Analyst argues iPhone sales are up even with production cut

Earlier reported claims of component shortages and supply chain disruption appear to have taken a chunk out of Apple’s stock price, but this is a buying opportunity, according to Morgan Stanley analyst, Katy Huberty. From the report:

Apple, Inc.: PULSE: What is the Risk of iPhone Production Cuts?

“We are buyers of any near-term AAPL share price weakness on iPhone supply chain disruption given AAPL is likely to receive more supply than competitors, demand isn’t perishable, and our FY22 estimates are unlikely to change materially even if revenue and EPS shift across quarters.

What happened?

Earlier this evening, Bloomberg reported that Apple is “likely” to cut its iPhone 13 build/production targets for C2H21 by as many as 10 million units because of prolonged chip shortages at Broadcom and Texas Instruments (both covered by Joe Moore). Apple, Broadcom, and Texas Instruments have not publicly commented on this report.

Morgan Stanley says

“While we have not specifically heard of material iPhone production bottlenecks due to semiconductor shortages at AVGO or TXN, broader supply tightness continues to be a real issue across a number of end markets. As we highlighted last week, the most significant iPhone production bottleneck ties to a shortage of camera modules for the iPhone 13 Pro/Pro Max due to low utilization rates at a Sharp factory in southern Vietnam impacted by COVID-19 related workforce limitations. Regardless of whether supply challenges become more pronounced near-term, we’d remind investors of three data points that support a ‘buy the dip’ view on the back of supply-driven disruption.

- First, Apple’s significant revenue outperformance – 7% upside vs. consensus forecasts YTD – is consistent with our supplier checks that Apple receives preferential treatment during periods of supply tightness. As a result, if Apple can’t meet near-term demand, the shortfall is likely to be even greater at competitors, creating an opportunity for share gains.

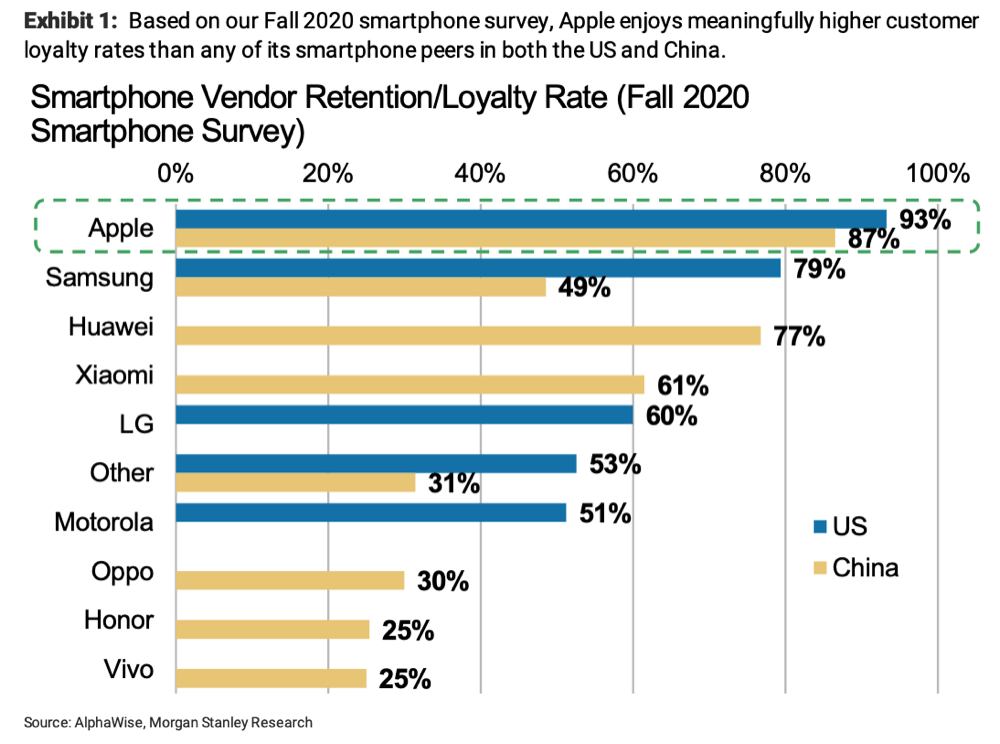

- Second, Apple enjoys market-leading customer retention/loyalty such that any delay in production just pushes iPhone sales into future quarters. In other words, demand isn’t perishable and any supply shortage shouldn’t materially impact valuation.

Apple’s customer loyalty in both China and the US will help it shine

- Lastly, during the most recent period of material supply shortages in the early days of COVID-19 factory shut downs, FY20 consensus revenue estimates were revised lower by 9% (FY20 EPS was cut by 12%) from peak to trough, yet by fiscal year end, Apple’s FY20 consensus revenue and EPS estimates were actually slightly higher than where they started the year (2), further supporting the view that demand isn’t perishable. This was despite a delayed iPhone 12 launch that also had the impact of shifting the revenue contribution from new iPhones into the following fiscal year.”

One more thing — even with a cut iPhone sales are still higher

Should the report prove accurate, Huberty says she expects the quarterly cadence of our iPhone shipment estimates to change, “but expect little change to our FY22 annual iPhone shipment forecast of 238.5M units (+4% Y/Y).”

Huberty also states that a 10 milloin unit reduction would still imply around 77 million iPhone 13 builds in the second half of this year, pointing out that this is actually “slightly higher” than the last three years of new iPhone model production.

“Additionally, from an overall iPhone perspective, and assuming no incremental impact to legacy iPhone model production, a 10M cut to builds would imply 125M total iPhone builds in C2H21, up 12% Y/Y and +4% compared to C2H19 when the iPhone production ramp was more on-schedule. This compares to consensus C2H21 consensus iPhone shipment growth of around 10% Y/Y.”

In other words, even with these reports Apple still has plenty of upside.

Morgan Stanley holds a $168 price target on Apple.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.