Apple Pay dominates U.S. mobile wallet space, will grow more

Apple Pay dominates its industry

Apple Pay has shone brightly during the pandemic, with millions opting to use the contactless payment system as they sought to maintain social distance.

Astonishing market share

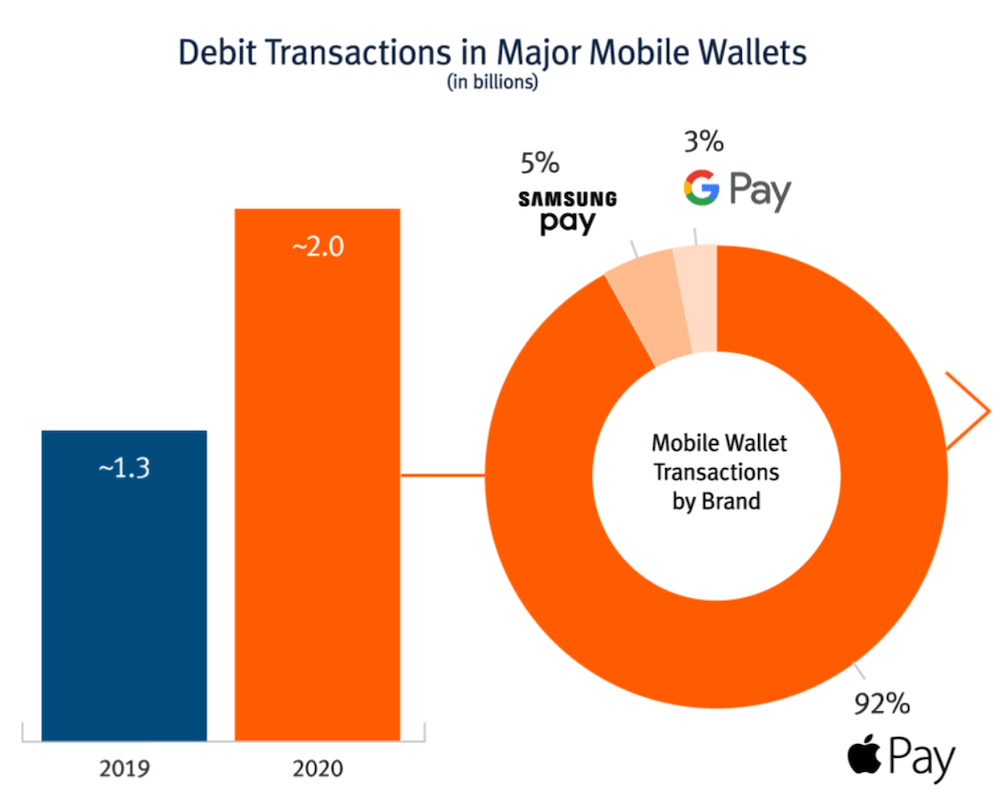

The recently published annual 2021 Debit Issuer Study from Pulse told us Apple Pay accounted for 92% of all U.S. mobile wallet transactions last year. The report also informs us that approximately 2 billion mobile wallet transactions took place in 2020, which essentially means around 1.8 billion Apple Pay payments took place.

Apple has become by far the biggest mobile wallet service in the U.S., the report claims. Samsung Pay took 5% of the market and Google another 3%.

But overall usage is up 51% year on year as users opt for contact free and at least 44% of Apple users who have set a card up for use via Apple Pay used it for at least one purchase. The report shows Apple Pay users make use of the service twice as much as do those on other platforms. This confirms use in the U.S. far in advance of previous expectations.

In terms of availability, the report tells us that 74 of the top 100 U.S. merchants and over 65% of all U.S. retail locations now support Apple Pay.

“Trends we thought would play out over five years accelerated into one year. Card-not-present behaviour is here to stay, and we think it will grow even more,” said National Banks as quoted in the Pulse survey.

Expansion continues

Apple continues to expand the reach of Apple Pay, most recently introducing it in Qatar with Chile and Central America thought to be the next nation in the company’s sights. It continues to build out its partner banks and relationships with other providers, such as those offering prepaid cards. There are also big names such as Coinbase and eBay launching support for the service.

What also seems to be happening is that as the pressure to use contact free payments grows users are choosing to adopt Apple Pay rapidly on the basis that it is a trusted service, given so many now use it. A case in point for this speculation might be in South Africa, where over 100,000 customers quickly signed up to Apple Pay once the nation’s First National Bank (FNB) offered support for it. The bank also revealed that around 700,000 of tis customers are equipped with Apple Pay compatible devices.

Of course, record iPhone 12 sales and strong anticipated iPhone 13 demand will also turn into a fresh opportunity for Apple Pay, many new users will sign up for the service, particularly now they have become more aware of it.

[Also read: What prepaid cards work with Apple Pay?]

Apple is also seeking new ways to expand the use of the service. Most recently by developing relationships to offer ‘Buy Now, Pay Later’ services. You’ll be able to choose to pay for things in four interest-free payments made every two weeks (‘Apple Pay in 4’), or across several months if you pay interest (Apple Pay Monthly Instalments).

In related news, Apple also seems to be looking at creating a system that lets users create virtual, temporary digital Apple Pay Later credit cards for single payments.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.