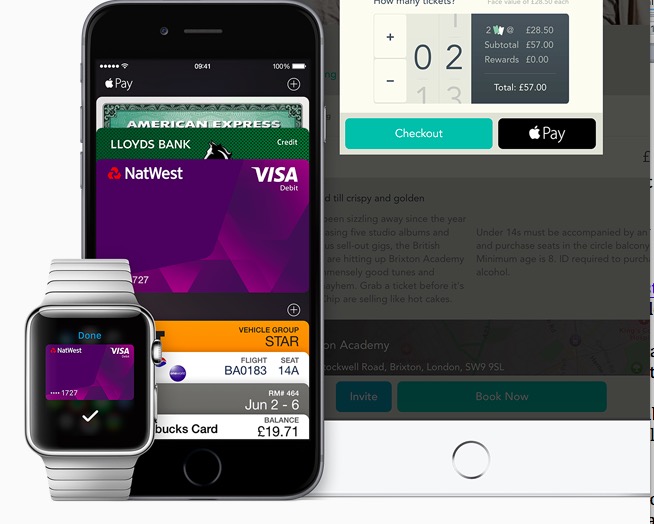

Almost 10 million US people use Apple Pay every week

This is interesting. A series of estimates hint that 10 million people in the US are using Apple Pay to purchase products and services every week.

Millions do

That’s the analysis based on a research report from First Annapolis Consulting , which states that 89 percent of US consumers with Apple Pay compatible devices use the service at least once a week.

(This is a very loose estimate based on another claim that 101 million people in the US use iPhones, but it does the job of putting the statistic into something like context).

The report reveals a wealth of interesting information about mobile payment systems from Apple, Google and Samsung, with the world’s biggest smartphone maker in a comfortable third place.

Millions don’t

It is interesting that when you look at the information you learn that Apple’s is by far the most popular and most widely used mobile payments system, even though it is not the most used platform. Partly this comes down to awareness, which Apple has done a much better job of building. I say this because it seems 89 percent of US consumers with an Apple Pay device are aware of the system, in contrast to just 64 percent of Android users and just over half (54%) of Samsung users.

That’s only part of the story of course, as 64 percent of a larger group should equate to relatively more users per percentile point, but right now we don’t see that. It seems 31 per cent of Apple users have used Apple Pay (up from 20% in December 2015) with 7 percent using it once a week. The other team look feeble, with just 9 percent of Android Pay compatible device users using the service and just 13 percent of those who can use Samsung Pay.

More would if they could

What makes this really interesting is that just 52 percent of users say they are satisfied with Apple Pay, while 61 percent of Android Pay users say they are. That’s very interesting given that onboarding is not the problem, as more users of Android and Samung Pay platforms report issues loading their card than do users of Apple Pay.

So if it’s not the technology that’s leaving Apple Pay users unhappy, what can it be? Turns out it’s the shops – or rather, it’s the shops who do not support Apple’s system yet. “Real and perceived merchant acceptance is the most common barrier to increasing frequency of use,” the report said.

In other words, Apple users want to use, will use and are broadly speaking happy with Apple Pay and are frustrated by merchant reluctance to support it. Meanwhile those on other platforms are aware those platforms support mobile payments, but a combination of lack of awareness and onboarding problems have prevented their wider adoption.

But privacy counts

That’s even assuming they trust the vendors they are using. “64% cited security concerns as their main reason for not using mobile payments,” reports NFCWorld.

This makes sense when it comes to using Android to purchase products. You have to really love targeted advertising to want an ads company watching what you are buying. Privacy remains important to many consumers.

There are many shops that actually have the right NFC terminals, but the workers there don’t even know that they work. Just this week I made some purchases at a Osco Drug counter in a Jewel supermarket (in the Chicago area), and I noticed the NFC symbol on the card reader. So instead of using my chip credit card, I used my iPhone, which is way faster. The cashier asked “how did you do that?” When I told her, she replied that she didn’t know that you could use ApplePay at their store.

Jonny, Tim Cook recently reported that Apple absolutely dominates ALL contactless payments in the USA (contactless credit cards as well as mobile wallets) with a 75% market share, so not sure what you mean by “it is not the most used platform”?

Also, Wristly reports that 80% of Apple Watch users have tried Apple Pay and 95% of Apple Watch owners report they would use Apple Pay if it were available in more locations.

I think Apple is in a pretty good position here.

Sy, I’ve experienced something similar at T-Mobile. I’ve had theft of my credit information at T-Mobile, so I do everything to avoid using my plastic at retailers and online. To date, T-Mobile won’t let me use my ApplePay account online and doesn’t even advertise that they accept ApplePay. I had to prompt the T-Mobile rep to let me attempt to pay my bill with its NFC terminal. When it worked the remark was “wow, didn’t know we had that yet!”