Apple’s services are fast becoming a $73b/year business

Yet another analyst upgrade for Apple today as Canaccord Genuity analyst Michael Walkley raised price targets from $275 to $355 a share.

Services, smartphones and wearables

In a client note shared with AppleMust, Walkley wrote:

“We believe Apple’s ecosystem approach, including an installed base that exceeds 1.4B devices globally, is leading to record services revenue, and we expect the higher- margin services revenue growth to continue outpacing total company growth.

“We are also encouraged by the strong demand for the iPhone 11 lineup and believe Apple will maintain its market share leadership of premium-tier smartphones that could be bolstered by a 5G upgrade cycle.

“Further, Apple has market share leading positions in wearables with Watch and AirPods, and both have strong sales and growth momentum.”

The analyst thinks Apple will continue to repurchase shares and increase the dividend paid to shareholders.

Strong sales predictions

Walkley predicts 185m iPhone sales for 2019, but predicts these will hit 205 million this year and 215 million in 2021.

“We believe sales for this year’s iPhone 11 lineup remained strong through the December quarter, including in China,” he said.

He also predicts the 5G iPhone will help fan a replacement cycle later this year.

On wearables, Walkley points out that demand for AirPods Pro still exceeds supply. He also notes recent IDC estimates of a 95% increase in wearables sales across the industry, observing that Apple holds over 35% of the wearables market.

The result?

The wearables segment may contribute an estimated $33.5 billion dollars to Apple’s bottom line this year, the analyst predicts..

That’s not all. With Apple already hitting its once optimistic $50 billion/year services revenue target, the analyst predicts the services segment may grow to as large as $73 billion in 2020-21.

“We believe these new services should help the record-setting Services momentum to continue towards 500 million subscribers and our $61b/$73b C20-C21 revenue estimates,” he wrote.

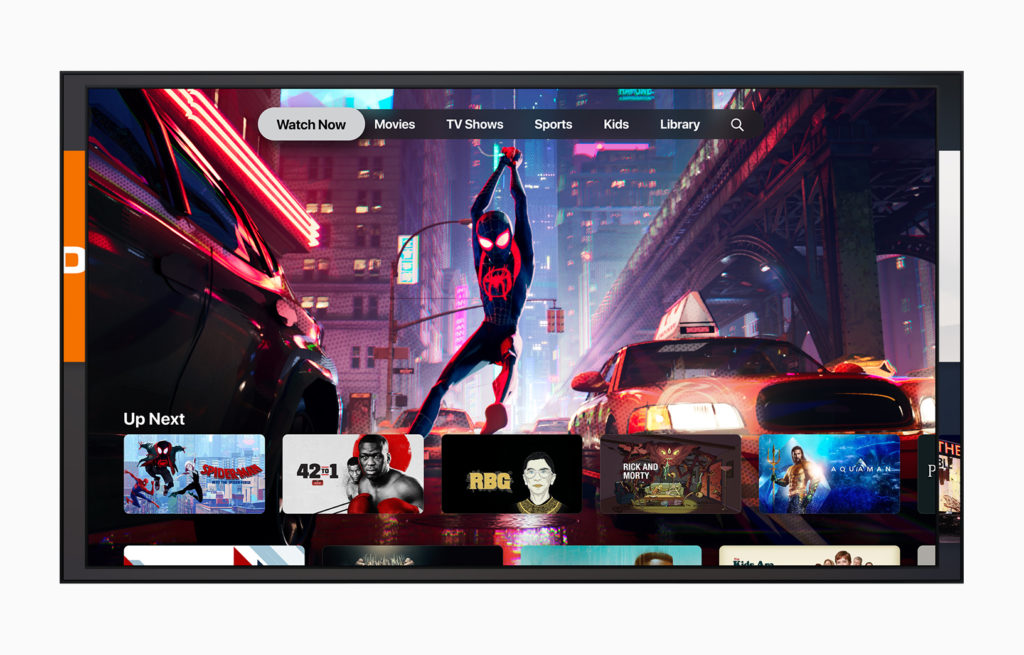

Up next:

One Apple business that doesn’t seem to be seeing much analyst bounce is, of course, the netbook devouring iPad family.

With this in mind it’s worth thinking about just what kind of further improvement a successful product refresh might deliver to Apple’s bottom line — and if analysts have yet factored this in.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.