Apple’s iPhone sees recovery in China, strength in India

The shoppers look like they’re coming back in China

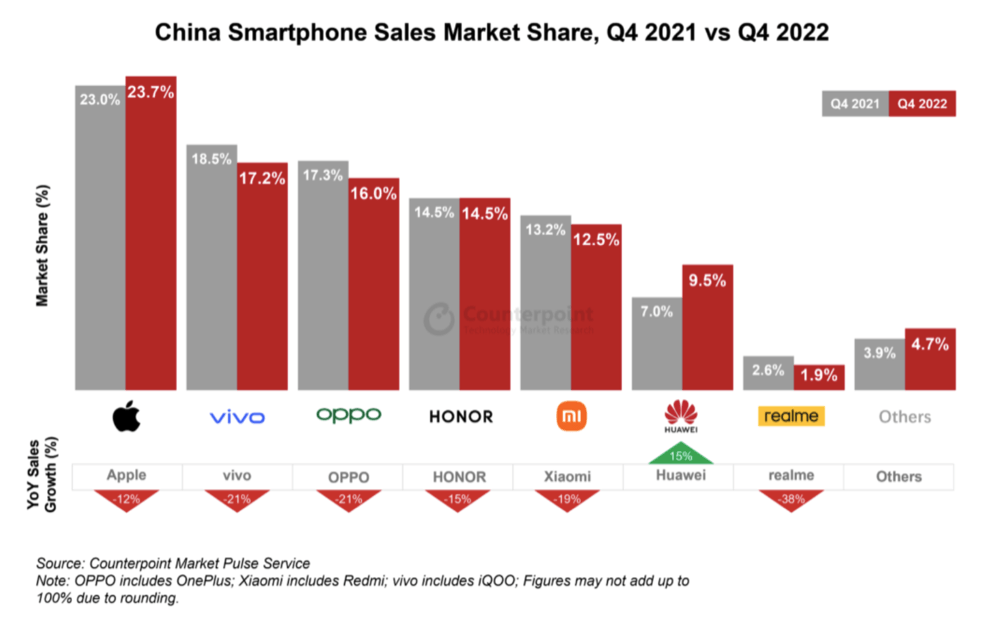

Apple took 23.7% of China’s smartphone sales in the December quarter even as iPhone 13 emerged to be the leading smartphone sold in India. These slices of data seem to give credibility to IDC and Morgan Stanley estimates as revealed this week.

China is heading to recovery

These two slices of Counterpoint data give a real sense of how Apple’s strategy to build business in both nations makes sense. It shows that despite frosty international relations, there’s still one US company Chinese consumers like, and demonstrates solid performance in India as Cupertino reaps the benefit of years of investment there.

China seems to be seeing some recovery, according to the analysts at Evercore. “Luxury retailers are signalling a major rebound in Chinese demand after a weak 2022,” analyst Amit Daryanani told clients as reported by Ped30. “iPhone sales should generally track the broader luxury market in China.”

This should be good news for Apple, which tracked a record 23.7% share of China’s smartphone market in the December quarter. Cupertino outperformed the market across the year, Counterpoint said, with 18% share across the year. While Chinese smartphone sales fell 14% across the year, Apple experienced only a 3% decline, which means it has increased market share in this giant smartphone market.

“This was despite the shortages faced by the iPhone 14 Pro versions as well as the comparatively lower popularity of the iPhone 14 series’ non-Pro versions due to limited upgrades compared to the iPhone 13,” Counterpoint said.

Apple’s growing business in India

What is also interesting in India is that sales of premium smartphones crossed 11% for the first time. This shows a change in consumer attitudes there as people in India realize the importance of solid tech choice. Sales of low and devices are slowing as demand shrinks and supply chain problems continue.

All the same, demand in India is also in decline, but BNPL schemes are helping some consumers invest in better devices. Samsung led the market, with 21% share. Apple grew 16% over the year to lead the premium and ultra-premium segments.

“India has become a strategic market for Apple. Increasing ‘Make in India’ capabilities for both local consumption and exports, expanding offline share through LFRs and aggressive promotions during the festive season accelerated Apple’s growth in India,” Counterpoint analysts wrote.

Estimating estimates

As we wind our way toward Apple’s next fiscal call next month, iPhone sales estimates look like this – do let me know as more come through.

- IDC: 72.3m (24.1% share).

- Morgan Stanley: 75.5m

- UBS: 79m

- Canalys: Gave no figure but estimates 25% marketshare.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.