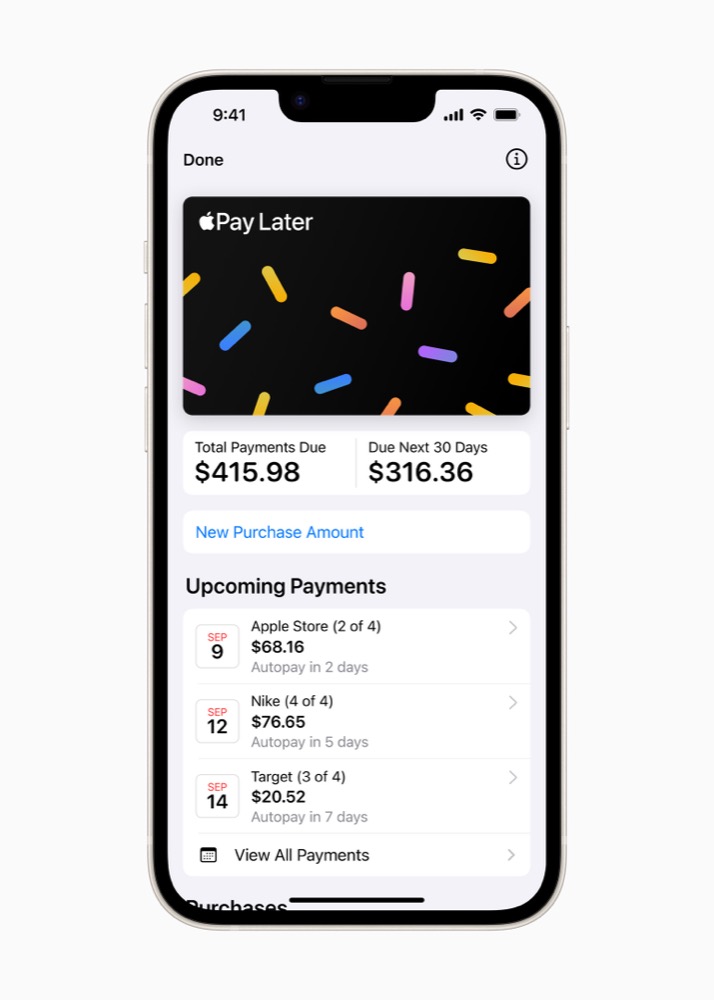

Pay it.. later…

We don’t really know the score yet, but early data from Adobe suggests Apple Watch may have been a sleeper success across the Thanksgiving US purchasing season – but so too may have been Apple’s Buy Now Pay Later service.

The Adobe data doesn’t spell it out, but with iPhone dominant in US mobile share and Apple Pay leading smartphone purchases, it’s reasonable to imagine Apple Pay Later had a pretty lucrative Thanksgiving season. Read on…

When BNPL shines, so must Apple Pay

Adobe tells us that Buy Now Pay Later (BNPL) sales hit all-time high on Cyber Monday. The value of this spending reached $940 million in online spend, up a staggering 42.5% YoY.

The number of items per order also rose 11% YoY. Adobe says that so far this season (Nov. 1 to Nov. 27), BNPL has driven a total of $8.3 billion in sales, up 17% on last. year. November 2023 is expected to be the biggest month on record for BNPL sales – and this must be positive news for the Apple Pay Later team.

After all, given that Apple Pay is by far the most popular mobile payment method it makes total sense to imagine a big chunk of those sales went through the Apple Pay Later service. That should contribute a few more dollars to Apple’s Magic Money Tree. (Don’t let anyone tell you magic money trees don’t exist, they do, it’s just that most of us don’t have access to one. We need to fix that).

You can also bet that Apple Pay was used for a large number of sales transactions. After all, iPhone is hugely popular in the US, and Apple Pay widely used.

Sales patterns, mostly mobile

At Thanksgiving, Adobe says 59% of online sales coming through a smartphone (compared to 55% in 2022). Over the five day season, smartphones drove 51.8% of online sales (up from 49.9% in 2022).

“Mobile has become a key growth driver in the digital economy, and the increased usage shows that many consumers now find the experience on par with desktop shopping,” Adobe said.

