Apple’s iPhone is eclipsing Android in smartphone market

Counterpoint claims Apple’s iPhone installed base overtook Android in Q2 22, giving the iOS device over 50% of the US smartphone market and a huge chunk of global sales.

Apple’s iPhone seems to be seizing the smartphone throne

This seems to be significant data. Not only does it confirm Apple’s recent claims to have experienced more interest from switchers than before.

It also hints at a direction of travel that seems to be taking place internationally as considerations of quality, privacy, ease-of-use, customer satisfaction and longevity become even more important to consumers trying to make good purchasing decisions.

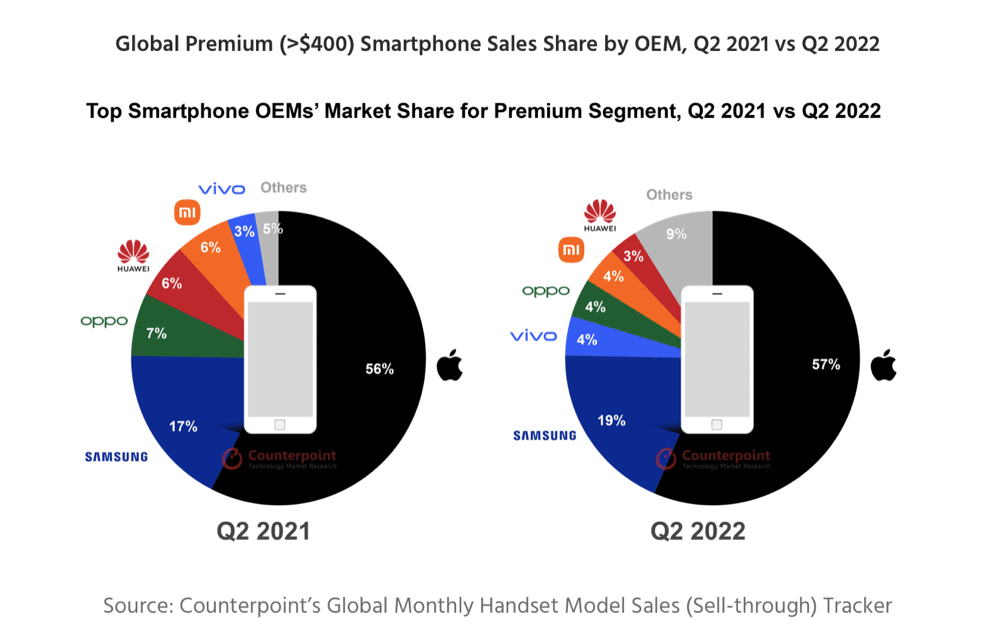

The global premium smartphone market ($400 and above wholesale price) average selling price (ASP) grew 8% YoY to reach $780, a second-quarter record, in Q2 2022, the analyst said, explaining this was mainly driven by 94% YoY sales growth in the $1,000 and above category.

That matches well, given Apple has hinted that consumers have been migrating to purchase its Pro devices most. Apple captured 57% of premium smartphone market sales, they said.

[Also read: 7 emerging Apple September 7 iPhone and Apple Watch rumors]

There was no evidence of any macroeconomic impact on demand for iPhones. Apple simply continued to attract new users as switcher growth hit a fresh record during the quarter, largely driven by robust growth in emerging economies.

What Counterpoint said

Senior Analyst Varun Mishra noted that consumers are upgrading to 5G devices. For Apple, he called this, “Especially significant, as the large installed base of premium iPhone users upgrades to 5G. Apple’s salesgrew 114% YoY, capturing over 78% of the $1,000 and above price segment.”

He noted,

“Consumers whose finances were not affected by the pandemic have been using the extra disposable income created due to restricted travel to buy more expensive devices, including smartphones. During the pandemic, users also realized the importance of smartphones and started seeing more value in upgrading their devices. Another interesting factor is that this trend in the ultra-premium market is ubiquitous across regions, despite inflationary pressures. This is because affluent consumers are not affected by the current economic headwinds.”

He also points to the ease of purchase, hinting at further activity in the BNPL markets.

“Hence, the low-to-mid-price segment has been hit hard by the recent macro headwinds while the high-price segment still looks solid, further boosting the ASPs. Also, the increasing number of financing schemes and a growing ecosystem of trade-ins and EMIs are also helping consumers to upgrade their devices without paying the total price upfront.”

All the same, the bottom line seems to be, consumers are discerning and if they are about to witness economic collapse they want a device that may see them through to the recovery. Hopefully.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.