Apple to end Goldman Sachs partnership for Apple Card

Image c/o blocks on Unsplash

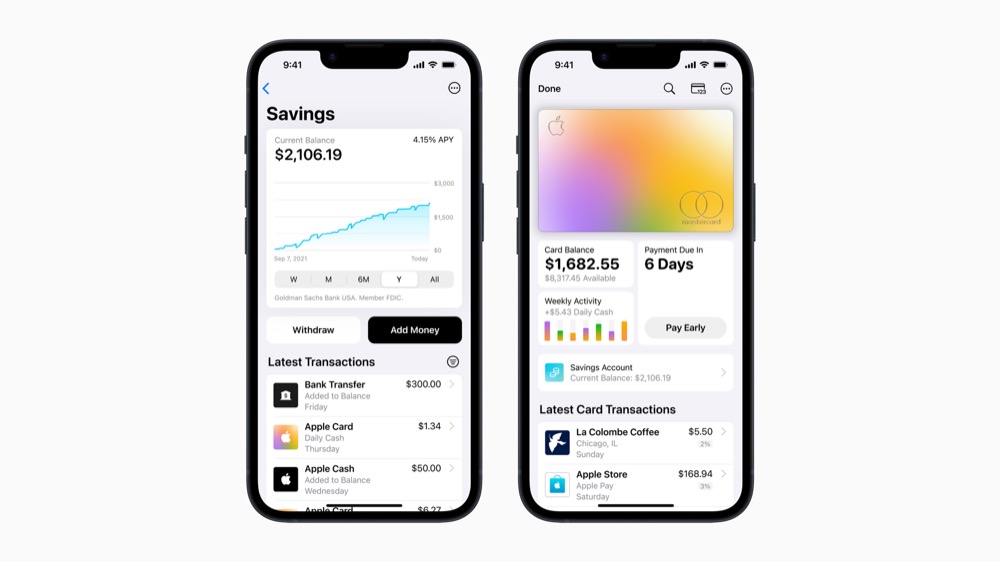

Is it curtains for Apple Card? I doubt it, given the high-value clients the service has already attracted and the billions already stashed in the Apple Card Savings account. However, news that Apple will end its partnership with Apple Card partner Goldman Sachs within the next 12-15-months doesn’t bode well for the service. I guess it won’t be available outside the US for a while – though Apple has denied the report.

What is the news story?

In brief the story confirms months of speculation that the Apple/Goldman Sachs relationship wasn’t going well. Previous reports claimed the latter firm wasn’t happy at the level or risk or the margins it achieved in its loss-making consumer banking division. Apple struck a tough deal with its fintech partner, it appears.

Now the Wall Street Journal tells us Apple is looking to exit its partnership with Goldman Sachs in the next 12-15 months. The two companies will allegedly dissolve all their existing partnership work, including Apple Savings.

What Apple said

Speaking to CNBC, Apple said:

“Apple and Goldman Sachs are focused on providing an incredible experience for our customers to help them lead healthier financial lives.

“The award-winning Apple Card has seen a great reception from consumers, and we will continue to innovate and deliver the best tools and services for them.”

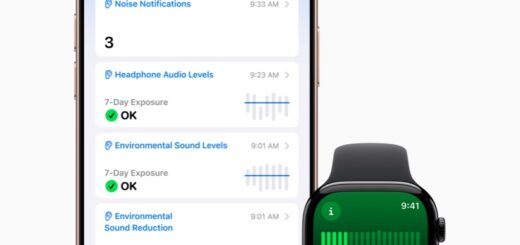

Offers a 4.15% interest rate on deposits

In the background

We’ve heard reports Apple was unhappy with Goldman Sachs customer service, with users reporting difficulties withdrawing funds, sourcing refunds, or making transactions. These problems were sufficiently widespread to cause the US CFPB to investigate Goldman Sachs, causing tension between both companies. Goldman Sachs execs blamed Apple for the scrutiny, while also complaining that the service was losing them money.

