Apple iPhone 13 leads smartphones in China, Counterpoint

Chinese shoppers climb Apple’s stairs.

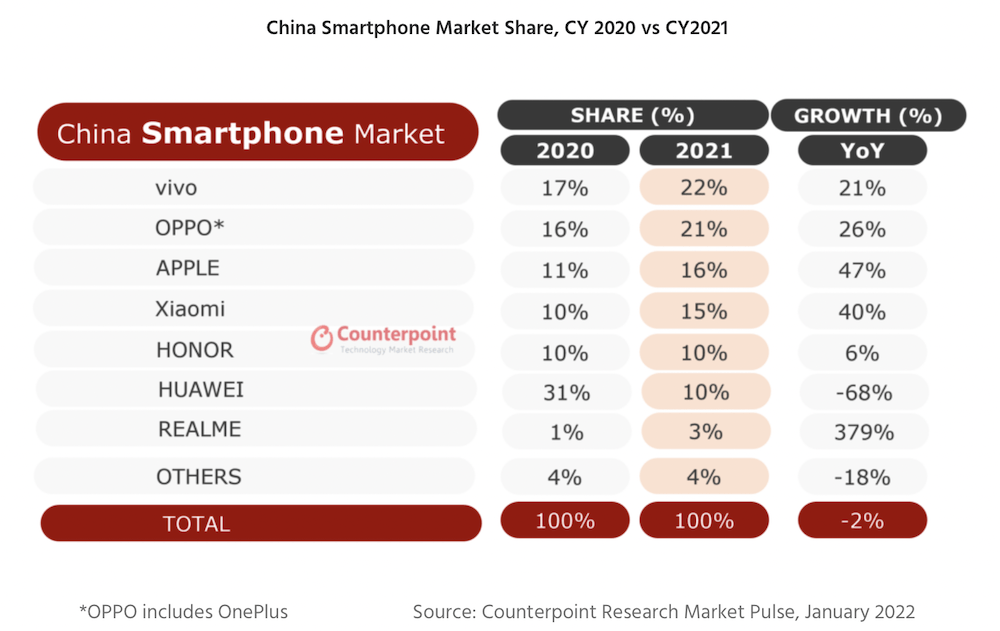

More news from Counterpoint in China, with the analysts following up recent news detailing the success of iPhone 13 there with data to show Apple has achieved its highest ever market share in China, as we expected.

Apple really is now big in China

The economic benefits flow back to the US, of course, with jobs, the wider app economy and shareholder profits all boosted by Apple’s success in the vast Chinese economy.

Counterpoint’s data shows that while smartphone sales in China dipped 2 percent for the year, Apple grabbed 23% of what was left, pushing Vivo into second place. Realme was the fastest growing brand – and (perhaps of more consequence as other markets install the infrastructure) four out of five smartphones sold in China were 5G phones.

Apple hasn’t had the number one position in China for six years. The last time it did was at the peak of the iPhone 6 ‘supercycle’.

Smart pricing, Huawei’s fall, more…

Research Analyst Mengmeng Zhang said,

“Apple’s stellar performance was driven by a mix of its pricing strategy and gain from Huawei’s premium base. Apple rose to first place in China right after the iPhone 13 was released (week 39) in September. Afterwards, it remained in the leading position for most of the fourth quarter. The new iPhone 13 has led the success due to a relatively lower starting price at its release in China, as well as the new camera and 5G features. Furthermore, Huawei, Apple’s main competitor in the premium market, faced declining sales due to the ongoing US sanctions.”

Apple has announced a big global macro photography competition, details are here

Some headwinds

Senior Analyst Ivan Lam noted headwinds, including component supply and reducing demand for smartphones in China as people choose to use them for longer.

Apple is ahead of the curve in this, offering regular software updates across the 5-year product cycle, while other vendors struggle to even meet three years of support.

(The latter is bad for consumers and terrible for the planet).

Sourced from Counterpoint

“The market in China continues to decline due to various factors in both the supply side and the demand side.

“Firstly, the ongoing component shortages are impacting shipments of all OEMs.

“Secondly, China’s average smartphone replacement cycle is becoming longer.

Skewing high

“Smartphone designs within brands have also become more homogeneous, especially in hardware, failing to motivate consumers to upgrade. Lastly, China has been experiencing a complex economic environment where exports are driving the growth and domestic spending remains lackluster,” Lam said.

Apple’s success in the premium segment is encouraging sign and will motivate Chinese OEMs to strengthen their footprints in the segment, the analysts believe, saying: “We expect the smartphone ASP to continue to rise in China as leading OEMs put more effort into increasing it to counter the decline in sales.”

Apple is working to increase its manufacturing capacity as iPhone becomes the world’s most popular 5G smartphone, it raised component orders in early December, and is expected to introduce its third-generation iPhone SE with 5G in spring, possibly as soon as March, reports claim.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.