Apple’s ‘unceasing’ iPhone sales seemed to surprise analysts

Selfie me with your iPhones

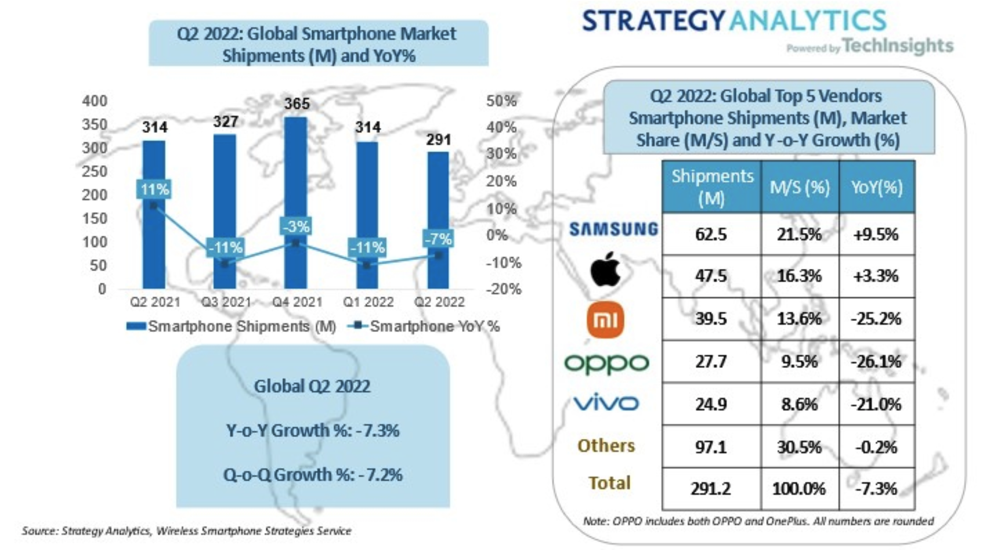

IDC and Strategy Analytics both published their smartphone sales estimates following Apple’s fiscal results yesterday, but they seem to have some dichotomy in their own analysis compared to each other and to Apple’s description of unceasing demand for its devices.

Some you get right…

You see, while Apple Chief Financial Officer Luca Maestri said there had been no slowdown in demand for iPhones, IDC predicted low year on year growth. Its numbers seemed particularly low.

Apple explained iPhone revenue grew 3% year over year to June quarter record of $40.7 billion.

“We saw new quarter records in both developed and emerging markets and the iPhone active installed base. reach a new all-time high across all geographies,” the company said. (India doubled, for instance).

It also set a June quarter record for both revenue and switchers to iPhone, it said. “We also attracted a record number of switchers for the June quarter with strong double digit year over year growth,” it observed.

Strategy Analytics seems to have got the year over year growth about right, predicting 3.3% growth, giving Apple 16.3% of the entire smartphone market. But IDC’s estimated 0.5% YoY growth doesn’t seem to fit Apple’s claims.

Cook predicts growth will, erm, grow

“Apple shipped 48 million iPhones worldwide, up +3% YoY, for 16% global marketshare in Q2 2022. This is the highest second quarter market share for Apple over the past ten years, at the expense of leading Chinese brands who are hampered by the sluggish performance in both home and overseas market. Apple had a good quarter, led by iPhone 13 series which continued to ramp up volumes in US, China and other key markets,” Strategy Analytics said.

[Also read: Apple Q3 FY 22 investor meeting transcript]

Moving forward, both Strategy Analytics anticipates a 7-8% shrinkage, while IDC admits the market fell 8.7% YoY – which makes its estimates for iPhones seem once again unusual, given Apple’s reporting.

Apple says it thinks demand is strong and very much seems to expect it to remain so.

Alluding to this, Cook said, “On iPhone, there was no obvious evidence of macroeconomic impact during the June quarter,” Cook said, and seemed to think growth will “accelerate in the September quarter”.

Here as an interlude, is the data from SI and IDC:

Strategy Analytics feels more on track

IDC’s data feels a little off the mark

So, what’s happening?

Are analysts calling their estimates wrong? Are consumers switching to iPhones because they are investing in the long haul and want devices that last? And to what extent is Apple’s services segment going to continue to woo consumers to spend a few dollars more?

I think some analysts continue to judge Apple incorrectly. But what’s more interesting is the services pitch.

Forrester Research analyst, Julie Ask points to some of the advantages Apple enjoys with its market.

“Apple has more affluent customers for its smartphones than Android does in the US,” she explained. “Mean income of an Android owner is $69,647 and for Apple is $88,256. Among Apple’s iOS owners in the US, 35% have a household income over $100K and Apple smartphone owners are 3x as likely as an Android owner to have an income above $300K. (All household income),” she told me.

The key notion here is that disposable income, customer satisfaction and the provision of high quality services experiences gives Apple a strong play to boost ARPU. (Note that in the current quarter, services accounted for around 40% of gross revenue after costs of sales was removed).

What next?

Cook pretty much telegraphed not to expect too much action in services over the next quarter, which I think implies that we should expect some later. How will the company boost its services appeal across the crucial December quarter?

Beyond services, accessories seem to be weakening, though new Apple Watch and AirPods models may help push things forward there, too. But, in terms of Apple’s iPhone at least, the company seems to have the momentum others in the industry seem to lack — and the company has yet another model waiting in the wings.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.