Global smartphone sales see steep Q3 decline – report

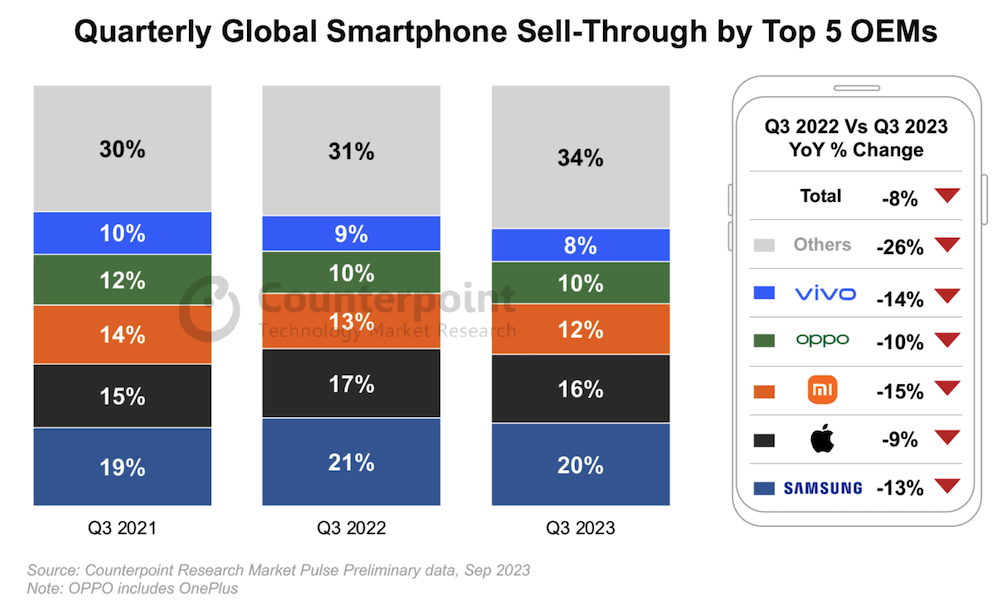

As we head into results season, global smartphone sales hit their lowest point for a decade in Q3, and while Apple is less impacted than all its main competitors, there are signs of waning iPhone 15 demand in China, Counterpoint’s latest data claims.

iPhone sales remain steadiest

The analysts do concede that, “A shorter period of iPhone 15 availability” during the third quarter led to a shift in demand to the next quarter. They claim global smartphone sales fell 8% year on year, though a 2% increase was seen in comparison to the previous quarter.

“Volumes declined YoY largely due to slower than expected recovery in consumer demand. But the market’s QoQ growth, especially the positive performance in September despite one full week less of sales of the new iPhones, is likely a sign of positive news ahead,” they said.

With 20% share, Samsung continues to lead the market, but Apple is a close second with 16. Xiaomi, OPPO and vivo rounded off the top five, with all five recording YoY declines.

Signs of a weak China

“Following a strong September, we expect the momentum to continue till the year-end, beginning with the full impact of the iPhone 15 series along with the arrival of the festive season in India, followed by the 11.11 sales event in China and ending with the Christmas and end-of-year promotions across regions. In Q4 2023, we expect the market to halt its series of YoY declines,” Counterpoint said.

What’s truly significant here of course is that while Apple saw just a 9% decline on a quarterly basis, all other manufacturers experienced steeper decline. Once again, this means Apple’s marketshare is growing in terms of devices in use worldwide.

There are some other down beats.

In China, Counterpoint reports that iPhone 15 series first 17 days unit sales in China down 4.5% compared to iPhone 14. Excluding the Plus, which was released three weeks late last year, sales declines exceeded 10%.

“China’s headline numbers for the 15 series are in the red, and this is a reflection of the broader decline in consumer spending,” saysMengmeng Zhang. “But the shorter pre-holiday shopping period coupled with supply mismatches on the Pro Max (with consumers shying away from blue) could push some of the demand to calendar Q4.”

Big in the USA

However, early US numbers show opposite trend with robust demand across all models, especially Pro Max.

“The US is hot right now with back-to-back stellar weekends for the new iPhone. Overall reception of the 15 series has been very positive and we’re expecting a major upgrade cycle from iPhone 11 and 12 users,” says Jeff Fieldhack, Research Director for North America. “Of course, we’re talking about the first couple weeks of sales, but it’s a positive sign and takes a lot of sting off the China numbers.”

In related news, Apple CEO Tim Cook is now on an unexpected visit to China, his second this year.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.