Apple is defining the ARM-based PC market, analysts show

The M2 and M1 chip stand side by side at WWDC

Apple’s M-series of Apple Silicon chips are built on the same ARM core as the company’s A-series mobile chips, but power almost every single ARM-based PC on the planet, Strategy Analytics said last week.

Apple erodes PC marketshare

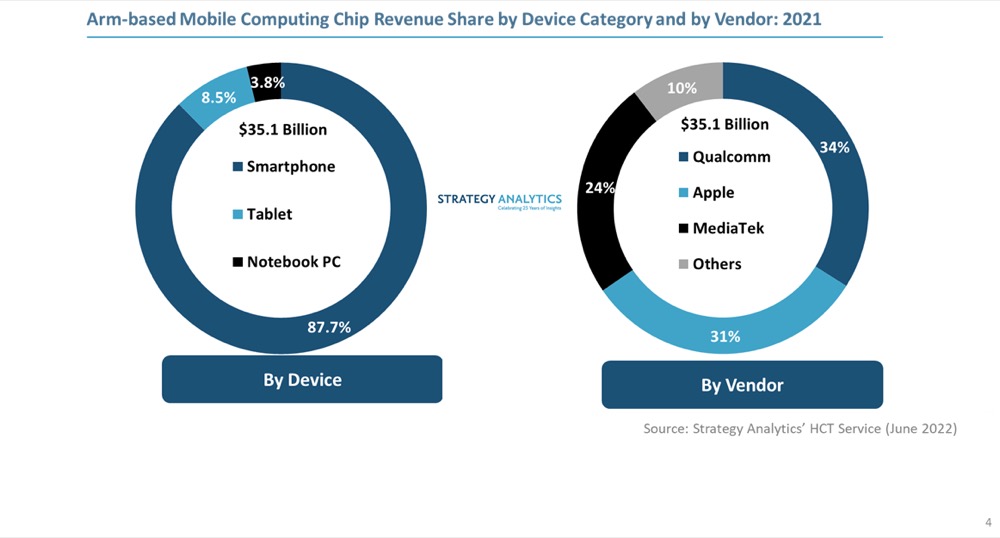

The analysts offer up some useful data points, for example that the market for Arm-based chips for us in smartphones, tablets, and PCs grew 27% to reach $35.1 billion in 2021. But, of course, with Apple offering Arm chips in all three of its device families, it’s not hard to follow the money to see where the future is going.

But seeing where the direction is is perhaps not perhaps as important at the pace at which that future is coming into view. In this case, Apple may have begun a big exodus from x86 to Arm.

“The Arm-based mobile computing market outperformed the x86-based mobile computing market in revenues and units. Per our estimates, the total Arm-based mobile computing chip revenue was almost 20 percent higher than that of x86 (excluding chipsets and discrete GPUs) in 2021,” the analysts said.

In other words, Apple is defining expectations around the next generation of computing. The PC it makes today will be the PC others make tomorrow.

The market leader

Report author, director of handset component technologies at the firm, Sravan Kundojjala , said:

“Apple established itself as a distant market leader in Arm-based notebook PC processors with almost 90 percent revenue share. Apple’s M-series family of processors set the benchmark and gave Apple a 2–3-year lead over the rest of the Arm-based PC processor vendors. Qualcomm captured just 3 percent revenue share in the Arm-based notebook PC processor market in 2021 and lags Apple in CPU performance.”

Apple leads the Arm-based PC market

The analysts tell us that Qualcomm, Apple and MediaTek captured the top-three revenue share ranking spots in 2021.

- Qualcomm led the Arm-based mobile computing chip market with a 34 percent revenue share, followed by Apple with 31 percent and MediaTek with 24 percent.

- Smartphone, tablet, and notebook PC processors accounted for 88 percent, 9 percent, and 3 percent of total Arm-based mobile computing chip revenue in 2021.

Report author, director of handset component technologies at the firm, Sravan Kundojjala , said:

“Arm-based mobile computing posted robust revenue growth in 2021, driven largely by growth in smartphone applications processors. MediaTek led the overall Arm-based mobile computing market in units while Qualcomm led in revenues. In addition, MediaTek led the Arm-based smartphone, Android tablet and Chromebook processor segments in unit terms in 2021.”

Qualcomm’s SWOT analysis

He also said: “Despite its low share, Qualcomm continues to invest in notebook PC processors with its Nuvia CPU cores. We believe that Arm-based notebook PC processor offers an attractive opportunity to Qualcomm, given the company’s growing collection of high-performance processor assets including CPU, GPU, AI, audio, imaging, connectivity, gaming and security.”

What is interesting to ponder, however, is that Apple at present still purchases silicon from Qualcomm in the form of 5G chips. At some point this will stop, and what guarantees really exist the Qualcomm will catch up? Apple has an ascendancy it is unlikely to choose to give up. Plus, of course, Apple retains the advantage of designing the hardware, processors, and application experience across its ecosystem.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.