Apple soft launches invite-only Apple Pay Later in US

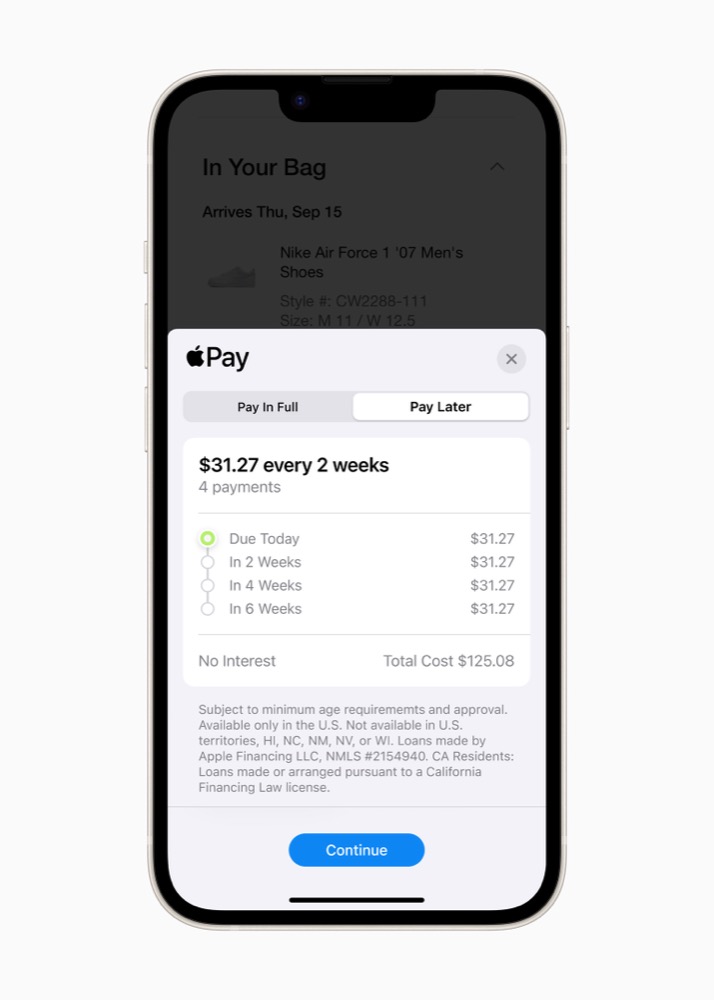

Apple Pay Later looks like this at checkout

Apple has at last begun rolling out its now long awaited Apple Pay Later service, but it’s only available in the US and the chance to make use of it is being provided to only a small number of users today. In the future it will be made more widely available.

To explain the decision to launch only to a small customer group, Apple describes the emerging new service as a pre-release version of what it intends to provide. “Starting today, randomly selected users will be invited to get early access to a pre-release version of Apple Pay Later via Wallet and through their Apple ID email,” the company said.

It is expected the service will become more widely available later this year.

What is Apple Pay Later?

Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees. Loans can be between $50-$1,000. The loans can be tracked, managed, and repaid from inside Apple Wallet. The loans can be taken out for online and in-app purchases and iPhone/iPad purchases made with merchants that accept Apple Pay.

What did Apple say?

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

How to get an Apple Pay Later loan

- Consumers can take out one of these loans from inside Wallet, with no impact on the credit.

- They will be asked to enter the amount they wish to borrow and agree to the terms of the loan.

- A soft credit check will take place during the process to help verify the applicant’s suitability for the loan.

- Once Apple Pay Later is set up, users can also apply for a loan at checkout when making a purchase.

- During the process you will be asked to link a debit card from Wallet as the loan repayment method. Credit cards cannot be used for this purpose as a guard against users building bigger debts.

What happens once you take an Apple Pay Later loan?

What happens once you take an Apple Pay Later loan?

Once you apply for the loan, you’ll see the Pay Later option appear when you choose Apple Pay as a payment method when checking out.

