Apple Pay gets ready to grab a $24b market opportunity

Apple Pay Later

Originally expected with iOS 16, Apple Pay Later seems later than expected but Apple has expanded internal testing of the service, which suggests it is toward introduction.

Announce Now, Ship Later

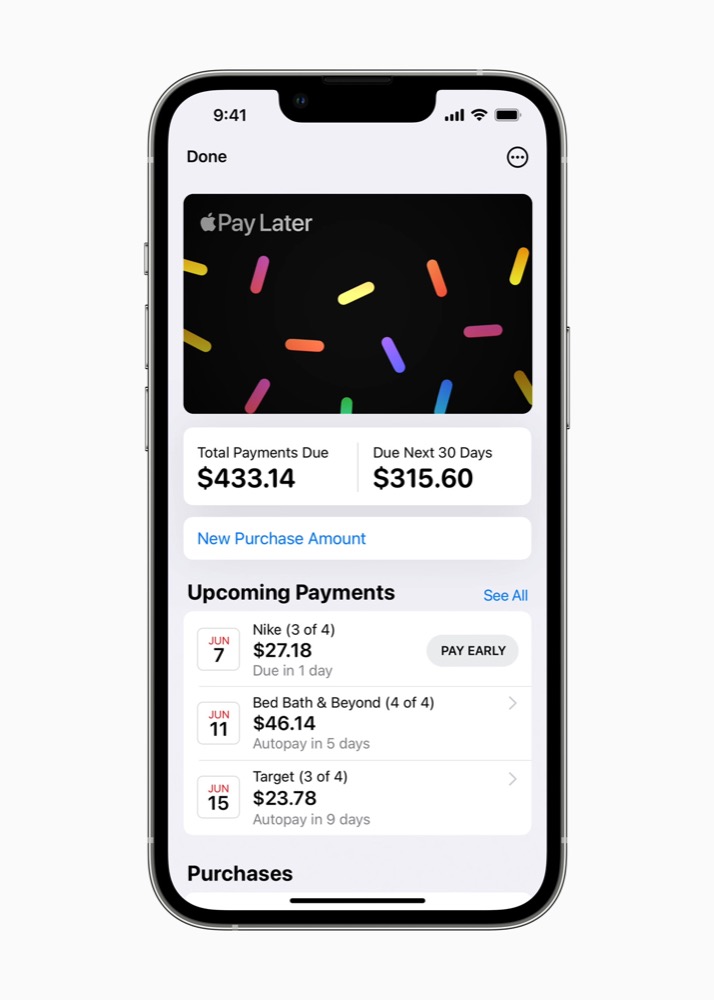

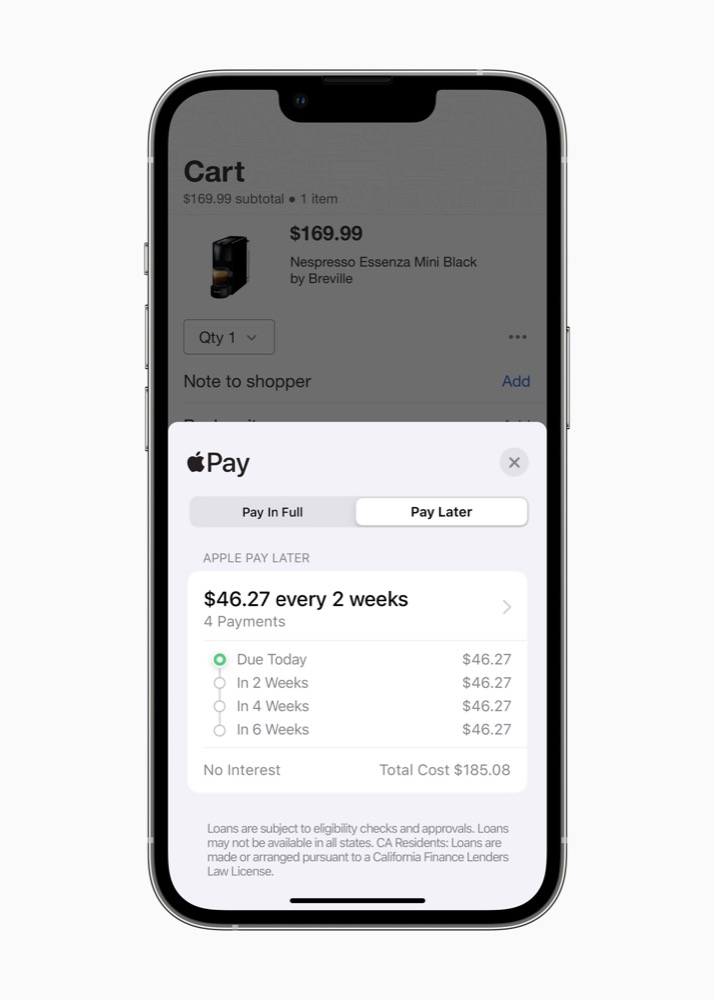

The company’s response to the rapid growing Buy Now Pay Later market, Apple Pay Later lets people purchase goods up to $1,000 in value on interest free credit so long as they pay the sum back across the next six weeks in four instalments.

The idea is that if you keep up with payments you pay no fee or interest. You only pay if you are unable to meet those payments. Apple has now opened up testing of the service to retail store employees.

BNPL services are surging in interest.

The FT reports that in the US, loans made by Affirm, Afterpay, Klarna, PayPal and Zip grew from $2b in 2019 to over $24b in 2021, according to the Consumer Financial Protection Bureau. Analysts expect the market to reach an astonishing $3,762.7 billion in value by 2030, which I find frankly frightening.

Apple seems to be handling the credit check and advancing the loans?

The debt trap?

Many are making use of these schemes in attempts to navigate the cost of living crisis, though debt advisors are very concerned at the implications of this.

Will already financially challenged people become locked inside debt traps? There’s a very real fear of this across many debt management teams.

While it isn’t known if Apple is making use of technology acquired when it recently purchased Credit Kudos the direction of travel – to run soft credit checks effectively – is evident.

To support the service Apple has launched a wholly owned subsidiary and may extend additional services in future. Apple already offers its US-only Apple Card.

Pay it.. later…

What Apple is saying

During the most recent financial call, Apple executives mentioned Apple Pay three times.

CFO Luca Maestri pointed out that the service is now available in 70 markets, across millions of merchants. “Payment services are continuing to set new highs all the time for us,” he said. “We saw a record breaking number of purchases made using Apple Pay globally during the holiday shopping season.”

The latter had been anticipated. Not only will Apple have generated generous transaction fees on mobile payments across the holiday season, it may also have made a few more cents on Apple Card sales.

“Thanksgiving this year has become an inflection point, where smartphones drove real growth and highlights how much these experiences have improved,” Vivek Pandya, lead analyst, Adobe Digital Insights said of Black Friday sales.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.