How Apple Pay makes money (Merchant Transaction Fees)

Square confirms it will work with Apple’s Tap to Pay system

While free to use, Apple Pay makes a little money from each transaction. How does this work? The short answer is transaction fees from merchants and banks, but let’s dig a little deeper for more.

What are mobile payments?

There are several different kinds of mobile payments:

- App versions of online payment platforms such as Paypal

- Direct carrier billing when you purchase products and then pay via your bill.

- Brand-based payments, such as when you have funds pre-loaded into an app you can only use to make a purchase at a specific business, such as Starbucks.

- App/device payment services, such as Apple Pay.

- There also QR code-based payment systems, which may overlap with some above.

How banks financed innovation

To enable the evolution of different types of payment (including traditional debit card payments), financial institutions had to figure out how to transfer money in consumer markets, and needed to build a business model to enable these exchanges to take place.

To get there, they looked at who is involved in making payments:

- The customer making a purchase.

- The bank the customer uses.

- The merchant.

- The bank the merchant uses.

When you make a payment, you are probably using most of these, though it can become a little more complicated when using an Amex or Diners club card, as these aren’t linked to banks.

Looking at the payment chain, banks then evolved a series of micropayments which are levied across the exchange. Customers don’t usually pay these directly, but merchants probably do and will pass these costs on in the form of higher prices. These ‘Merchant Service Fees’ go to the relevant parties in the exchange, usually the bank and sometimes the payment provider, in this case Apple.

What Apple Pay does (in brief)

Apple Pay sees a payment made wirelessly using the NFC chip and a payment terminal. Apple basically becomes a platform to support the exchange between all four parties, disintermediating the transaction and adding another layer of security by encrypting card and banking data used.

The Apple Pay business model relies on the company taking a slice of the Merchant Service Fee. Apple takes a slice of that fee and may also take an interchange fee for its part enabling the transaction to take place. It also takes a fee for tokenizing card data to enable mobile payments. Those fees also enable its Apple Pay Later service.

What are the fees?

The fees aren’t huge. A 2014 FT report claimed banks and payment networks paid 0.15% of the value of each transaction, which means Apple makes $15 out of every $10,000 spent.

When using a contactless card, fees – which are usually around 2% of the transaction levied against the merchant – work like this:

- The issuer bank (the bank the customer users) typically charges 1.7% of the transaction.

- The payment network, such as Visa or Mastercard, may take a flat fee of around $0.10.

- The merchant bank takes 0.2%.

There’s a good piece that looks at some of the variations in this here.

Apple takes a small slice of the interchange fee charged by the issuer bank.

The bottom line is that Apple takes a very small cut out of a very large number.

What is the potential?

The digital payments market valued at over $1 trillion, and with Visa and Mastercard processing over $14 trillion in payments each year Apple has a $1.5b-$21b business opportunity.

Use of contactless payments has accelerated dramatically in recent years.

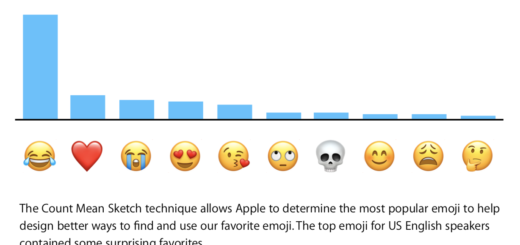

Nearly 20% of all in-person credit or debit card transactions are now contactless and while mobile payments represent just a sliver of this, Apple Pay still has the largest transaction volume of any such service.

Apple Pay accounts for 92% of all mobile payment transaction in the US and usage continues to increase. As of Feb 2020 Apple Pay accounted for 5% of global card transactions. We don’t know what the value of each transaction is, but if we just assume ten bucks a time as a vague average, then Apple Pay is potentially near to becoming a billion-dollar business, and that business may still be larger.

Apple CEO, Tim Cook, opened the year explaining:

“The growth of Apple Pay has just been stunning. It’s been absolutely stunning. And there’s still obviously a lot more there to go — and because there’s still a lot of cash in the environment. And so I think that both of these and whatever else we might do have a great future ahead.”

And now you know how Apple Pay makes money.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.