Apple supply chain buoyant on big spike in sales

Investors reaching for the skies…

The Apple supply chain is enjoying its very own gold rush on the back of the success of the iPhone 12 and every other product to emerge from Cupertino in the last 12 dreadful months.

Spreading the wealth

Report after report seems to have shown the strength of iPhone 12 sales in the last few months, and now we’re beginning to see how this has impacted across Apple’s manufacturing ecosystem.

TSMC, Foxconn, and many smaller suppliers are all benefitting from this, and while it’s hard to ascertain the exact numbers it’s easy to speculate that Apple’s overall sales continue to be up as it navigates its way through what is usually seen as being its traditionally quiet second quarter.

We should learn more in April when the company may report its results – but here are some highlights from its supply chain.

TSMC – Apple business up 36.22%

Apple’s chief chip manufacturer, TSMC, recently announced $11.94 billion in sales from its largest client, believed to be Apple. That’s about 25% of its total revenue in a year in which revenue rose 25.17% on the back of strong global demand. Interestingly, revenue from TSMC’s largest client rose 36.22 percent in that year. The company says it expects further improvement in the current year.

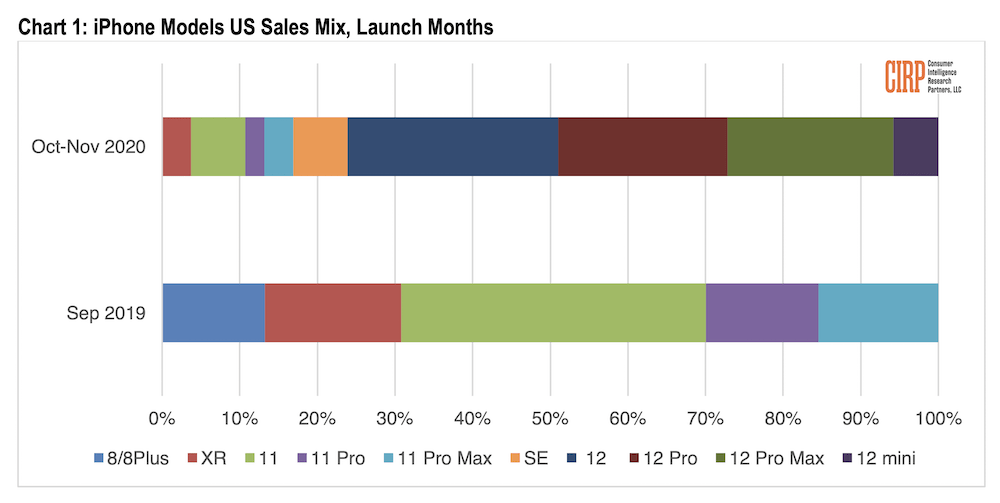

The latest CIRP data shows iPhone 12 boom

Hon-Hai – up 84.81%

Key Apple supplier Hon Hai Precision Industry/Foxconn saw February sales soar 84.81% in contrast to the same month last year, a new record analysts attribute to iPhone 12 sales. It’s constructive to note that the month includes a 7-day Chinese New Year holiday, which slightly depressed results month by month. The company said it expects sales to drop this quarter by double digits, though market momentum will remain. Analysts predict Q2 revenue will decline around 30%, but will still be 35% up on the same quarter in 2020.

I hope this hard working woman gets a big bonus

GIS Holding – up 10% Y-o-Y

Apple uses touch modules from GIS Holding inside iPads and MacBooks. The company has confirmed its net profit for 2020 grew 10 percent on back of increased demand for tablets and computers. The company is 24% owned by Hon Hai Precision.

IQE – up 25%

Cannaccord Genuity raised its targets on Cardiff-based semiconductor wafer and materials company IQE, which also supplies photonics cells to Apple.

The analysts cited increased sales of 5G smartphones as part of this and predicted “continued demand momentum” in 2021. The analyst noted revenues grew 25% in 2020, and while didn’t specifically note the iPhone, it seems pretty clear where that growth came from.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.