Apple Pay Later will look at previous Apple purchases

Pay it.. later…

While the service hasn’t yet slipped into the world we’re learning more concerning how Apple plans to offer its take on payday loans, Apple Pay Later.

Apple’s credit criteria come into view

The latest report, presumably from behind the curtains in a highly placed executive’s office, given the frequency and accuracy with which they appear from this source, goes into a little more detail concerning how Apple will assess a person’s credit worthiness.

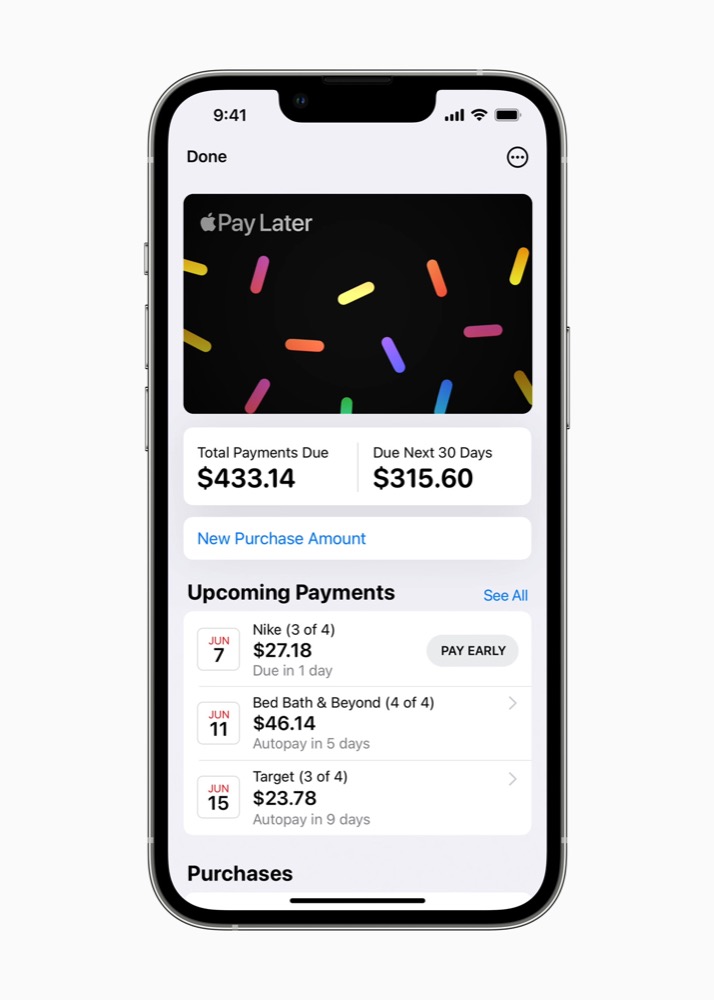

Assuming someone passes these credit checks, Apple will extend loans of up to $1,000, which must be paid back in four payments over six weeks.

It appears your spending history with Apple will be among the criteria used to extend these loans. The report tells us the process will look at data the company holds on a user, including:

- A user’s history with Apple, including spending at retail and the App Store.

- What Apple devices they own.

- Apple Cash P2P payments.

- Apple Card history.

All about soft credit checks

Now while this makes for a sticky headline it is logical. Apple is trying to develop a credit checking system that doesn’t leave traces on a person’s credit record (a soft check) rather than the hard checls that do leave traces and can impact a person’s credit worthiness.

Given that one tjhing the company does know is any purchasing activity that has taken place via a user’s Apple ID, it’s no surprise it will consider this. Apple has no insight into Apple Pay transactions under its privacy policy.

What information it does have will likely be set beside additional data from outside of Apple to determine credit worthiness.

Apple Pay Later

Apple will also require government ID, social security numbers and that 2FA is set up on a person’s account. If Apple does offer credit a person will have 30-days to use the loan.

The service is expected to launch in the US in the coming weeks and is currently seeing extensive testing across Apple retail in the US.

As we revealed last week, US the pay later market grew from $2b in 2019 to $24b in 2021, according to the Consumer Financial Protection Bureau.

Analysts expect this to rise dramatically in the next few years, though debt advisers are extremely concerned at the potential impact of such easy credit schemes.

To support the service Apple has launched a wholly owned subsidiary and may extend additional services in future. Apple already offers its US-only Apple Card.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.