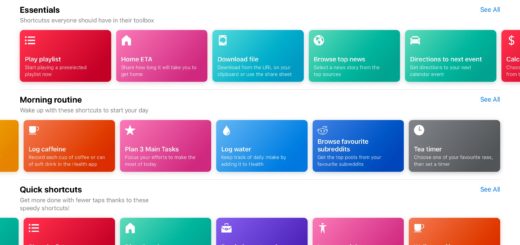

Apple’s happy iPhone continues to gobble the industry lunch

While investors continue to struggle with their emotional reaction to news of Apple’s most recent c.$151,000 profit per minute quarter, fresh data confirms the iPhone maker’s growing ascendancy in the now contracting market for mobile devices.

Apple makes $151k profit each minute

Let’s take a birds-eye view at the global situation first.

That’s where Counterpoint tells us Apple’s smartphone revenue and profit achieved June quarter records as the company supped deep on 45% of the first and 85% of profit.

That tasty treat may have come within the context of a 3% decline on shipments but did so as global smartphone revenues dipped 8% YoY. Profit also fell But not at Apple, which grabbed a deeply satisfactory 85% share of the profit the industry is generating, up from 81% this time last year.

Now, this isn’t to celebrate some wealthy multinational making tonnes of cash, but to point out that when an entire industry is chasing that remaining 15% share of profit don’t be too surprised if the devices it generates are a little second rate.

That’s important given Apple has also confirmed it is now attracting switchers at a rapid rate.

So, the momentum isn’t elsewhere.

What did Counterpoint say?

We know that part of Apple’s success is rooted in successfully upselling customers to pro devices, which means it makes more cash per sale and therefore helps manage reduction in sales made. The result being the company’s, “share of global operating profits also grew by 4% since Q2 2022, reaching 85%, another second quarter record for Apple,” said Research Director, Jeff Fieldhack.

What happens next?

Counterpoint reckons the industry will attempt to woo customers to higher value premium devices, even as they also work to build share in emerging markets, which the analysts think will “drive the next chapter of growth”.

“Consumers are opting for premium offerings, driven by easy and affordable financing options. IDC expects this growth momentum to continue in the upcoming months in 2023,” said Upasana Joshi, Research Manager, Client Devices, IDC India.

So, what’s happening in the emerging markets?

Apple, really.

Sure, it’s not the biggest vendor, but it is certainly in the game – that even while the rest of the industry works to compete in the premium segment in which the company has already established powerful mind share as a result of actually, you know, building that better. Apple just continues to do what it has been doing for years – making devices people love (with a 96% customer satisfaction rate).

This has generated market strength everywhere, including in China, where it set records in its most recent quarter.

It has also helped the company achieve record results in the world’s number two smartphone market, India. There, Apple has seen its share of the market grow strongly over the last year. It now holds 5.5% of the entire market for a massive 61% YoY growth, according to IDC. Apple also has the highest average selling price in India, at $929. In other words, the company has the bit of the market where the money (and the user satisfaction) is even while competitors continue to struggle, not just with Apple but also with one another.

Apple must be on the way out, just like he predicted.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.