Apple’s Mac sales strong as shortages bite global PC sales

Which home, home office or office wouldn’t benefit from these?

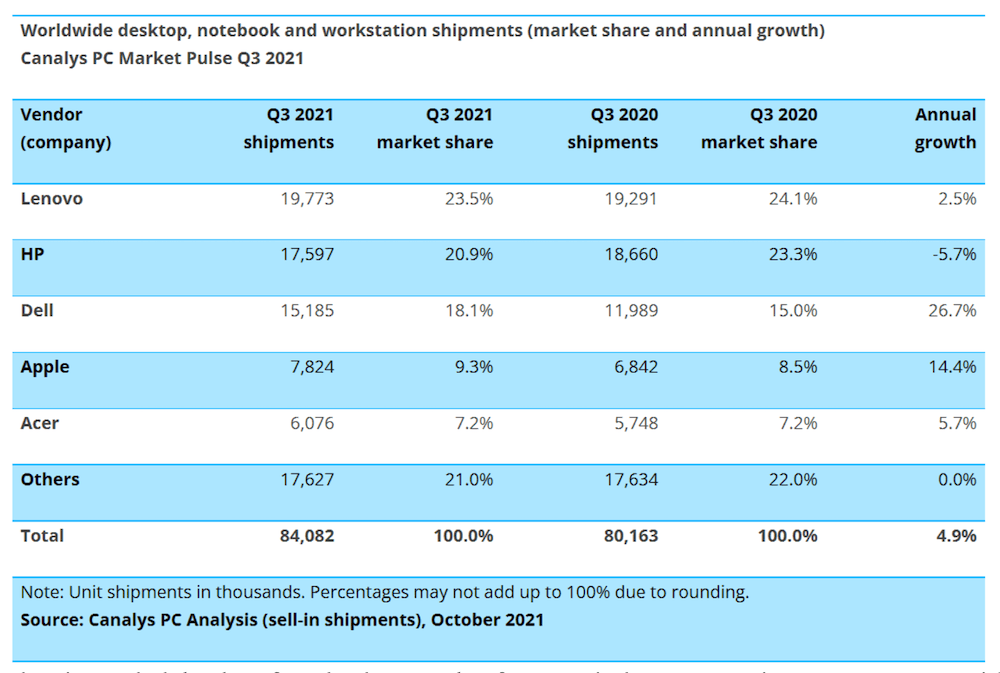

Canalys is out with its latest PC market report, which states component shortages dampened sales in the current quarter – though Mac shipments climbed over 14 percent.

Apple’s Mac sales continue to shine

The data reflects global PC sales. Canalys states that Apple shipped around 7.82 million Macs in the quarter, which is up 14.4% on last year and gives Apple 9.3% of the global PC market. Apple is now the fourth biggest global PC maker, behind Lenovo, HP, and Dell.

The analyst previously claimed Apple to have sold 6.4 million Macs in the second quarter. Mac sales have increased almost every year since 2009. In 2000, it held 2.92% of the PC market and its sales have grown strongly across the pandemic, partially on the strength of such positive acceptance of the M1 Macs.

The analysts point to component constraints to argue that the pandemic-driven boom in PC sales may be slowing. The market grew 5% in Q3 for 84.1m units.

“Disruption to the global supply chain and logistics network remains the key inhibitor of higher growth in the PC market,” said Ishan Dutt, Senior Analyst at Canalys.

Canalys continues to count both Mac and iPad sales

Supply chain crisis

“More than a year on from the onset of the pandemic, manufacturing continues to be hindered by lockdowns and other COVID-19 related restrictions, particularly in Asia. This has been compounded by a massive slowdown in global transportation with freight prices and delay times skyrocketing as a number of industries compete to meet unfulfilled demand.

“The shortfall in supply of PCs is expected to last well into 2022, with the holiday season of this year set to see a significant portion of orders not met. Vendors able to manage this period of operational upheaval by diversifying production and distribution and having better visibility of orders to prioritize device allocation will be equipped to ride out the storm.”

Hybrid work continues

Rushabh Doshi, Research Director at Canalys:

“Hybrid work models will be an important part of the new normal post-COVID-19 and will require PC vendors to enhance product portfolios and go-to-market strategies, as faster processors, better cameras and anytime-anywhere connectivity take centre-stage. SMBs and Enterprises are also likely to focus on ease of procurement, security and device management as they move to sustain these new policies for the long term. Adding to this, PC demand is expected to be robust from SMBs as various industries race to make up for lost time, and consumer spending shifts onto categories that were otherwise restricted during the lockdown, mainly tourism and travel.”

Looking at individual regions, LATAM, EMEA and Asia Pacific (excluding Japan) registered strong annual growth in shipments of 17%, 16% and 13% respectively. North America (US and Canada) saw total shipments fall by more than 9% year-on-year. Japan saw the worst decline as PC shipments fell by close to 30%.

“With the supply situation throwing curve-balls one after the other, PC vendors have it harder than anyone, as they manage this intricate and complex problem of supply and demand, where no magic formula exists,” added Doshi.

“What’s worse is that they need to address not two, or twenty, but more than a hundred markets around the world. Being a PC vendor is both enviable and unenviable at the same time.”

Perhaps less so for Apple, which now has an army of tens of millions of iPhone users to convince to get a Mac.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.