How do manage an Apple Pay Later loan

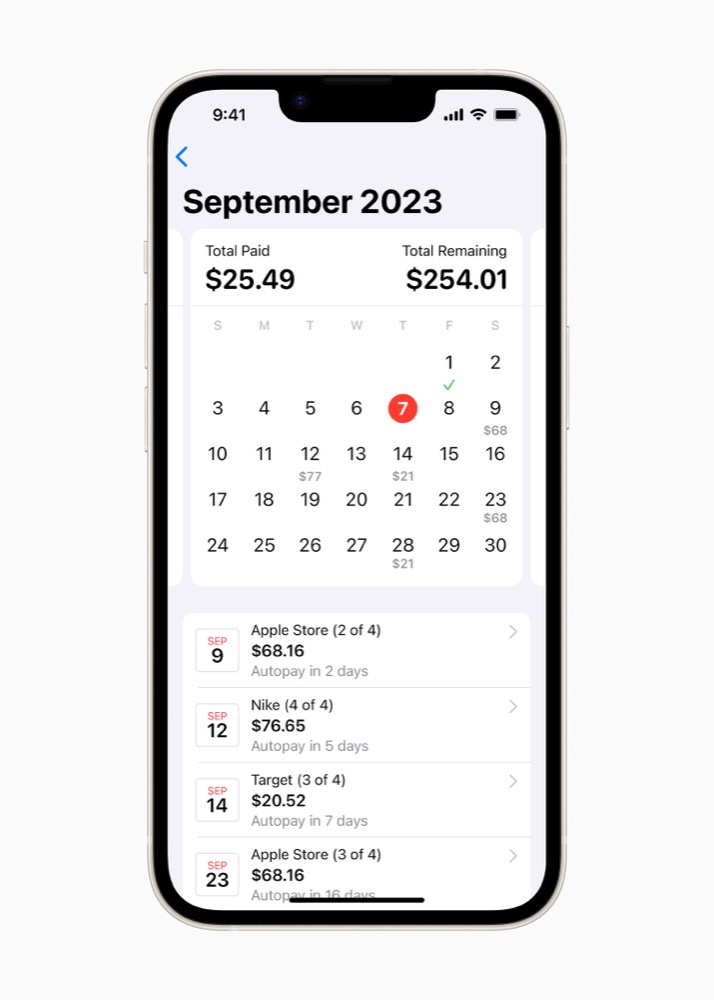

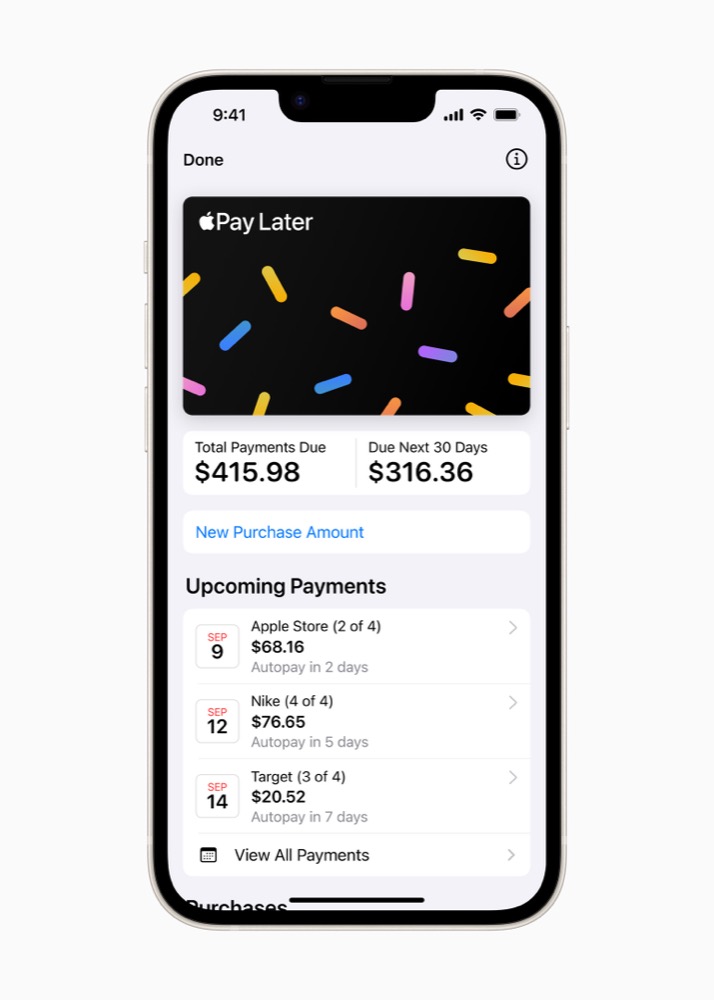

Wallet holds all the information about the loan. Open this to see the current total amount due for all existing loans along with information about upcoming payments. Users can check these payment dates on a calendar and will also receive a notification to let them know when a payment is becoming due.

Also read: Apple Pay Later will look at previous Apple purchases

Who owns the loans?

As predicted, Apple Pay Later is offered by Apple Financing LLC, a subsidiary of Apple Inc., which is responsible for credit assessment and lending. Apple Financing will begin to disclose Apple Pay Later loans to U.S. credit bureaus starting in fall, which means users need to stay up to date on their payments.

Who is Apple working with on Apple Pay Later?

Apple is working with Mastercard and Goldman Sachs on this new service. Apple is making use of the Mastercard instalments program which makes it easier to implement the service at checkout. Goldman Sachs is the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases.

Why is Apple doing this?

In the US, loans made by Affirm, Afterpay, Klarna, PayPal and Zip grew from $2b in 2019 to over $24b in 2021, according to the Consumer Financial Protection Bureau. Analysts expect the market to reach an astonishing $3,762.7 billion in value by 2030.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.

What happens once you take an Apple Pay Later loan?

What happens once you take an Apple Pay Later loan?