Apple may reach $358/share, says Morgan Stanley

In a note to clients received at ‘Must Towers today, Morgan Stanley analyst Katy Huberty throws three potential Apple price targets, ranging from $107 to $358 per share. And raised her own price target to $200. There’s a lot of upside yet.

The ‘flight to quality’

Huberty thinks the impact of Apple’s new product introductions isn’t fully baked into existing estimates. “Despite a consistent and material revenue contribution from new products and services over time, Apple shares don’t seem to bake-in the impact from upcoming new product launches. We believe this will change as Apple approaches the launch of an AR/VR product over the next year,” she writes.

“We estimate that over the past five years, about 6% of Apple’s total annual revenue, on average, has come from products or services that didn’t exist 5 years prior, with the Apple Watch, AirPods, Apple TV (the hardware), Apple Music, Apple TV+ (the streaming service) and Apple Pay leading the charge over this time period.”

She also sees that while IT Hardware may be a challenging market in 2022, Apple “should benefit from a flight to quality”. A flight to quality is, of course, precisely what we are seeing in PC and smartphone markets as purchasers push to get the best they can afford in expectation of a few tough years ahead. Look at how the high-end iPhones are selling. That’s a flight to quality right there.

To the three targets.

Bull case:

$358. This estimate is based on iPhones achieving an all-time high in sales in 2022 along with a preference for high end models. In this scenario, Apple’s smartphone revenue reaches $430b with a nice $56b additional for new products, such as AR glasses.

“This outcome assumes AR/VR generates similar revenue per installed base user as the iPad in its first 4 years, equating to $74B of FY26 revenue, or $56B discounted back to 1 year from today, which on a premium peer growth multiple of 20x EV/Sales, implies $1.1T of Enterprise Value and a $358 bull case valuation (9; up from $264 previously), or 50x our bull case FY23 EPS of $7.15.”

Base case:

$200. In this scenario, Apple experiences a record FY21 but sees flat iPhone replacements with high upgrades in China and increasing Mac share. We see growth across Apple’s hardware and services and some valuation boost on strength of incoming product.

Bear case:

$107. In this outcome, iPhone sales slow while WFH demand shrinks, impacting Apple’s other products and dampening services growth. Services will insulae the company from a weak market, to some extent.

Interesting data to note

There are some fascinating data nuggets buried in Huberty;s report, for example:

- Apple’s stock price has increased nearly 500% over the last 5 years (vs. the S&P up 105%)

- iPhone revenue grew just 40% over the same period.

- Apple wearables have gone from zero to $38b since 2014.

- Services have become a near $70b business, doubling over the last four years.

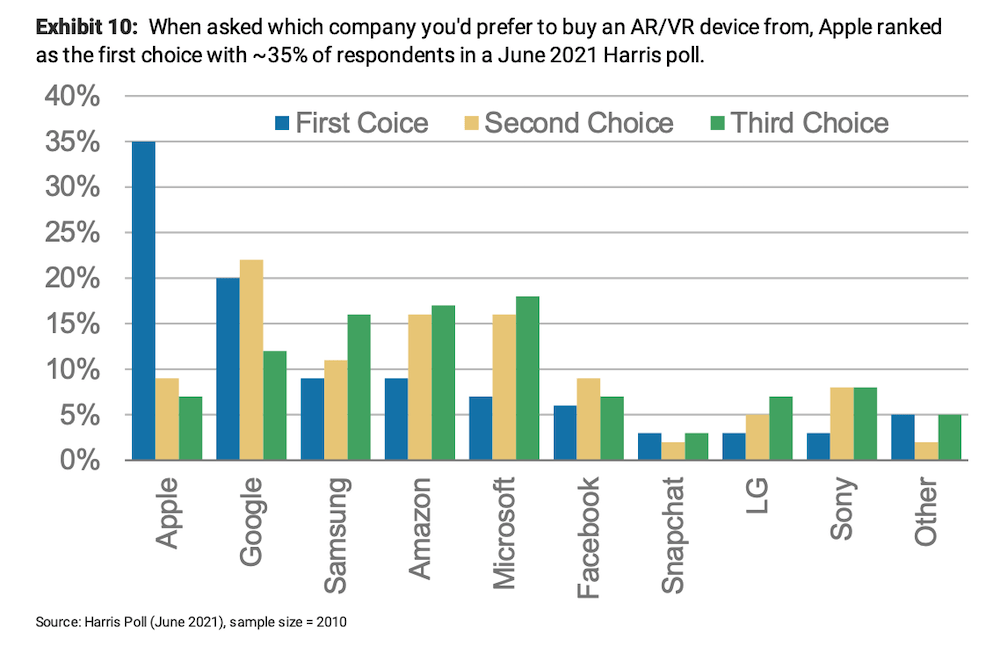

- 35% of respondents prefer to buy an AR/VR device from Apple, significantly ahead of the second place vendor, Google (10).

- Apple brings 250,000 points of distribution, in-house semiconductor and component development, supply chain scale, an ecosystem of developer tools and application marketplace.

Who do you trust?

Toward AR glasses

Huberty seems very optimistic when it comes to Apple’s plans for AR glasses. She thinks these will see adoption similar to the early days of the iPad, which generated $20b of revenue in year one.

The analyst has a c$29b revenue target for then AR glasses by FY26, an estimate that ignores the potential for new services and the potentially profound impact such a product might have.

The analyst also notes that consumers are more likely to purchase AR glasses from Apple than they are from anyone else.

What about iPhone supply?

Like me, the analyst doesn’t believe Apple has cut iPhone production. She assumes higher December shipments (targeting 83m), and thinks continued strength in many markets along with the imminent arrival of iPhoner SE3 will generate additional growth.

“For context, we estimate that prior iPhone SE launches (March 2016 and April 2020) have contributed an incremental 10 points of iPhone unit growth in the first calendar year they were launched .”

Citing Sensor Tower, the analyst estimates App Store net revenue grew 14% Y/Y in November, down a little since October. The analyst estimates App Store net revenue is up 15.2% Y/Y on a quarterly basis exceeding previous forecast and doesn’t expect any changes in payment regimen forced on Apple to significantly change that.

Bottom line?

Apple has so many opportunities to generate revenue that if one strand of its business does badly, others should do well – and one of the biggest supporting pillars across the company’s entire business is user satisfaction. Which is what drives people to use its services and purchase its products. When it comes to AR glasses, who would you purchase from? Facebook/Meta or Apple? I think the battle for the metaverse is probably over before it has really begun.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.