Apple’s iPad ate netbooks. Now it’s coming for Chromebook

Apple is king of the tablet business in the US

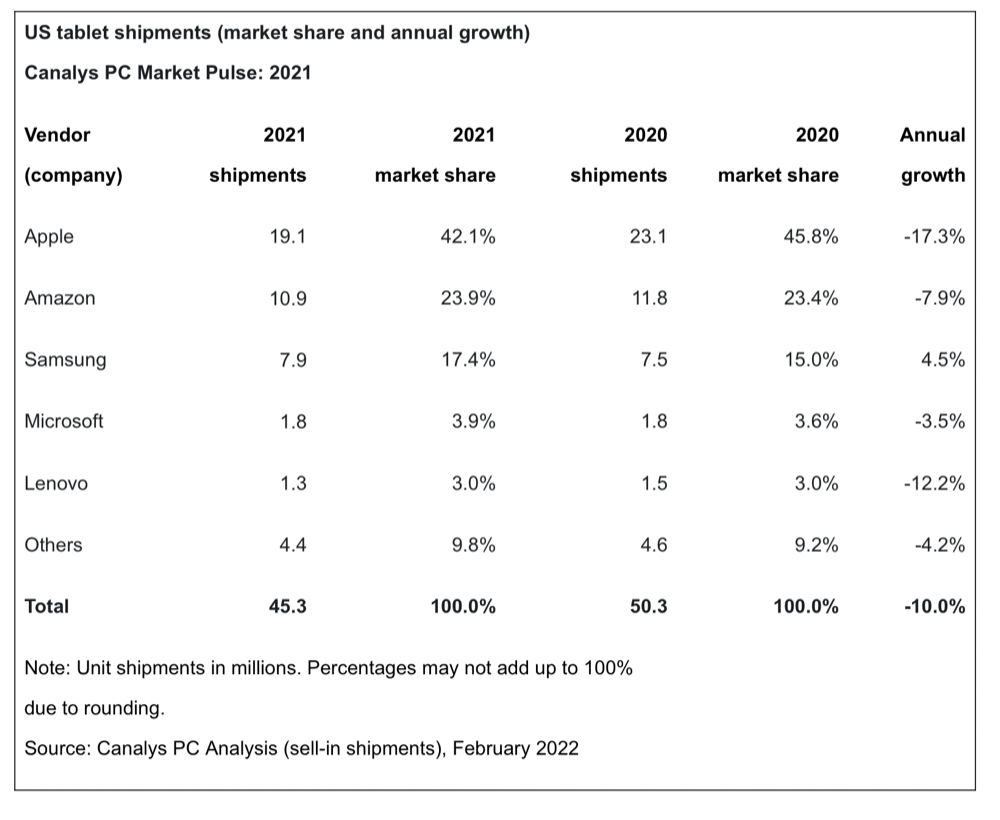

Despite well reported component shortages, Apple dominated the US tablet market in 2021 while demand for Chromebooks declined dramatically, Canalys data claims, echoing previous reports.

Apple dominates despite product refresh delays

Reporting on the PC industry, the researchers state that US PC shipments (including tablets) grew 1% in 2021, despite suffering a 28% fall in Q4 2021. They claimed 33.8 million desktops, notebooks, workstations, and tablets were sold in that fourth quarter.

