Apple expands manufacturing capacity as iPhone leads in 5G

While it came to 5G a little late, Apple moved fast once it did

With an eye on expanding market share, Apple seems to be working to increase its manufacturing capacity even as iPhone becomes the world’s most popular 5G smartphone, with 25 percent of the global market for such devices.

In another positive insight, Morgan Stanley analyst Katy Huberty claims Apple’s December iPhone sales are more robust than anticipatedas component availability improves. She predicts around 82 million unit sales in the quarter.

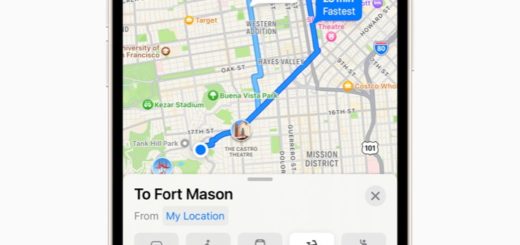

Apple takes the 5G call

Apple’s 5G smartphone was followed by Android devices from Xiaomi, Samsung, Oppo and Vivo. Honor was the fastest growing Android 5G smartphone brand QoQ in Q3 2021, says Strategy Analytics.

Apple ships around 200 million iPhones every year, but as it seeks to grow its share of the market on the back of the positive reception of its 5G-enabled iPhone 12 and iPhone 13 family, it is also seeking to diversify its manufacturing base to feed that growing need.

A Nikkei Asia report explains this in a little more detail.

Building up manufacturing capacity

That report confirms Luxshare Precision Industry to be building a massive, 285,000 sq. meter new factory dedicated to iPhone production. That company hopes to secure the contract to manufacture up to 15 million iPhones for Apple each year, taking space in a supply chain that also includes Foxconn and Pegatron.

“I went on a business trip nearby and saw Luxshare’s new manufacturing complex. I am shocked by the scale of the complex and the possible capacity it could build for iPhones,” an Apple supplier executive told Nikkei Asia.

Apple also continues to expand manufacturing capability in India, and while that effort does seem to be encountering some obstacles there’s no reason those challenges won’t be overcome.

What the industry needs

Another factor in play is a move by existing manufacturers to diversify their customer base. Companies that have been manufacturing Android devices want to join the Apple supply chain, in part because they can see how smaller vendors are being pushed out. They don’t want to be left manufacturing devices for firms that exit the market, so it is common sense for such companies to attempt to take position in the Apple supply chain.

[Also read: The annual AAPL iPhone ‘pump ‘n’ dump’ season has begun]

(This doesn’t need to be confined to smartphones, Wingtech recently joined the Mac manufacturing chain as an example of this).

As Apple’s market share across its primary prodcuts (PC, tablet, smartphone) continue to increase we will inevitably see more manufacturers beating at Cupertino’s doors seeking contracts.

One thing this does reflect is how the smartphone industry has become a duopoly shared between Apple and Google. In the absence of serious unique competition, the operating systems now define the entire experience.

This is likely to face regulatory change as governments seek to constrain the extent of that power. “Apple and Google have developed a vice-like grip over how we use mobile phone,” Andrea Coscelli, Chief Executive of the CMA recently said.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.