Apple Card is best U.S. credit card, says JD Power

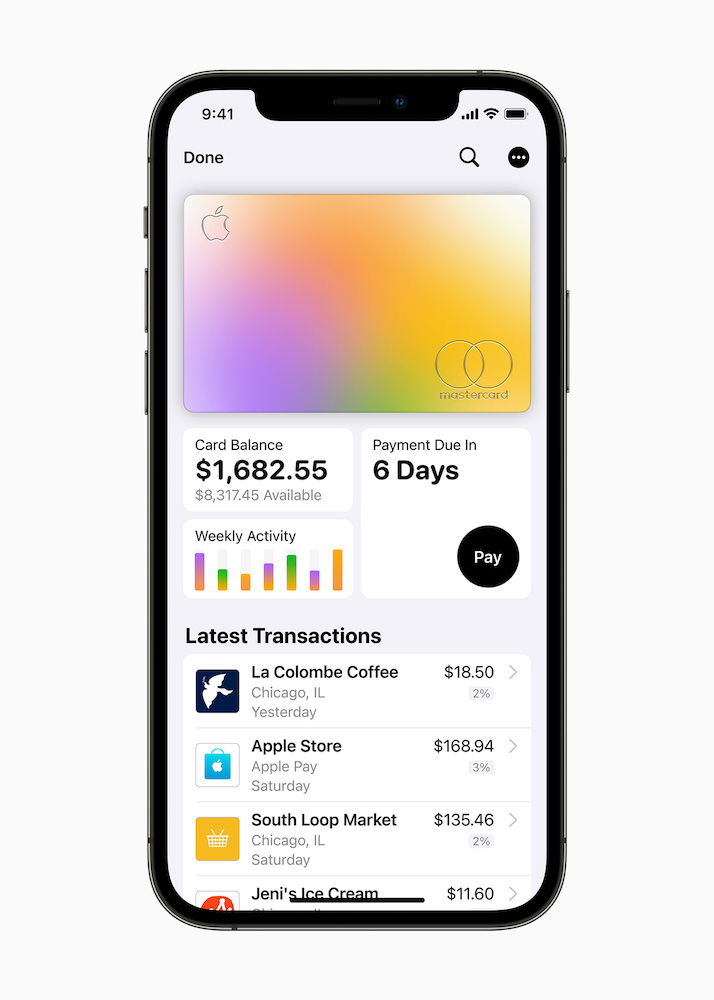

Apple Card makes debt more fun

While most U.S. users have become less satisfied with credit card issuers during the first pandemic plague year, Apple Card user ratings say it’s the best mid-sized credit card you can get, according to J.D. Power and Apple PR.

A shining light in an ocean of credit

In effect, Apple Card is a shining light in an environment defined by financial stress, lack of responsiveness and misaligned terms and rewards.

“While there are some bright spots this year among individual issuers, the pandemic really broke a multi-year trend of improving satisfaction,” J.D. Power’s John Cabell, director of banking and payments intelligence, said.

“The industry missed the mark on supporting customers’ changing needs when many were facing significant financial challenges. Whether through blunt actions, such as tightening credit limits at the very moment when customers were most reliant on their cards as a source of short-term funding, or through lack of customer service accessibility, credit card issuers experienced declines in overall satisfaction, trust, brand perception and Net Promoter Scores this year.”

The malaise failed to reach Apple Card. J.D. Power writes:

“Goldman Sachs, issuer of the Apple Card and new to the study, is the highest-ranking midsize issuer with a score of 864—47 points higher than the nearest issuer. Goldman Sachs performed highest in the segment’s factors of benefits & services; communication; credit card terms; interaction; key moments; and rewards.