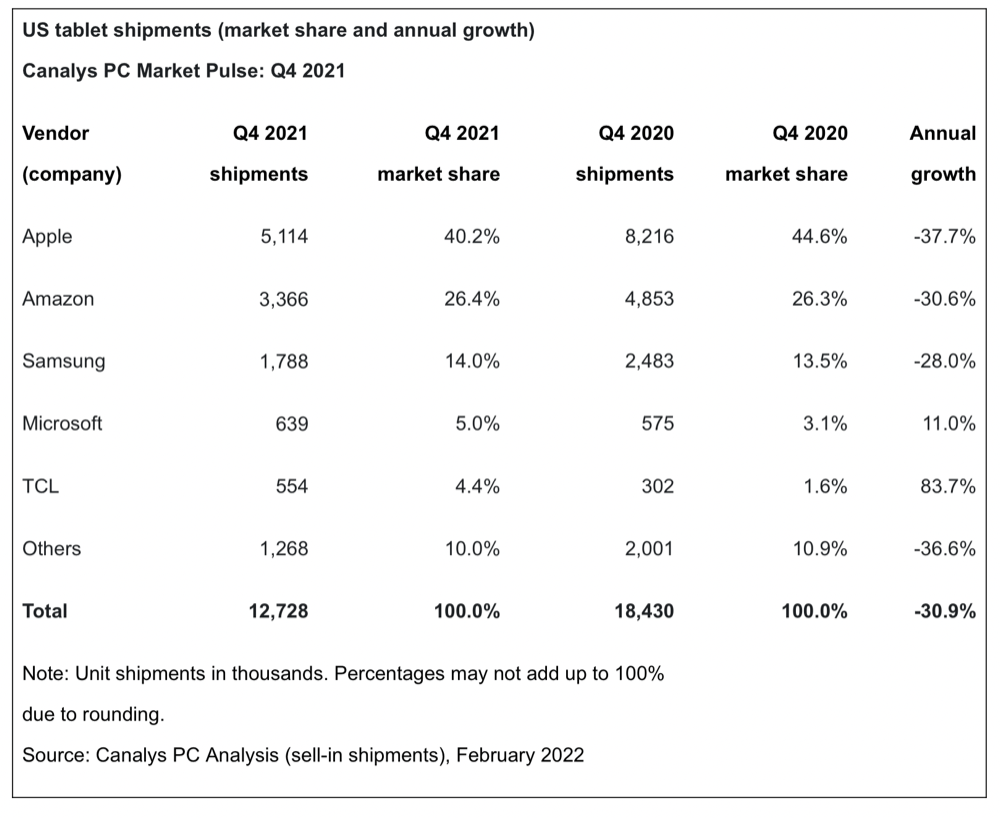

There’s more detail concerning overall PC sales below, but it’s the tablet market we’ll look at first. Shipments of these shrank 31% to 12.7 million as consumer demand slowed significantly, the analysts said.

Don’t forget we all think Apple delayed introduction of new iPads in that quarter to divert available components to meet the demand for iPhones. Despite doing so, Apple maintained its dominance in both Q4 and the full year, ending 2021 with 19.1 million iPads shipped, though this represented a 17% drop from 2020.

Amazon and Samsung took second and third place with 10.9 million and 7.9 million units respectively as the country’s key Android vendors. Both saw relatively weak holiday season demand compared to the same period in 2020. Microsoft and Lenovo placed fourth and fifth respectively in the 2021 tablet market.

Has the shine gone from Chromebook?

Canalys claim the Chromebook market had a second consecutive quarter of poor shipment numbers, posting a 73% fall from Q4 2020.

“While it is was an undeniably poor quarter for Chrome, significant declines were expected after the surge in shipments that coincided with peak education demand due to lockdowns,” said analyst Brian Lynch.

He doesn’t think the shine has gone from Chromebooks, instead predicting a boost in sales as schools upgrade and spend cash received from the Emergency Connectivity Fund.

“The education market will return to high levels of output by the 2023/24 school year as school boards seek to refresh devices bought during the pandemic. The need for devices with better specifications, such as larger displays and faster processors, will provide renewed opportunities for Chromebook vendors. The first half of 2022 is also set to provide a boost to Chromebooks as some schools will use a portion of the allotted US$7.2 billion approved via the Emergency Connectivity Fund to support the spread of digital education,” he said.

Though with Apple preparing to introduce improved iPad models, it will be interesting to see if those introductions are coupled with attractive new benefits for the education market.

What about PCs and Macs?