What does this mean?

Apple will now need to find a new partner to run the backend services for Apple Card. There has been speculation it may work with Amex, and yet it is also plausible the company may choose to go its own way – though that path is fraught with risk. It is possible that Apple will simply let this side of its business expire, given that times have changed, credit is no longer cheap, and the wider economic outlook isn’t especially rose-tinted. At the same time, Apple Card has won over some very high value customers, so there is something to fight for there. A third of Apple Card users earn over $100,000 per year, and 60% of these use the service as their primary card. Apple is also unlikely to want to abandon a service that attracted such praise. It would be weird.

What happens next?

If Apple exits the market this will be seen as a big scalp by the traditional banking industry. The company has been in discussion with Amex, apparently, but can’t move there due to an existing agreement with Mastercard. Apple has also been in conversations with other providers, but no decision has yet been reached. However, if you use an Apple Card the service should remain in place across this particular shopping season.

Why it matters

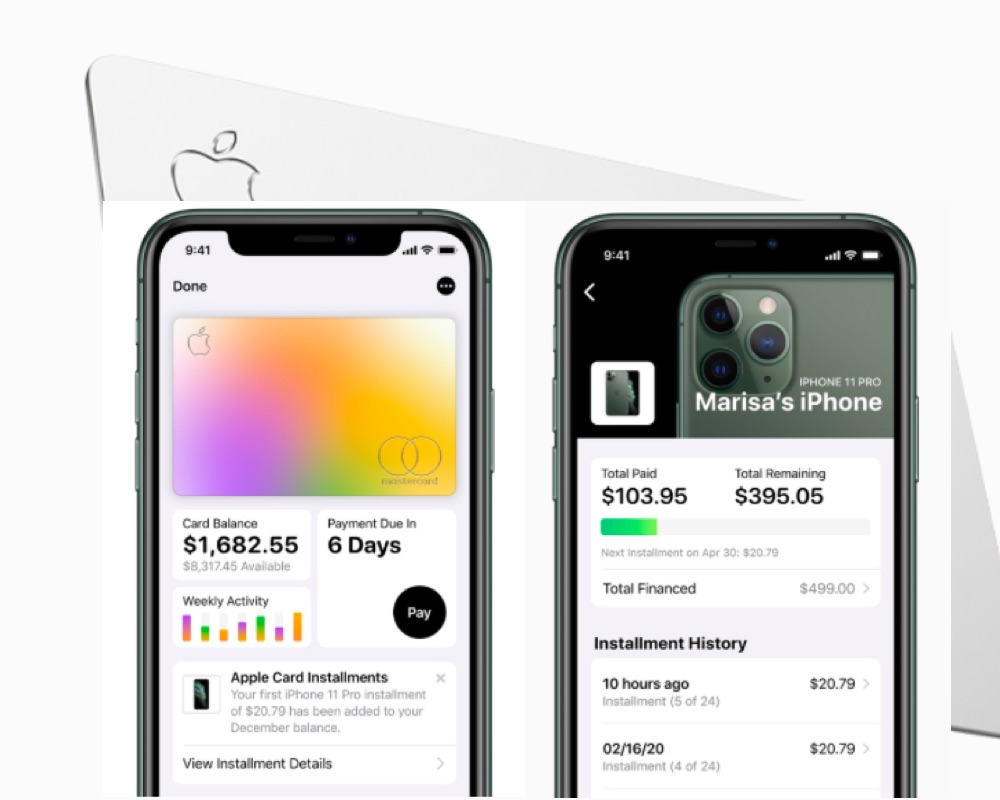

Apple Card is an award winning service that has become incredibly popular with US customers. The software the card provides is highly usable and great features such as the ease of changing PINs or card numbers when a card is lost or stolen have won a lot of praise. Indeed, on launch the card was lauded by many (including me) for setting a new and higher bar for what cards should do. You get similar features with the excellent Revolut service and those from other challenger banks.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.