Apple’s 2020 trends suggest strong iPhone 12 launch – analysts

A man working at Apple wearing a mask.

Apple will outperform the global smartphone market this dreadful pandemic year, says Counterpoint Research, which predicts iPhone 12 sales will be greater than those of iPhone 11 despite the late launch of the device.

Riders on the storm

The Counterpoint Research analysis seems to be:

- 5G iPhones will stimulate interest.

- The iPhone SE helped Apple get through some of the toughest months of lock-down.

- iPhone 11 remains popular, still selling one million units per week.

- Apple’s smartphones maintained momentum while the market declined.

- Apple’s online sales in developed markets were very strong.

- Apple’s sales are currently 11 points above the industry average.

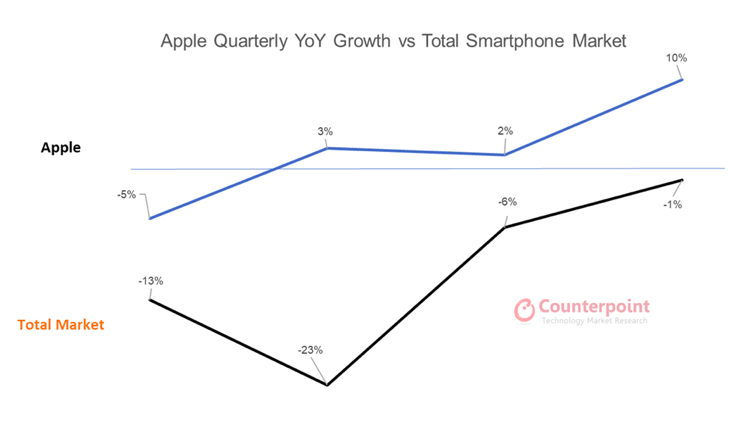

How Apple is tracking against industry averages, Counterpoint

In a press release, Counterpoint Research Director Tom Kang said:

“Apple has done a great job outperforming the global smartphone market. During the COVID-19 low point in Q2 2020, Apple was helped by the timely launch of the iPhone SE, which created a new, low price point for iPhones at $399. It helped Apple get through the worst months of COVID-19 and its lockdown periods.

“In addition, the iPhone 11 has proved to have great longevity, still selling over one million devices per week on the brink of a refresh. The SE and iPhone 11 helped maintain momentum through Q3 as the general market remained negative.”

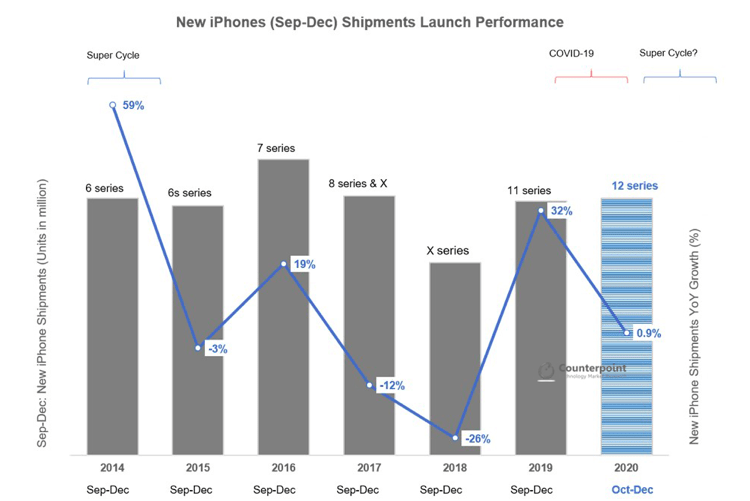

Historical iPhone sales in first quarter by model

What’s the state of play?

The analysis reveals a few additional insights, not least that sales of premium smartphones saw significantly less decline than the rest of the market. While sales of smartphones in all tiers fell 23%, those of premium devices fell a (still significant) but less painful 8%.

Who does this benefit?

Apple, which is the biggest player in the premium markets.

From that base, the analysts believe the introduction of 5G will unleash what they describe as “significant” pent-up demand for an iPhone upgrade. Research Director Jeff Fieldhack notes additional trends that may benefit also Apple’s upgrade cycle in 2020:

“Also benefitting Apple this smartphone refresh will be greater efforts by global mobile operators to upgrade the iOS installed base to 5G. In countries where 5G has begun to roll out, operators will have significant monetary incentive to migrate LTE iOS subscribers to their near-empty 5G networks.”

He also predicted what might be good news for consumers, as carriers seek to mitigate against post-pandemic churn once we (eventually) begin to enter an era of recovery.

“Look for significant promotional offers, especially in 5G rollout countries. The US is likely to see its most competitive marketing wars in years, which will benefit Apple. European carriers will also see elevated levels of marketing. But China is not expected to be as aggressive.”

So, will this be a super-cycle? I don’t really anticipate this as market conditions are appalling, but Apple does seem well-positioned for the next few months of struggle.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.