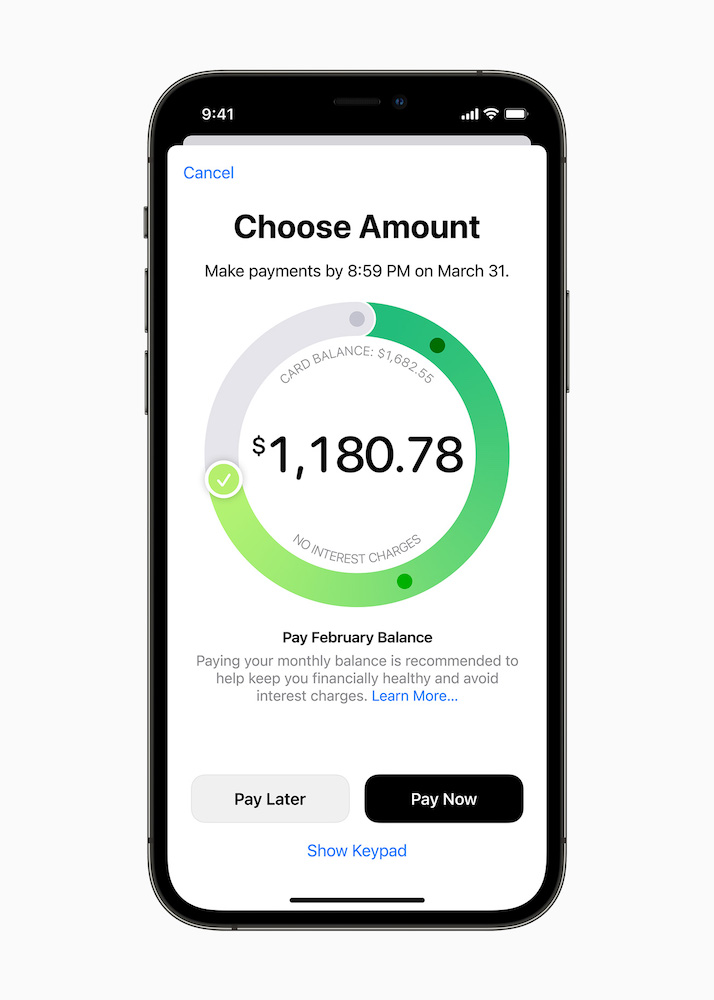

Payment controls

What Apple said

“It is exciting to be recognized with this first J.D. Power win, just two years after introducing Apple Card in 2019 and the first time being included in this study,” said Jennifer Bailey, Apple’s vice president of Apple Pay.

“We designed Apple Card to help our customers lead healthier financial lives, so it’s incredibly meaningful to see that our customers are valuing this. Being recognized as the leader in this category this year is an honor, and we look forward to continuing to deliver this product, service, and support with our award-winning issuer as Apple Card expands to more and more customers across the U.S.”

Goldman Sachs also seems pleased:

“Nothing energizes us more than the affirmation that we are providing a simple, transparent product that delivers value and that customers love,” said Harit Talwar, Goldman Sachs’s chairman of Consumer Business.

“Creating this experience with Apple has been incredibly rewarding, and we are committed to continuing to deliver best-in-class service to our customers. It takes a village, and I am grateful to my colleagues at Goldman Sachs, the teams at Apple, and all of our partners who have helped us be No. 1 in customer satisfaction in the U.S. credit card industry.”

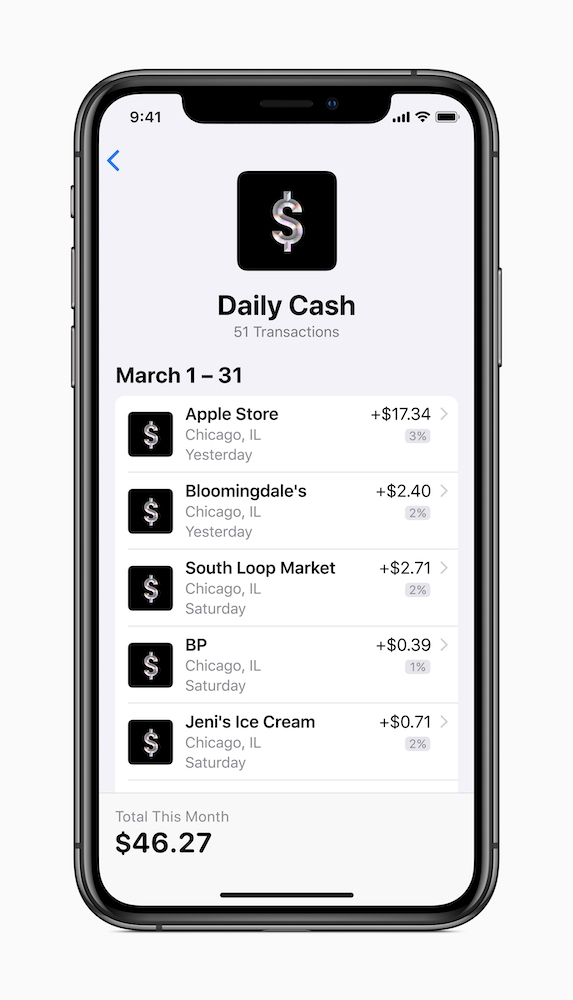

We know Apple Card works and is popular. It’s hassle-free Daily Cash awards tempt consumers, though only in the U.S. as the card isn’t available elsewhere.

But what about other credit cards?

The survey reveals the real deal among credit card users. It seems that outside of Apple Card, people are unhappy at reducing credit limits, the rewards deals being made available are missing the mark and new offerings from the likes of Apple Card are raising the bar on what people expect from their card. In other words, Apple Card has shown people what they are missing.

The other beneficiary is likely to be Apple Pay.

That mobile payments service is surging forward in the U.S., accounting for an astonishing 92% of such use in that nation.

This will inevitably translate into constant interest in Apple’s also available credit card product, and the huge satisfaction levels cited in the J.D. Power survey hint that the iPhone maker has already built strong foundations for its future offers in the mobile finance space.

While possibly the biggest step it could take is to launch the card outside the U.S., given the continued non-appearance of Apple Pay Cash we may be waiting some time yet.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.