Apple is growing in ‘the right places’ – Morgan Stanley

There’s life in this old dog yet….

For Apple, the challenge of being one of the biggest companies in the world with a personal relationship with its customers is that its stock price sometimes reflects Siri reality more than it reflects, reality. That’s potentially what’s happening now, suggests Morgan Stanley analyst Erik Woodring, who thinks the stock is now the most under-owned large cap USs tech stock.

Real, real, real

That’s significant you see because it means there’s a huge amount of value to be unlocked. And right now, Apple has beaten Microsoft in the under-owned games.

Further, he argues that “on average, stocks appear to experience a technical pull higher when active ownership is much lower than the market, and vice versa.”

Now, there are plenty other arguments around this under ownership made in the Morgan Stanley client note I’m looking at as I write this, but the big point is that the gap between what the analysts think ownership should be and what it seems to have reached around 3%.

Yes, this reflects sentiment around flat iPhone sales and all the other challenges Apple faces, but perhaps these fears are more endemic than they need to be.

Apple is growing in ‘all the right places’.

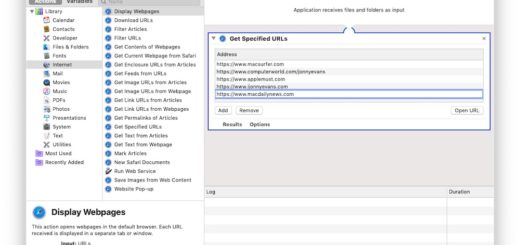

“While we know that Mac and iPad demand remains challenged, we are encouraged by the fact that September quarter growth is coming in the right places, with the iPhone inflecting to Y/Y growth, Services re-accelerating to low double digit growth in F4Q23/FY24, and gross margin tailwinds still underappreciated by investors,” wrote Woodring.

The analyst sees a 5% upside to current estimates in the next fiscal year and anticipates the stock will outperform based on:

- Accelerating growth.

- Higher margins.

- Growth in the installed base.

- Higher spend per user, including moves to a subscription model.

- High penetration of Apple services.

What might this mean? The analyst sees a profit opportunity.

And also, there’s this…

In a client note earlier this week, Woodring observed that App Store revenues are tracking 10% higher than he’d originally predicted, even as iPhone builds stay in line with expectations. He expects Apple to make 49 million iPhones and to shift c. 90 million units of iPhone 15 when they appear.

“The team continues to see a 3-4 week delay in iPhone 15 Pro Max production due to Sony’s CMOS image sensor delay, and the 49M September quarter build forecast takes into account 4-6M iPhone 15 Pro Max units being pushed from C3Q to C4Q,” he wrote.

iPad sales are down, he said, and demand for Macs remains weak he said – which seems a shame given how utterly brilliant the 15-inch MacBook Air is, but there you go. Morgan Stanley will be tracing supply chain builds/orders for those products in late September/early October, “which is when Apple historically adjusts build forecasts following initial pre-order feedback,” he said.

All the same, the bottom line seems to be that perhaps, just perhaps, concerns about the impact of slower than anticipated Apple sales are a little overblown. Even within the current tough market, there may be good life in the old dogcow yet.

Image thanks to Benjamin White.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.