Foxconn warns of challenges as tech stocks tumble

Designed by Apple in China

What happens when you face a global pandemic, inflation, war, and environmental catastrophe?

We’re all finding out in real time as tech stocks fall, supply chains shrink and demand for consumer electronics declines – but things can still go back better, maybe.

Crazy like a Foxconn

Foxconn returned strong Q1 profits but warned current quart revenue could slip as growth slows down. The company cited inflation and slowing demand, along with supply chain challenges as the reason.

It also said that some of its anticipated flat revenue could also be attributed to much higher sales last year and a lull (which usually comes in Q1) before new product launches this year.

While the company didn’t cite Apple, Apple is the company’s biggest customer, so you can draw your own conclusions to that.

“There are many uncertainties in the market at the moment,” Foxconn Chairman Liu Young-way told a post-earnings call, citing the pandemic, geopolitical risks, and inflation among them for the year.

“They are presenting quite some challenges to demand and supply.”

The ripple effect spreads economic gloom

The company said that COVID regulation at its production centers in China had only a limited impact on manufacturing capacity as it kept workers on site in a closed loop system but did admit demand had declined as the nation remains locked down.

At the same time, the company is also experiencing decline in demand in other markets reflecting war in Ukraine and high inflation, all following years of uncertainty.

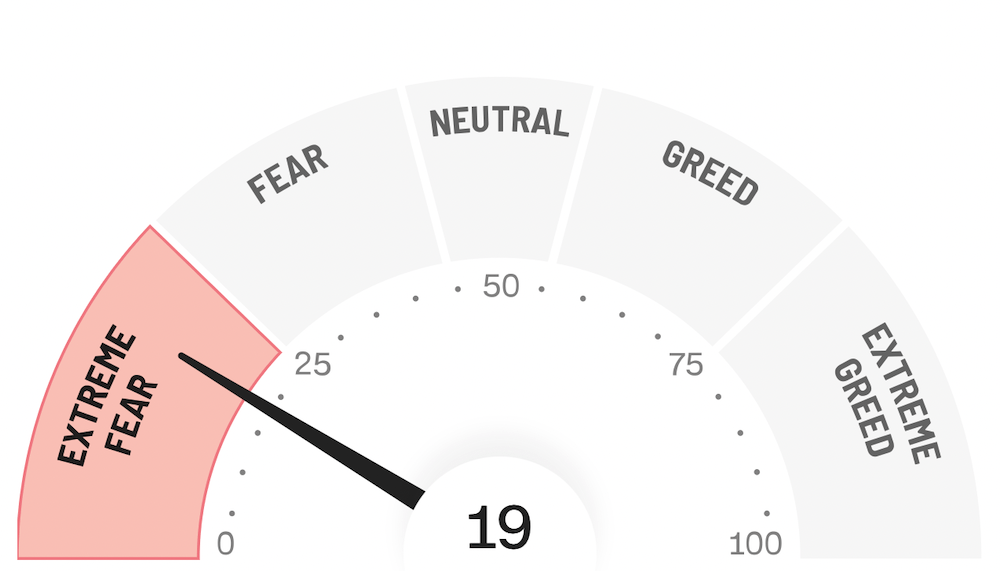

The impact of all these forces on investor sentiment is well articulated in CNN’s legendary ‘Fear & Greed’ index, which uses sentiment analysis to shine a little light on investor confidence.

CNN’s Fear and Greed index makes current sentiment pretty clear

The needle is currently firmly set on Extreme Fear, reflecting skittish investors, declining stock prices and market volatility. Though some larger investors are, of course, buying on the dip.

Seeking new growth

Foxconn is working to take position in other potential growth markets. It is now finally closing its deal to acquire electric vehicle (EV) production facilities in Ohio from Lordstown.

The two companies will form a joint venture to build cars.

It is possible, I suppose, that Apple may end up becoming a customer, in the event it drives forward the Apple Car.

Apple warned of supply chain constraints during its last fiscal call, and as China continues to battle COVID-19 it appears the company’s MacBook Pro manufacturing production lines may be feeling the pressure. Sadly, given the company’s increasing market share in a declining industry. At present, people ordering new Macs are experiencing waits into July on strength of this.

Apple recently revealed yet another quarter of record revenue.

Subsequent to this its stock valued declined rapidly.

Seven great quarters, one less great one looms

Apple also revealed that the last seven have been the best ever seven quarters for the Mac, with new records for upgraders in March quarter.

In addition to which almost half of the customers purchasing a Mac were new to the Mac. Over half of those buying an iPad were new to that, the company said, and two thirds of those buying a watch.

“We are very pleased with our record business results for the March quarter, as we set an all-time revenue record for Services and March quarter revenue records for iPhone, Mac, and Wearables, Home and Accessories. Continued strong customer demand for our products helped us achieve an all-time high for our installed base of active devices,” said Luca Maestri, Apple’s CFO.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.