Apple buys smart UK credit reference start-up, Credit Kudos

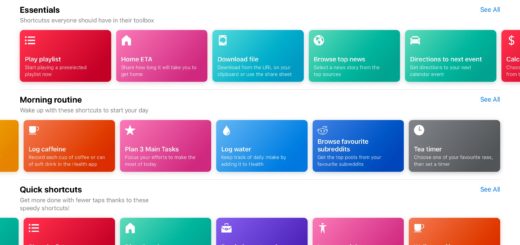

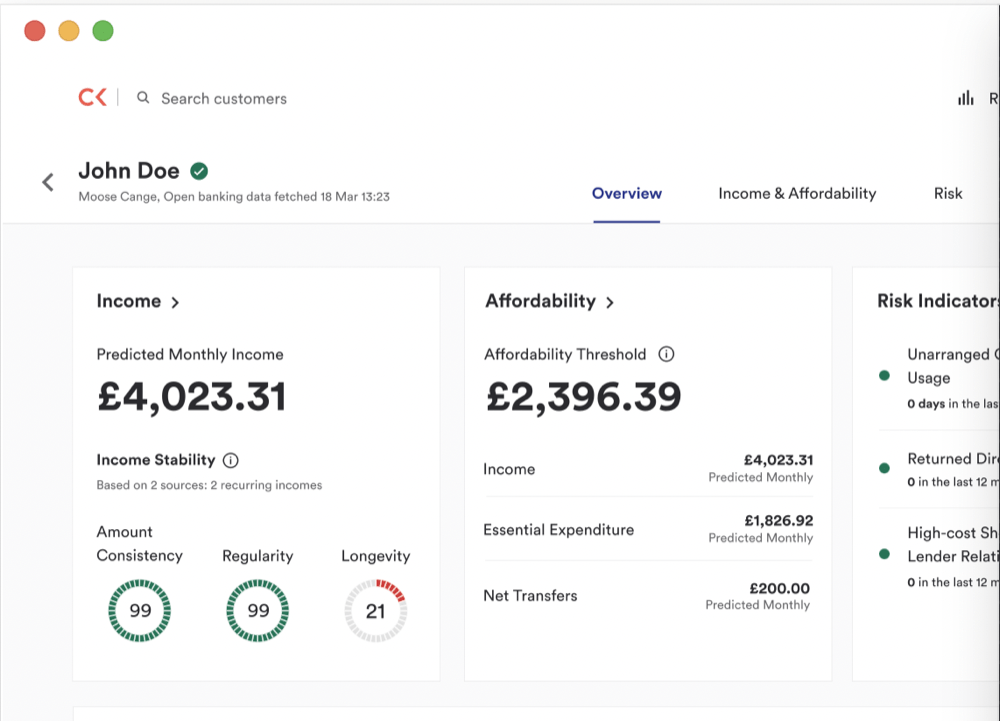

The Credit Kudos system makes use of open banking, machine learning and market data to deliver financial checks

Apple in the UK may now be moving forward plans to introduce new financial services, possibly including Apple Card, following a quietly executed $150 million acquisition of UK credit bureau, Credit Kudos.

A unique credit referencing system

As originally reported by The Block and Finextra, the acquired company is a credit reference agency that uses open banking technology to deliver “finely-tuned credit scores”. Credit Kudos says its mission is to help people access responsible finance they can afford.

Credit Kudos enables lenders to provide credit to borrowers who may have been declined under traditional credit scoring systems. The company website says its predictive insights are built by “combining transaction and loan outcome data.” The system also makes use of machine learning to reach its decisions.

The way the company’s credit scoring system works has the added advantage of not impacting a person’s credit report, the company said.

Credit Kudos is now an Apple subsidiary

It is interesting that the service terms of use changed slightly since the acquisition with new terms published March 21. Within these revised terms you’ll find the disclosure that “Credit Kudos is a subsidiary of Apple.”

The deal apparently closed earlier this week.

It is also of interest that some links from the Credit Kudos page (privacy for example) now pass you through to the Apple website.

Above is an interview with Kitty Sadler, then a Product Manager at Credit Kudos in which you can learn a lot more about how the Credit Kudos system works.

Finextra says the purchase could enable Apple to:

“Extend acceptance of its credit card to overlooked sectors of the population and could presage a move into the buy now, pay later market.”

What about Apple Pay later?

While there has been some speculation the company may eventually introduce Apple Card in the UK, there is also some speculation Apple may choose to enter the BNPL market.

Access to an accurate but privacy-focused credit scoring system may help the company achieve both aims, enabling consumers to purchase new Macs on short-term payment basis.

We have heard claims Apple and partner Goldman Sachs may be planning to introduce BNPL services via Apple Pay.

[Also read: What prepaid cards work with Apple Pay?]

Dubbed Apple Pay Later, the service would give users a chance to spread repayments across four interest free payments made over a set period of time. Applications would be approved via Apple Wallet.

You’ll be able to choose to pay for things in four interest-free payments made every two weeks (‘Apple Pay in 4’), or across several months if you pay interest (Apple Pay Monthly Instalments).

Can you see where the puck is going?

We think expansion in the UK/Europe is on the cards. Apple recently more than doubled the London office space used by the Apple Pay team.

Apple CEO Tim Cook set speculation flowing in January when he specifically referred to Apple Pay and Apple Card as two services he thinks have a “great runway” ahead. Since then the company has enabled a new feature that lets merchants use their iPhone and Stripe to take card transactions.

As of Feb 2020 Apple Pay accounted for 5% of global card transactions,

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.