Otherwise the data shows that in the US at least consumers are getting wise to spending strategically.

That leads to bigger sales velocities when prices are reduced, and that seems to be the case here.

Consumers spent a total of $12.4 billion on Cyber Monday, up 9.6% YoY. The Adobe Digital Price Index, which tracks online prices across 18 product categories shows that e-commerce prices have fallen for over a year now (down 6% YoY in Oct. 2023).

What else we learned from Adobe?

In the peak hour (10:00 to 11:00 pm Eastern), consumers spent $15.7 million every minute. Cyber Monday remains the biggest online shopping day of all time, with many shoppers waiting to grab major discounts in categories such as electronics (peaking at 31% off listed price), toys (27%), apparel (23%), furniture (21%) and appliances (18%).

Top sellers on Cyber Monday included toys, gaming consoles such as Xbox and PlayStation, and smart watches. Other top sellers included skin care gift sets, small kitchen appliances (blenders, mixers, coffee pots), TVs, activity trackers, and Bluetooth headphones.

(I’m willing to bet AirPods sold well, also.)

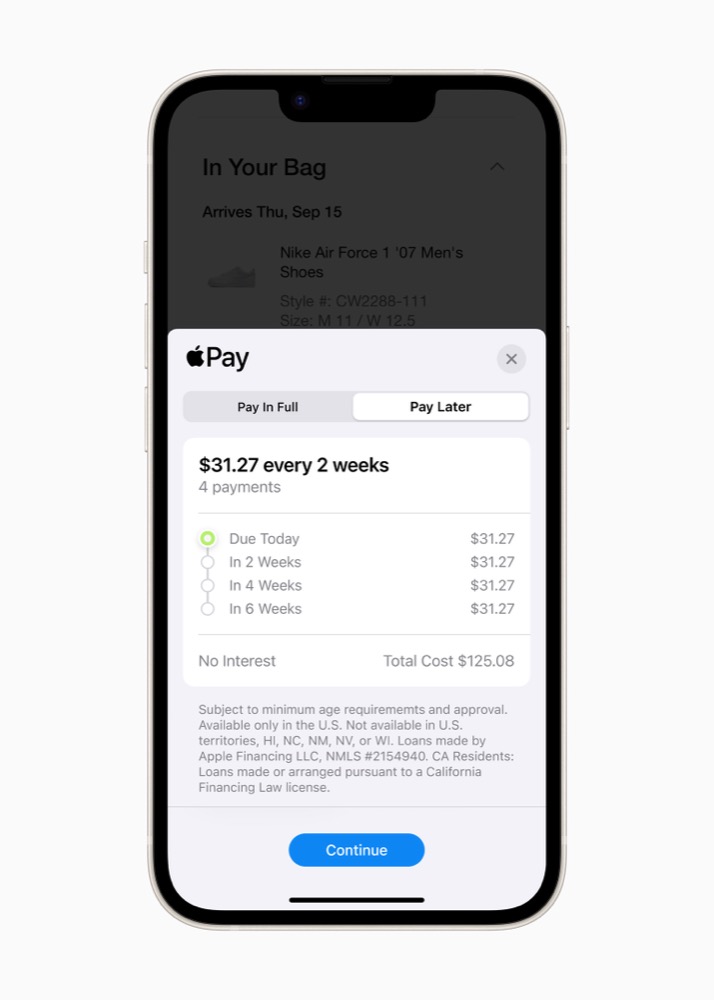

Apple Pay Later looks like this at checkout

Across the 5 days from Thanksgiving to Cyber Monday, US shoppers spent over $38 billion overall, up 7.8% YoY. It was bolstered by record spending online during Thanksgiving ($5.6 billion, up 5.5% YoY), Black Friday ($9.8 billion, up 7.5% YoY) and over the weekend ($10.3 billion, up 7.7% YoY).

“The 2023 holiday shopping season began with a lot of uncertainty, as consumers shifted their spending to services, while dealing with rising costs across different facets of their lives,” said Vivek Pandya, lead analyst, Adobe Digital Insights. “The record online spending across Cyber Week, however, shows the impact that discounts can have on consumer demand, especially with quality products that drove a lot of impulse shopping.”

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.