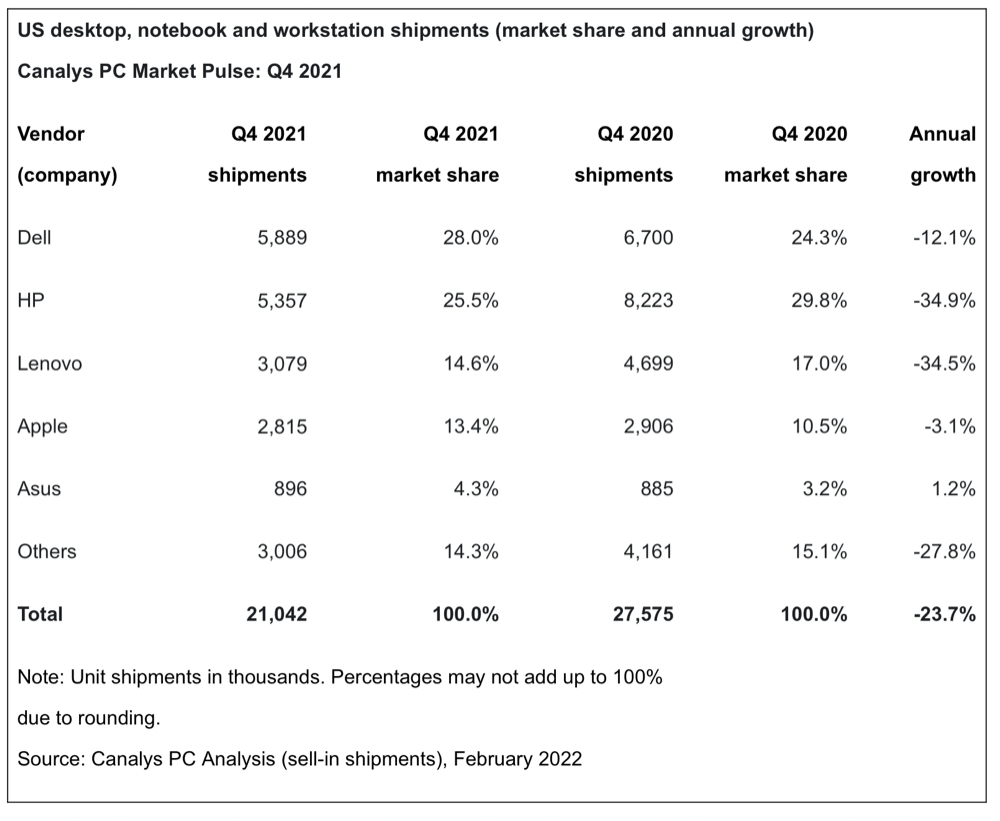

Overall demand for PCs seemed shaky, but this mainly reflected soft Chromebook sales. Notebook shipments fell 28% year on year to 17.5 million. Desktops were the best-performing category, up 9% to 3.6 million units.

In the market for PCs excluding tablets, HP led all vendors for full-year 2021, boosted by a strong standing in the Chromebook market (?), which led to struggles in Q4 as demand from the education segment fell off. Dell took the lead in Q4, but second place in the year with 22 million shipments. Lenovo’s shipments grew 11% year on year. Apple and Acer rounded out the top five, both experienced growth in the year.

However, what’s interesting is market share. We know the M1 and later Apple Silicon Macs are driving plenty of sales, and this seems to be reflected in market share. Apple took 13.4% of the market in Q4 and 10.5% of the market across the year. That was a fall year on year, but that decline may be accountable to what we know to have been slower than usual iPad sales in the last big quarter.

[Also read: Counterpoint predicts fast adoption of Apple’s AR glasses]

However, with Apple planning new Macs and iPads in March, it will be interesting to see how this translates in market share terms when it comes to Q2 2022. (They will at best only be available a short time in Q1 22).

Will Apple’s offer be enough to lure those education district budgets? Can they make a better sales story than Chromebook’s, given schools may have slightly stronger budgets? What are Apple’s education teams doing to ensure they do? And can it turn its status as the world’s top smartphone maker into becoming a top three PC vendor?

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.