Apple takes credit check and loan risk of Pay Later service

Apple seems to be handling the credit check and advancing the loans?

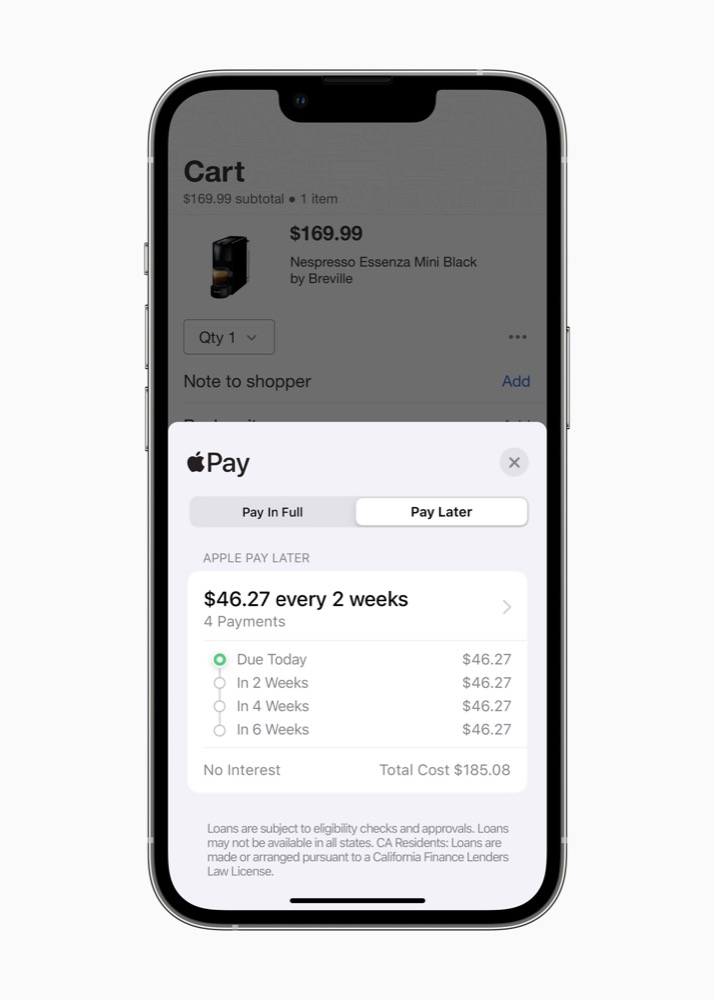

Apple has launched a wholly owned subsidiary to support its newly introduced Apple Pay Later service. It will be tasked with user credit checks and will extend short-term loans, the company has said.

Apple takes Apple Pay Later risk in-house?

A report on CNBC also reveals that Apple is using a white label ‘Buy Now Pay Later’ (BNPL) product called Instalments from Mastercard.

The latter company handles the vendor-facing side of the interaction. Goldman Sachs is also involved as the technical issue of these loans. But Apple’s own credit and credit checking facilities make the final decision.

What this essentially means is that Apple is handling decisions about loans, the credit check process, and the lending itself, which the report argues shows how the company seeks to handle as many financial services as it can internally.

Because the loans are made across six weeks and Apple’s credit-checking system will no doubt assess potentially fraudulent attempts against its already highly effective App Store fraud checking services, the company isn’t taking such a huge risk in extending credit. There’s some risk of default, but the company has the muscle to manage such risk.

Pay it.. later…

The credit check is a soft credit check, apparently

Apple says it will run a soft credit check to ensure borrowers can pay back loans, which will likely be capped at $1,000.

The service is only available in the US but hints that the company may choose to extend additional services in future.

While it isn’t known if Apple is making use of technology acquired when it recently purchased Credit Kudos the direction of travel – to run soft credit checks effectively – is evident. Apple already offers its US-only Apple Card.

[Also read: How iOS can reduce your insurance premiums]

The BNPL market is likely to become deeply competitive in the context of recession.

There are risks, and opportunities

Smaller operators may find themselves overextended, while larger concerns, including Apple, will need to tread carefully. Demand for these services will likely grow rapidly as consumers seek to make what cash they do have go further, but economic uncertainty will inevitably drive some default, which operators will need to handle strategically.

Apple’s big advantage in this market is of course its high customer satisfaction rankings, the deep loyalty it has built between itself and consumers, its world leading ease of use and the fact its users have already become accustomed to using Apple Pay.

And, of course, the hundreds of billions of dollars it has with which to secure these small debts.

Also read:

- WWDC22: What’s new in macOS Ventura? Quite a lot actually…

- WWDC: Apple surges forward, begins M2 chip transition

- WWDC22: Apple Watch gets big health upgrades

- WWDC, iOS: Lockscreen gains widgets, more ways to share

- WWDC opens doors with good news from AirPods & HomePods

- WWDC22: Apple makes devs API-er with Weather and more

- With iPad OS 16, Apple asks, ‘what’s a computer’?

- Apple’s ‘Innovation engine at full throttle’, Morgan Stanley

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.