Apple is already improving its Apple Card (u)

Do you remember those first few weeks after Apple announced Apple Card when critics panned its offer as not being as good as those available from other card issuers? It looks like they didn’t know Apple very well…

Apple is already improving its Apple Card

You see, while critics panned the card for what they argued were only limited cashback schemes maxxing out at 3% for Apple purchases, what they didn’t consider was that with its particular position in the smartphone economy the company could easily augment its deals.

After all, everyone kind of knows that iPhone customers tend to be among the more affluent smartphone users, are more willing to use mobile payments services, and are more switched onto using online and new breed services.

Such as Uber.

And that’s where Apple’s made a smart move.

Et tu, Uber…

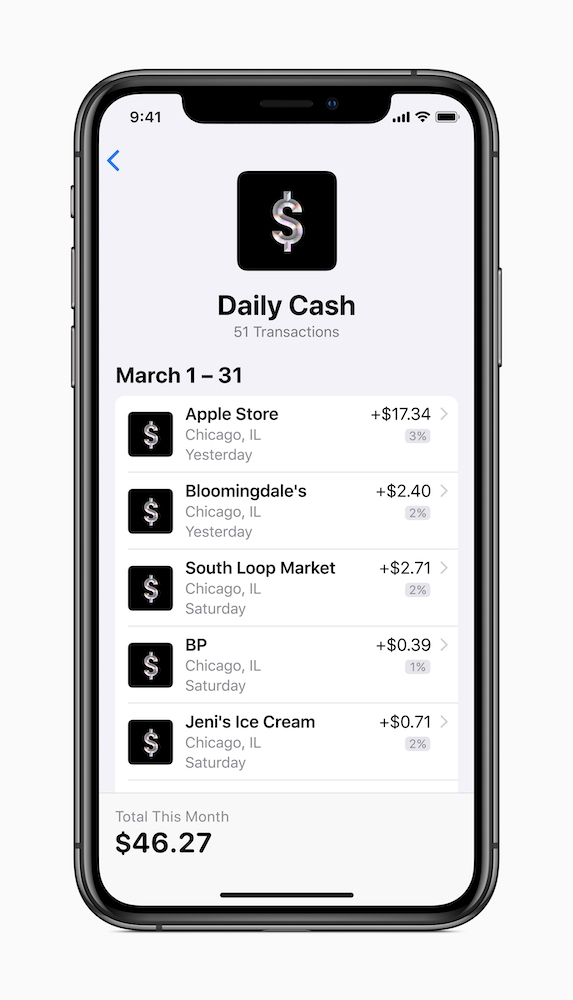

The company today announced that Apple Card users will get 3% cashback (directly and daily into your Daily Cash account) when using Uber (or Uber Eats) with their card.

And it doesn’t stop there.

“Apple Card will continue to add more popular merchants and apps in the coming months,” the company said.

Think about that.

UPDATE: On September 12, Apple announced that it will also be offering 3% cashback at all Walgreens and Duane Reade stores (both were early Apple Pay supporters).

They must see what I think they see, which is:

Most businesses recognize Apple users as being among the most valuable customers in the world.

A deal with Apple to support 3% Daily Cash purchases made from your business is an instant and immediate way to reach those valuable customers – and is probably a more cost-effective tool than advertising.

Plus, you know, every single customer your reach by reaching a deal with Apple to offer 3% cash return is someone who has already been credit checked.

And all those customers can be reached with a simple message via Apple Pay.

(That’s even before any customer segmentation tech kicks in, which I’ve not been made aware of yet.)

I don’t think many other credit cards have that kind of reach.

[Also read: Everything we know about Apple Card (updated)]

Apple is showing its mettle here.

Not only that, but don’t neglect that Apple Card charges no annual, late, international or over-the-limit fees.

“We’re thrilled with the overwhelming interest in Apple Card and its positive reception,” said Jennifer Bailey, Apple’s vice president of Apple Pay.

“Customers have told us they love Apple Card’s simplicity and how it gives them a better view of their spending.”

People in the U.S. can now apply for an Apple Card via Wallet on their iPhone.

And, just like any other Apple product, you can expect the company to iteratively and consistently improve it…

Which is why the Apple Card you get today will offer a whole range of added services and features in three years time.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.