Apple’s services pivot unlocks $1 trillion opportunity

The services push really isn’t trivial…

Apple is changing its business model to place much more focus on services than on product sales, fresh analysis claims. Doing so makes complete sense and falls very much in line with what we’ve all expected as the company focus on services grows. The latest Morgan Stanley report explains what the company is doing.

Apple executes extremely well

To get a sense of how effectively Apple is managing the transition, analyst Erik Woodring notes one of the company’s biggest advantage —

While lifetime value to customer acquisition costs generally scale at 5x or above for most companies, at Apple, that LTV/CAV ratio sits at an estimated 16x. That’s wildly ahead of any other big name subscription business and reflects strong customer loyalty, low churn, and highly efficient user acquisition.

To translate that, it means that Apple as a service can generate more high-paying loyal customers than others – and those clients stick around.

How to make a trillion for a few dollars a day

What does this mean for Morgan Stanley, where analyst Woodring will replace the great Katy Huberty in leading the Apple beat? It means Apple can unlock an additional $1 trillion of market growth from its sustained installed base as it shifts to subscription mode.

What Morgan Stanley said

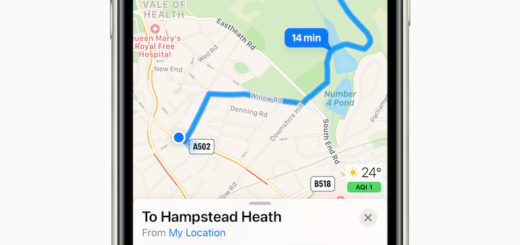

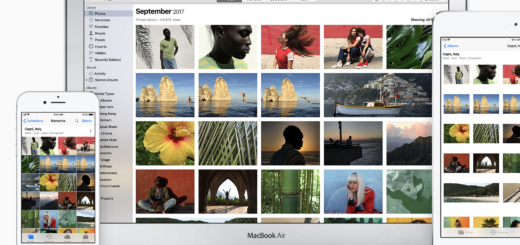

“As we’ve long argued, Apple’s industry-leading retention rates and expanding ecosystem of hardware and services has already created one of the world’s most valuable technology platforms that centralizes and controls everything from traditional communication to entertainment, social media engagement, photo & video development, gaming, business, payments, travel, fitness, and more. However, the market continues to value Apple shares more like a traditional – albeit best-in-class – technology hardware platform, at 22x EV/FCF vs. 31x for the average SaaS model and 44x for subscription-driven streaming platforms (1). We believe that as Apple’s installed base matures, retention rates maintain or improve from already high levels, new market opportunities emerge, and Apple proves they can drive sustained growth in spend per customer, investors will begin to gravitate towards a more lifetime value (LTV) based valuation approach. Our new, interactive LTV DCF model, with what we consider to be conservative assumptions (2), suggests long-term valuation upside to just over $200 per share, or a >$3 trillion market cap – over 30% higher than Apple’s current market cap (3). We see Apple’s CY22 year-end installed base disclosures – provided in January 2023 – as a key catalyst for the market to begin pricing in this model transformation, while a formal shift to a pure subscription model, reported earlier this year, would perhaps have an even greater valuation impact, in our view.”

[Also read: JP Morgan predicts Apple Arcade a $1b+ business by 2025]

Some details cherry picked from the report

The Apple business model is shifting from one that maximizes hardware shipment growth to one that maximizes installed base monetization, driven by launching new, complementary products, enabling better cross platform software functionality among products, expanding into new/adjacent markets, and launching a slate of first-party services.

- Apple’s installed base is now more mature. An estimated 80% of Apple’s 1.1 billion iPhone users have been in the model for more than one year, compared to 65% just 5 years ago.

- Apple’s total total addressable market today is upwards of $1.5 trillion. Our survey work suggests Apple retention rates are over 90% in the US, and are 80% in other key markets like China.

- While Apple’s 1.1 billion installed base is mature, we estimate that Apple added 90 million net new users in CY21 which accounted for nearly 40% of iPhone purchases in FY21, a 4-year high. T

- US iPhone owners already spend an average of ~$2 per day on Apple products/services today .

- Apple’s current stock price suggests that the market still views Apple as just a premium, transactional hardware business. It’s actually more than that.

All the same, in a previous report, Morgan Stanley warned that the outlook for the coming quarter may be a little muted, but lopped $5 off the near-term target price, making this $180. The analysts predict June quarter revenues of $80.6 billion, down just 1.1% on last year.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.