Goldman Sachs celebrates ‘shared focus’ with Apple on Apple Card

Offers a 4.15% interest rate on deposits

Have reports of tension between Apple and Goldman Sachs over Apple Card been overblown? We don’t know for sure, but Liz Martin, Goldman Sachs’s head of Enterprise Partnerships seemed positive in a press announcement celebrating success of Apple Card Savings from the partners today.

A shared focus on best-in-class experiences

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

Martin was cited in a release that explains how Apple Card’s Savings account by Goldman Sachs has already achieved over $10 billion in deposits since it launched in April.

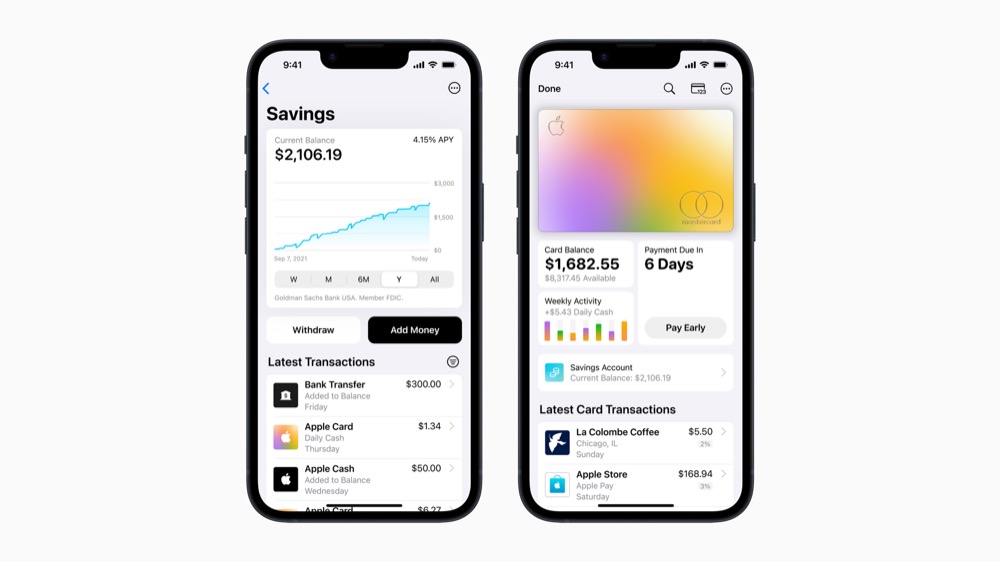

As previously reported, we know the high value savers the service has inevitably attracted like the 4.15% APY, higher than most other available savings schemes in the US. That cash goes into Apple’s Daily Cash and can itself be saved. Since the launch of Savings, 97% of Savings customers have chosen to have their Daily Cash automatically deposited into their account.

What Apple said

“With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

Built into Wallet on iPhone, Apple Card has transformed the credit card experience by simplifying the application process, eliminating all fees, encouraging users to pay less interest, providing the privacy and security users expect from Apple, and offering Daily Cash on every purchase.

How to start saving

If you have an Apple Card, you can set up and manage their Savings account directly from Wallet. Just open the card, tap More, select Daily Cash, tap Set Up Savings, and follow the onscreen instructions. Maximum balance limits apply. Savings is available with iOS 16.4 and later.

In the background

In January, a report claimed Goldman Sachs has lost over a billion dollars, mainly on strength of the Apple Card partnership. This has led to speculation the partners are seeking a third party to work with, potentially to replace Goldman Sachs. American Express was briefly in the frame but reporting on that petered out.

At the same time, in October, Apple and Goldman Sachs renewed their partnership until 2029, and then introduced Apple Card Savings. The service was at that time reported to have attracted over a billion dollars in deposits in just four days.

Can this business model scale?

Given that this press release emerged in the prelude to Apple’s Q3 FY23 financial call on August 3, perhaps there is more to learn. This is, after all, traditionally a quiet period for Apple news, and the fact one of its partners has come out waxing positive over their joint business may bode… something, after all.

But the future will be clearer tomorrow.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.