Apple’s Restore Fund protects trees to save the planet

Apple has announced its latest strategic move toward becoming a completely green business, this time in the form of a $200 million investment in nature-based carbon removal projects.

At its very simplest, the idea is that this money will go toward protecting existing ecosystems while creating new ones, which comes down to protecting and planting trees. Apple created the fund to encourage global investment to protect and restore critical ecosystems and scale natural carbon removal solutions.

What Apple said

“The Restore Fund is an innovative investment approach that generates real, measurable benefits for the planet, while aiming to generate a financial return,” said Lisa Jackson, Apple’s vice president of Environment, Policy, and Social Initiatives.

“The path to a carbon neutral economy requires deep decarbonization paired with responsible carbon removal, and innovation like this can help accelerate the pace of progress.”

Apple’s Restore Fund

The fund is handled by Apple’s Restore Fund. This is part of the company’s comprehensive roadmap to become carbon neutral for its entire supply chain and life cycle of every product by 2030. Apple will reduce 75 percent of all emissions by 2030 and balance the remaining emissions with high-quality carbon removal.

(NB: I do note this is the first time I’ve experienced seeing that 75% figure).

The Restore Fund which was first launched in 2021 with a $200 million funding pot which the company has now doubled. The aim is to remove 1 million metric tons of carbon dioxide per year while generating a financial return for investors. Apple suppliers that become partners in the fund can use this as part of their decarbonization strategy.

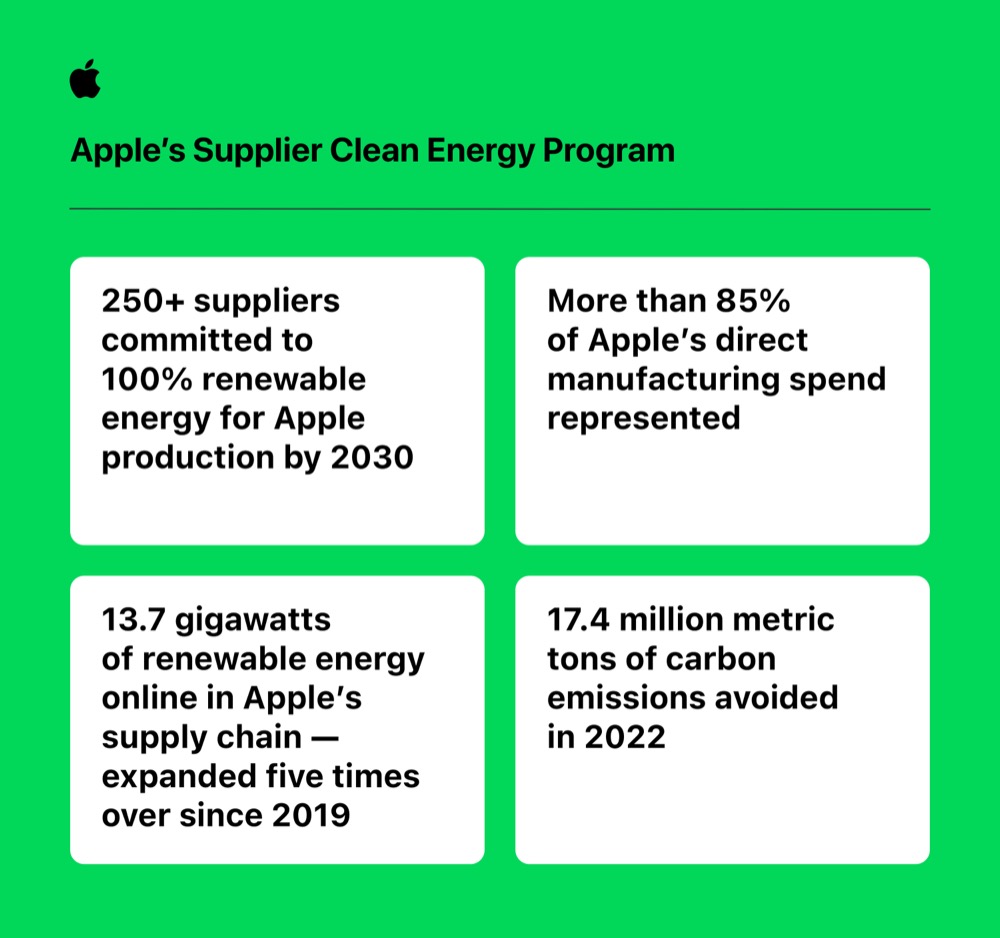

Apple wants to become carbon neutral across all Apple-related operations by 2030, including across both Scope 1/Scope 2 direct and electricity-related emissions. Over 250 Apple manufacturing partners have committed to using renewable energy.

The fund supplements Apple’s many other green investments.

What has the scheme achieved so far?

The scheme has already placed three initial investments in Brazil and Paraguay. These aim to restore 150,000 acres of sustainably certified working forests and will also protect an additional 100,000 acres of native forests, grasslands, and wetlands.

That saving of the trees will remove the equivalent of 1 million metric tons of carbon dioxide from the atmosphere per year by 2025. That matters, as carbon removal is critical to addressing climate change and achieving global climate goals, as leading scientific bodies such as the IPCC agree.

And yes, there’s (going to be) an app for that…

To monitor and measure the impact of Restore Fund projects, Apple is deploying innovative remote sensing technologies — including Space Intelligence’s Carbon and Habitat Mapper, Upstream Tech’s Lens platform, and high-resolution satellite imagery from Maxar — to construct habitat and forest carbon maps of the project areas.

Apple is also exploring the use of the LiDAR Scanner on iPhone to enhance monitoring capabilities on the ground.

Who is Apple working with?

Apple is working with Conservation International and Goldman Sachs on this with the partners investing in carbon removal projects. Climate Asset Management — a joint venture of HSBC Asset Management and Pollination — will manage the fund.

They are looking at two major strategies:

- Nature-forward agricultural projects that generate income from sustainably managed farming practices.

- Projects that conserve and restore critical ecosystems that remove and store carbon from the atmosphere.

“This unique blended fund structure aims to achieve both financial and climate benefits for investors while advancing a new model for carbon removal that more fully addresses the global potential for nature-based solutions,” the press release said.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.