IDC, Canalys both confirm Mac sales up, PC sales not up

No matter which way you break your eggs it’s becoming pretty hard to ignore PC sales data that continues to show that Apple is growing market share at the expense of everyone else. The latest insight into this Big Picture comes from IDC and Canalys. Here’s what they say in their latest PC sales data report:

Up, up and away

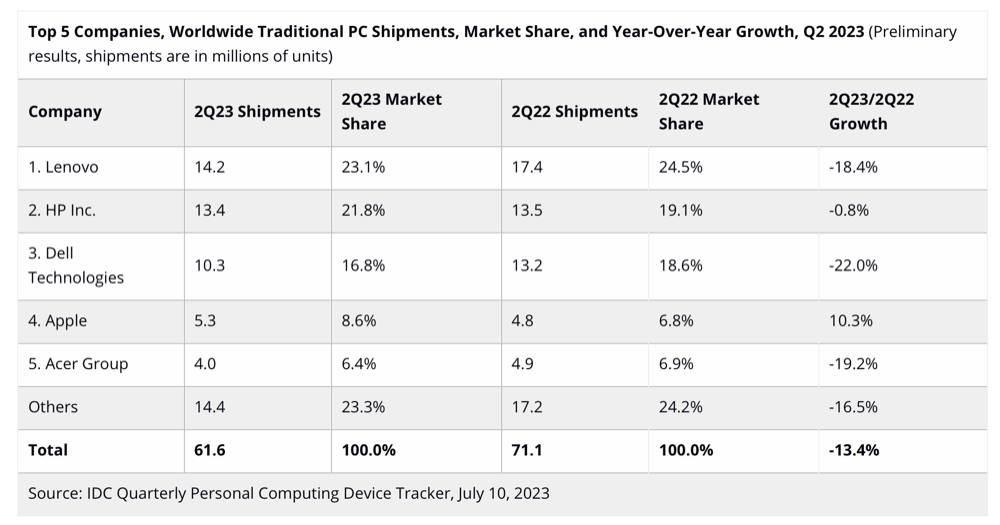

Global PC shipments declined 13.4% year over year during the second quarter of 2023 (2Q23), the analyst said.

This is the sixth consecutive weak quarter as economy, war and all the multiple additional flavors of complexity governments everywhere seem ideologically unable to resolve gain momentum.

In practise, weak demand means high inventory, meaning there’s huge tottering piles (figuratively at least) of unsold computers everywhere – great if you’re seeking a new computer this Amazon Prime Day. (In the UK, the M1 MacBook Air is currently a huge 22% off).

“The overall weak demand has caused inventory levels to remain above normal for longer than expected. This includes finished systems at the channel level, as well as the supply chain,” IDC observed.

Apple isn’t immune to all of this, of course, but Apple is also the only PC manufacturer to experience any sales growth across the period, IDC said. Those Apple Silicon Macs really did make their appearance at the right time and right place to seal success.

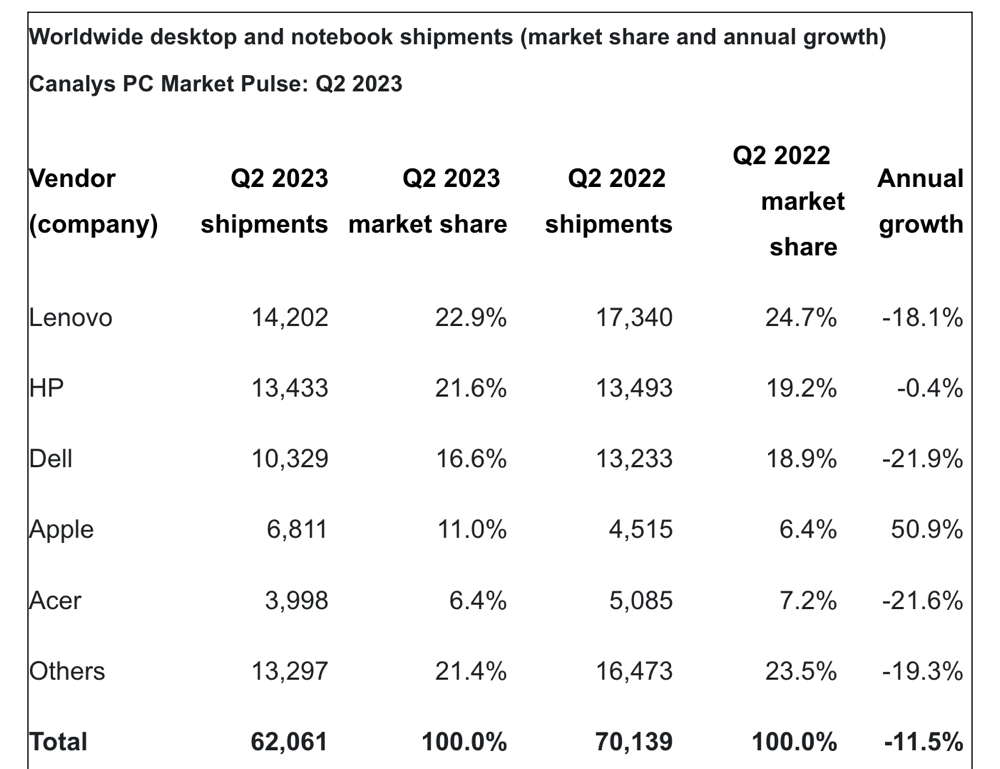

Canalys data, also revealed today, confirms this, noting that Apple outperformed the market with a 51% jump thanks to its brilliant MacBook Air system.

Here’s the data:

Canalys Data

IDC data

As you can see, Apple experienced 10.3% growth year on year, which no one else has enjoyed. “Apple benefited from a favourable year-over-year comparison as the company suffered supply issues during 2Q22 due to COVID-related shutdowns within the supply chain,” IDC said.

Apple grew the most said Canalys, pegging total shipments of 6.8 million units and market share expanding to 11 per cent from 6.4 per cent a year earlier.

There may be trouble ahead

There’s still a lot of confusion on the road ahead, with the impact of AI on workplace IT still to be determined.

“On the consumer side, we’re seeing a return to pre-pandemic habits where computing needs are shared across multiple devices, and we firmly believe the consumer wallet will favour smartphones over the PC,” said Ryan Reith, group vice president for IDC’s Client Device Trackers.

“On the commercial side, workforce reductions (for many big companies) as well as the introduction of generative AI only add more confusion as to where to place an already reduced budget.”

These are far from isolated series of data points. In general, Apple has been experiencing really strong growth in PC sales across the last few years, as pointed out here, here, and here. Most recently, Apple beat Dell in Europe for the first time.

“The install base of active Macs reached an all-time high across all geographic segments and we continue to see strong upgraded activity to Apple Silicon,” Apple said during its last fiscal call. User satisfaction with the platform sits at an astonishing 96%.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.