Apple Card: User experience matters — who knew? (Apple)

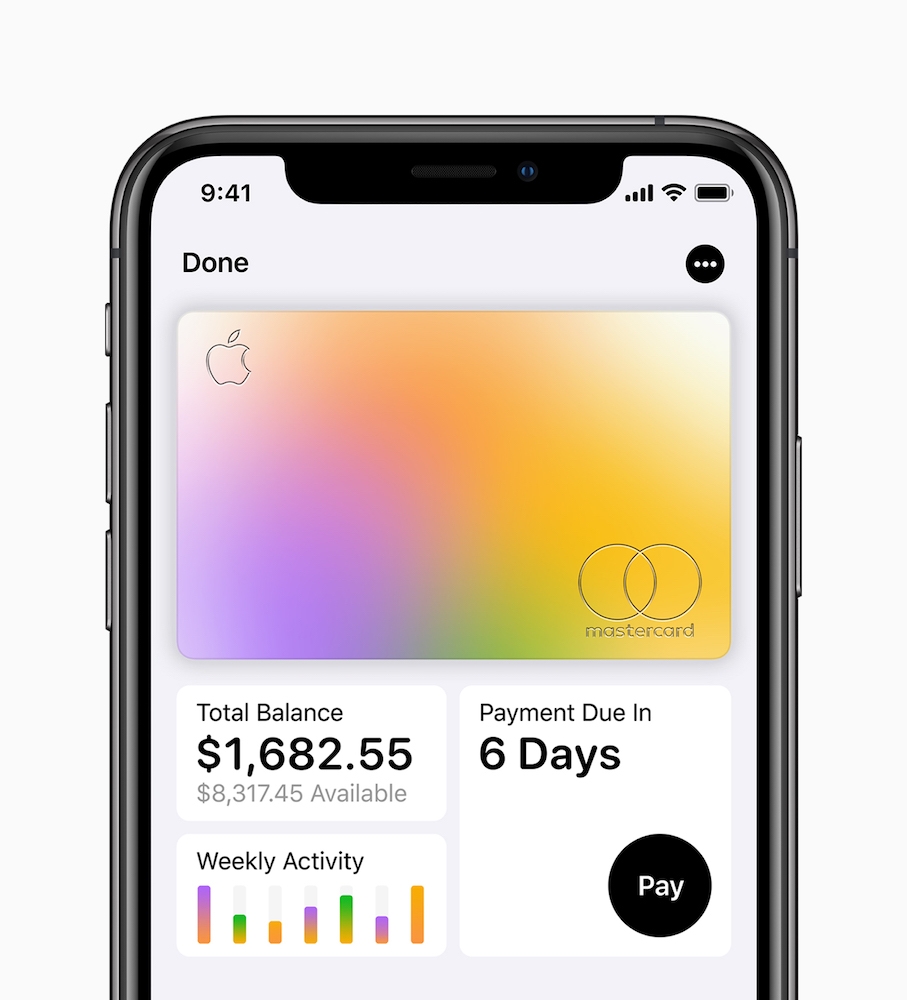

The Apple Card app tries to put you in control…

It seems like ever since the announcement of Apple Card I’ve read countless reports complaining the rewards offered by the card (which can still improve) aren’t good enough – but it looks like consumers go where the best user experiences are.

JD Power sees the appeal

Apple is attempting to enter a strong market. According to the J.D. Power 2019 Credit Card Satisfaction Study, overall customer satisfaction with existing cards is currently at record high.

In 2019, only 11% of customers have switched their primary credit card and almost half (45%) said their primary reason for switching was for a better rewards program.

Another 17% of those who switched did so to take advantage of a sign-up offer.

JD Power’s pulse survey looked at consumer perception and awareness of the Apple Card offering, and compared those results with its existing market data.

User experience matters

“Ultimately, we found that awareness is already remarkably high for the Apple Card and many credit card customers are likely to apply when it becomes available – despite the fact that it offers a relatively middle-of-the-road rewards package when compared with other cards,” they said.

“Despite an incredibly tight credit card marketplace, it looks like the Apple Card will be a hit because of the power of the Apple brand and a history of delivering on a superior user experience,” they conclude.

Here’s the stats:

- 38% of U.S. adults are already aware of Apple Card.

- Among those who are aware of it, 35% say they are somewhat or very likely to apply for it.

- This is even higher among younger credit card customers — among 18-29 year-olds, over half (52%) are aware of the Apple Card.

- 52% of Apple Pay users say they are likely to apply for the Apple Card in the next 12 months.

- To-date, roughly 11% of adults report using Apple Pay for purchases in-store, and that number rises to 20% among people who use an Apple iPhone.

- Currently 49% of iPhone users say they trust Apple to protect their personal data and privacy while 59% trust their current bank or credit union.

- 67% of Apple Pay users trust Apple to protect their personal data and privacy.

The JD Power Credit Card Industry Insight wasauthored by Jim Miller,Vice President, Banking and Credit Card Intelligence at J.D. Power.

What does this mean?

I’ve been digging around to try to figure out some context around what this might mean.

A report earlier this year from Loup Ventures claimed an estimated 383 million Apple Pay users already exist.

There are an estimated 2 billion credit cards in use worldwide, 102.4 million of which come from American Express.

If half of all Apple Pay users eventually choose to use Apple Card, then Apple will immediately be bigger than American Express – albeit without actually owning the payment network (which belongs to Mastercard).

It is also interesting that adding around 190 million Apple Card users to the Mastercard network would immediately make Mastercard bigger than Visa.

It also suggests Apple will be one of the bigger single brands on that network. And that’s just a beginning, and if this doesn’t underline the digital transformation of the financial industry, I just don’t know what will.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.