Apple sold 3 iPads for every Chromebook sold in Q122

Apple’s M-series Mac range.

If you include tablets (as you should), Apple now leads the global PC market, and its market share is growing while most others decline.

Not only that, but the company sold three times as many iPads as the entire industry managed to sell Chromebooks, fresh data claims.

Mac leads the Apple insurgency

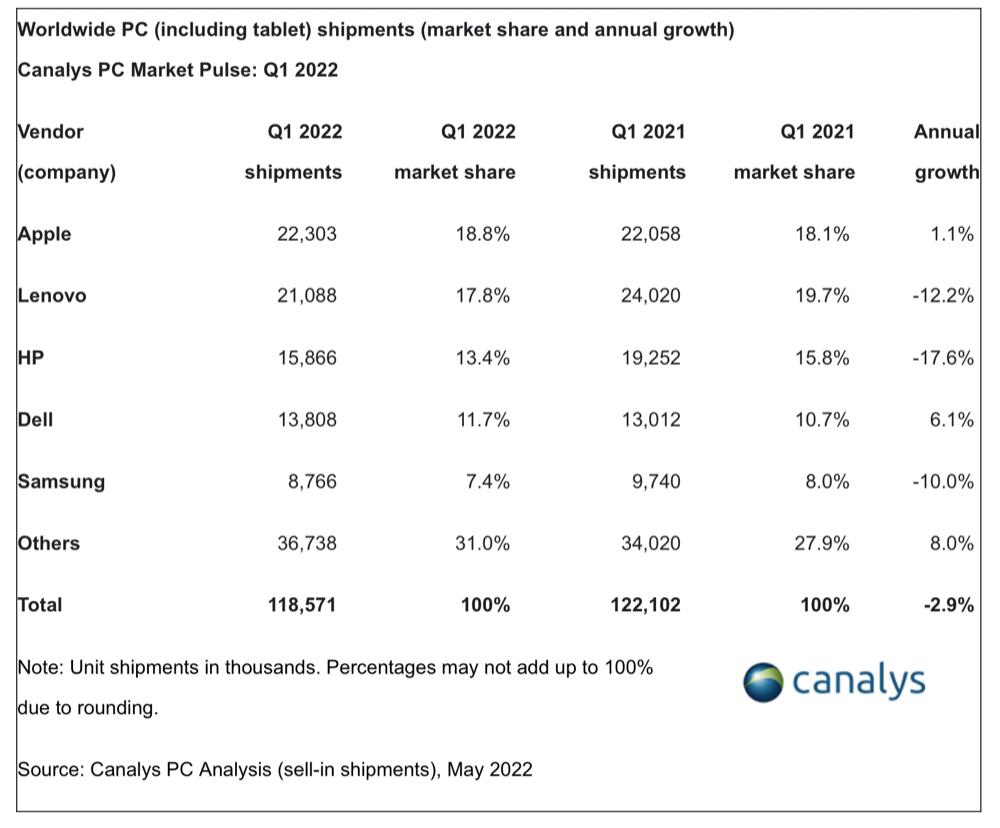

Information from Canalys shows global PC shipments fell an average 3% YoY in Q122, to 118.1 million units.

Within that global quantity Apple sold 22.303 million Macs and iPads in the quarter, up 1.1% for 18.8% share of the entire PC market. In other words, when it comes to computers people use, almost one in five is now an Apple device.

What is interesting is the extent to which this growth was generated by Mac sales. This reflects recent findings from both IDC and Counterpoint Research, which both saw Mac sales increase while PC sales broadly speaking slowed. iPad sales declined 2% in the same period. Even there, Apple leads, as tablet sales fell 3% YoY industry wide. Apple sold 14.881m iPads in the quarter.

Worldwide PC market growth, includes iPads

Apple sells three times as many iPads

Canalys claims PC shipments remain extremely strong compared with before the pandemic, with a three-year CAGR of 12% from Q1 2019.

It also notes declining interest in Chromebooks. Despite the hype that surrounds that category, sales are dwarfed by those of the iPad. Chromebook shipments fell by 60% year on year in Q1 to 4.9 million units, Canalys said. In other words, Apple sold three times as many iPads as the entire industry sold Chromebooks in the period.

[Also read: Report claims Apple Silicon Macs may have Samsung inside]

- In the total PC market (including desktops, notebooks, and tablets), Apple took first place from Lenovo as it shipped 22.3 million units in Q1 2022, up 1% annually.

- Second-placed Lenovo saw a year-on-year decline of 12%, shipping 21.1 million devices worldwide.

- HP’s shipment of 15.9 million units placed it third as it also underwent a significant decline of 18%.

- Both HP and Lenovo faced a difficult comparison from a volume perspective due to their large Chromebook output in Q1 2021.

- Dell took fourth place and benefited from the commercial demand surge, helping it achieve a healthy 6.1% growth in shipments to 13.8 million devices.

- Samsung rounded out the top five with 8.8 million units shipped.

8 quarters of growth

Canalys Analyst Himani Mukka said, “The market has now posted eight consecutive quarters of shipment numbers greater than in Q4 2019, before the pandemic. Increasing commercial deployments are now helping to offset the softening of consumer demand that has followed the large buildup of the tablet installed base over the last two years.

“Looking ahead, the market will face greater pressure on supply from the Russia-Ukraine conflict and COVID-related lockdowns in China. Lingering tablet demand from Q4 2021 was expected to extend into Q1 2022, but the supply situation is now likely to push backlogs into the second quarter.

“From a regional perspective, Asia Pacific is set to be the growth engine for tablets as they cater to price-conscious users in markets where broadband connectivity is a luxury. For example, certain education deployments in India are bundling tablets with free cellular data packages to ensure students are equipped to handle new digital learning processes. In such markets, tablets are also able to support basic productivity needs at affordable prices and with better accessibility in the channel.”

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.