Apple-as-a-service will build revenue, says GlobalData

When you consider how Apple Stores try to focus on customer need, it becomes a little arguable rental has always been the direction of travel — did Steve plan it?

Apple’s rumoured hardware subscription program could increase both its customer base and revenue, says GlobalData. It may also help boost attach rates for products such as AppleCare. Combined, this would give the company predictable, recurring income.

But Apple hardware subs will be price sensitive

GlobalData thinks price will matter. If Apple hits the spot then it could make its devices more affordable to more people while reducing the length of time people hang onto devices between upgrades.

That last item may seem a little counter-intuitive, given the company’s work to help meet 2030 zero carbon targets. But the scheme would also boost recycling take-up and let the company reuse and critical hardware components. At present people tend to hang onto their device for around three years.

But price is critical.

We already lease Apple products

Hardware leasing programs are not a novelty in the US. Sprint launched a leasing program dubbed Sprint Flex in 2017, which was retired by T-Mobile in August 2021. Apple’s current upgrade program allows users to pay for devices in 24 monthly instalments. Device instalment options from wireless carriers work on a similar principle.

The main difference between the rumoured subscription program and device financing programs is that with the latter, users can own the device at the end of the payment plan; with the subscription program, a customer would lease their device for a limited amount of time and never truly own it.

For Apple, it’s about offering a better deal

Deepa Karthikeyan, Technology Analyst at GlobalData, said:

“The success of Apple’s rumoured subscription program would ultimately depend on how it compares against existing device financing options, both from wireless carriers and Apple itself where the cost of the device is spread over 24 or 36 months. It is important to note that current promotional deals from carriers offer users up to $1,000 if they trade in a device or switch carriers, which acts as an incentive for device ownership. Like everything else, the program’s cost and time commitment structure would determine its uptake rate.”

A good chance to sell accessories

Making it possible to get the hardware on a more financially accessible basis should help Apple build sales of attached products – Apple One, AirPods, and all the other accessories it provides. After all, if you can affordably lease all your Apple kit you may be more willing to spend a few dollars more on those additional products.

Apple could make subscriptions contingent on also possessing AppleCare protection, an additional cost that would both boost revenues and protect customers.

“For Apple, a subscription hardware program will help bulk up its monthly recurring revenue share by potentially requiring customers to subscribe to its device protection and insurance plans,” said Karthikeyan.

Don’t ignore the Counterpoint Research claim that Apple hardware as a service could generate almost $5,000 per year from the most committed users.

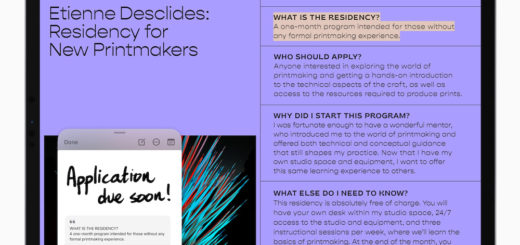

The first Apple Retail stores looked like this.

The smoke is rising, something’s coming

I’m seeing plenty of signals to suggest Apple is preparing the ground to offer such services. Not only has the concept been speculated upon for years, but the company now appears to be gathering the pieces it may need to offer such a service.

Apple Pay related evolutions such as Account Pass, the move to Visa’s network for Apple Card and the purchase of Credit Kudos may just as easily support hardware-as-a-service business models as it could support a Buy Now Pay Later business the company is also thought to be considering. Or both.

It’s impossible to put a time frame around this now, but I’m willing to suggest that we’ll see additional news around Apple Pay in the coming weeks which may hint at Apple’s future direction.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.