Apple’s iPhone biggest brand in China again after 6-year gap

Two fresh market reports keen Apple-watchers may need to take a glance at: Counterpoint claims Apple has once again become the biggest smartphone brand in China, while Canalys believes the company now dominates the smart wristband market.

Apple is big news in China

iPhones have always been insanely popular in China (and elsewhere across APAC region). People seem to love them, and while relations between the US and China sadly seem under stress, Chinese consumers seem to want to maintain their love for the collective, internationalist vision that Apple’s products represent.

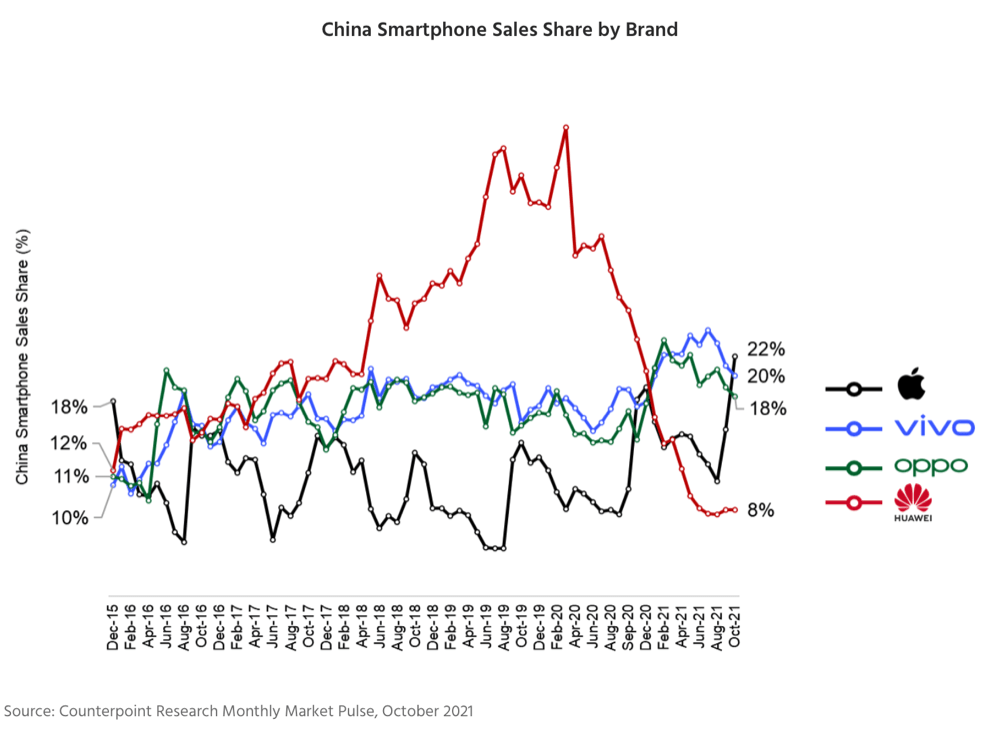

Perhaps this is why Apple has once again become the leading smartphone brand in China for the first time since December 2015, according to Counterpoint Research. Not only this, but the company saw the highest growth among all the major brands in October, as people rushed to grab an iPhone 13.

“Apple’s sales grew 46% month on month,” Counterpoint said. “The highest among all major OEMs in the country. In comparison, China’s smartphone market grew only 2% MoM in October. Apple’s stellar show came at a time when many consumers were delaying their purchases ahead of the Singles’ Day sales in November. Other key OEMs saw MoM declines in their October sales.

Wedbush analyst expects Apple to sell over 10 million iPhones over the Black Friday weekend. “Apple could exceed selling 80 million iPhone units in the quarter with stronger Pro versions driving higher ASPs,” he said. We know that in October, iPhone 13 was already setting records.

Counterpoint market data shows big spike in iPhone sales

It could have done even better

The supply chain challenges have impacted Apple, but the company still appears to be faring better than others, the researchers said.

“Apple, with its strong brand equity, is gaining the maximum from the gap left by Huawei in the premium segment. Apple could have gained more if it were not for the shortages, especially for the Pro versions. But still, Apple is managing its supply chain better than other OEMs,” said Counterpoint Research Director Tarun Pathak.

Counterpoint senior Analyst Varun Mishra said,

“Due to supply issues, the normal wait time for the iPhone 13 Pro and iPhone 13 Pro Max ranges between four and five weeks in China. Some Chinese customers choose to pay premiums to get the new phones delivered immediately.

“Overall, the China market has been slow throughout the year and Apple’s growth is a positive sign. It indicates that Chinese smartphone users are maturing fast and are looking to buy more high-end devices, which can be a good opportunity for brands. The supply chain is also prioritizing higher-end and higher-margin devices amid the shortages.”

Such a useful device

Apple Watch ticks along

The Canalys report tells us that in Q3 21, global wrist worn warble shipments hit 47.82 million units.

That’s down 11% on the year, but sees Apple regain first place with 7.33 million sales. Xiaomi took second position with 7.21 million units, while Huawei held third place. All three market leaders experienced decline.

That decline seems to reflect a somewhat tepid response to the latest iteration of Apple Watch 7, despite really positive reviews of that product on launch.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.