Apple diversifies as it prepares business for future shocks

To get ready for the future you need to consider the past. Image c/o: Jacinta Iluch Valero/Flickr

When it comes to change management, Apple’s execution continues to surprise many in the industry. Two years into COVID-19, and the company appears to be accelerating plans to diversify its supply chain.

Diversify everything, get ready for anything

That’s not the only thing Apple is diversifying, of course.

The company’s smart pivot to services over the last few years means it has built a growing ($19.8 billion in the last quarter, $68 billion in FY 2021) flow of high margin revenue. Services now accounts for around 20 percent of Apple’s revenue.

That’s great for Apple, as the income is predictable and helps hedge the company against the risk of a product being poorly received. Its services segment is now bigger than IBM.

The pivot to services is being followed by almost any large business, at least to some extent, and is a common-sense approach to take when managing increasingly difficult economies.

With an installed base of an estimated 1.8 billion users (BoFA), Apple evidently hopes to continue to tempt people to the growing number of services it provides. What’s important is to consider that this switch to services has made the company far more resilient.

It makes the company that much less reliant on its core business of product development and design and gives the firm a valuable cushion against crisis in its supply and manufacturing chain.

Tim Cook spent a lot of time discussing Apple’s approach to COVID-19

Apple isn’t just a hardware company any more

The company’s primary business is built around product development and design.

We think Apple may have new product families to introduce once it considers the time is right, but what about the ones it already creates?

The entire industry has suffered in the last two years as COVID continued to close whole markets, creating a major shortfall in component supply. The resurgence of the virus in China is thought to be impacting some Apple product production – though Apple’s partners are recruiting to meet stronger than anticipated orders for iPhone 13.

Virus-related shutdowns are likely to continue as the war against the pandemic continues, and when these challenges are combined with an increasingly fractured political climate, Apple and its partners now seem to be rushing to diversify their supply chain.

It no longer makes sense to source all eggs from one basket as the economic models that have driven capitalism for many decades collapse.

Sweat the detail

Sweating the detail in this case means Apple and its partners are seeking to fill the gap in legacy nodes — power management, image sensors and other chips. — which have become so scarce during the pandemic.

Apple’s main manufacturer, Hon Hai/Foxconn intends to build a chip production facility in Malaysia where it seems likely to manufacture some of the ‘legacy nodes’ we know Apple and others have had a tough time sourcing during the pandemic. These will likely include power management chips, image sensors and chips for electric vehicles, according to reports. Most of the big manufacturers, including Apple chip manufacturer, TSMC, are building similar facilities to make such ‘legacy node’ chips.

Foxconn also recently reached an agreement to enter a joint venture with India’s Vedanta to manufacture semiconductors there. The company has also engaged in a series of recent acquisitions to make a dent in the electronic vehicle market, including a deal to purchase a factory in Lordstown, US.

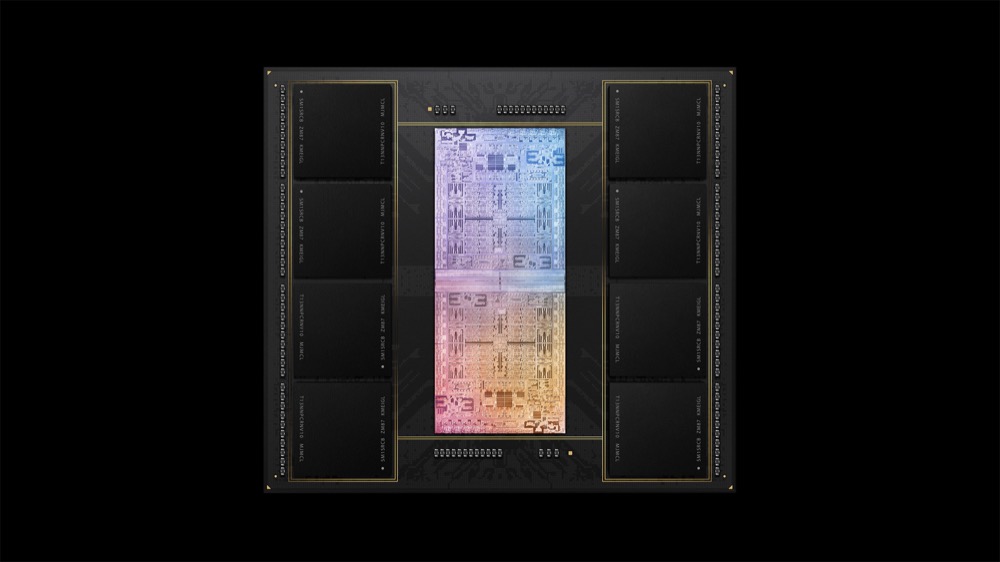

It is also worth noting that Apple’s move to build and develop its own silicon can also be seen as a form of diversification:

Not only has this reduced the cost per processor, generating additional margins which can be used elsewhere, but it has enabled the company to invent completely unique products.

TSMC is also thought to be discussing the creation of a new semiconductor manufacturing plant in Singapore. Once again, this facility seems to be focused on building the ‘legacy’ chips that have been scarce in recent months. The company is building additional plants in the US.

Opening new markets

Apple is taking diversification seriously at the very highest levels. Apple CEO, Tim Cook, recently hosted Vietnam Prime Minister Pham Minh Chinh at Apple Park to discuss taking further investments in that country. Apple has 31 partners based in that country assembling components for use in its products, a report from Saigon Online claims.

Cook told government officials he wanted to extend the company’s supply chains into Vietnam.

This diversification takes time, of course, but we know the company has been steadily investing (both directly and through its partners) in new production hubs worldwide.

Prepare for the new

While bringing this online will take time, it’s also no stretch of speculation to imagine that the company will also be building out new production facilities (and new production partners) as it moves toward introduction of two new product families:

- AR Glasses: Recently demonstrated to the Apple board and now expected to appear – though possibly only to developers – at some point this year.

- Apple Car: The next generation of transportation, scheduled I think for c.2025.

Both these products will likely be supported by Apple’s own silicon chips and ‘legacy node’ silicon built en masse by Foxconn, TSMC and other Apple partners as the company seeks to sidestep reliance on those hard-to-source components by replacing existing supply chains.

Meanwhile, Apple will continue to lean hard into services income as it works to protect its revenues against any additional economic/supply chain shocks.

Investors take note:

Apple is already responding to future circumstances, and already has c.20% of its revenue generated by services, other tech firms are far less well-prepared for additional calamity. This makes it reasonably plausible to think current AAPL stock sell-off underestimates the company’s innate business strengths.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.