IDC sees strength of Apple’s iPhone strategy as market dips

Despite a supply chain crisis, ongoing pandemic, murder in Ukraine, declining consumer confidence, and unyielding further miseries, Apple’s iPhone 13 was the sole bright spot in the smartphone industry, according to IDC.

Apple iPhone up, smartphone market down

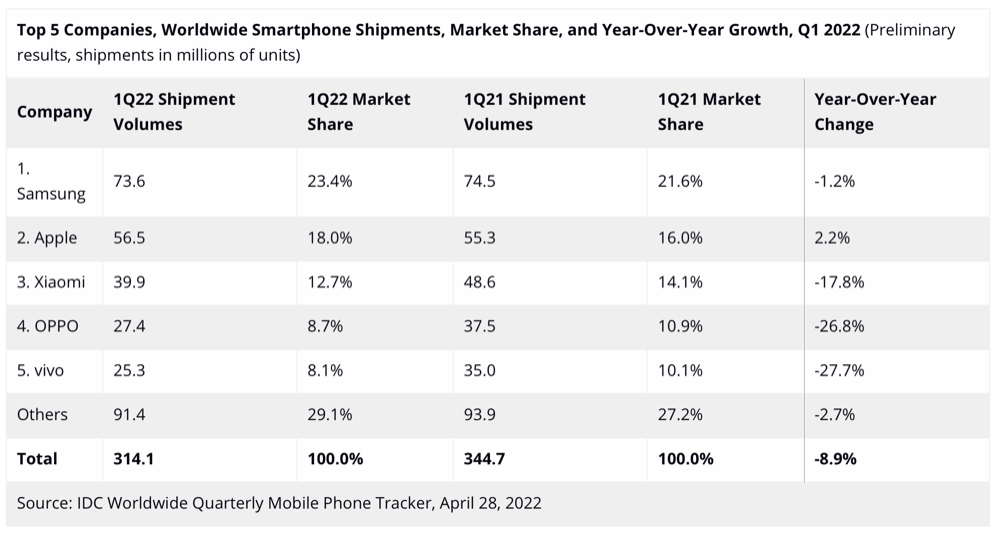

The Worldwide Quarterly Mobile Phone Tracker reports that worldwide smartphone shipments declined 8.9% year over year in the first quarter of 2022 (1Q22).

That is the third consecutive quarter of decline for the smartphone market as shipments fell to 314.1 million units, about 3.5% lower than IDC forecast in February. Readers with a long memory will note that this data tallies with a recent Canalys report.

What is surprising in how IDC reports this data is the lack of any significant analysis as to why Apple has bucked this trend.

Buried in the announcement the analysts say only that “Apple came in second (in the vendor race, ed.) with 18.0% share.”

Why is Apple growing while others aren’t?

For reasons known only to the great gods of objective analysis, the IDC announcement fails to mention that despite all the headwinds, Apple also grew 2.2% YoY while every other vendor saw decline.

Now, growth of 2.2% may not sound a lot, but being the only smartphone vendor to see any improvement should surely be seen as food for thought? Surely analysing those reasons is what others with an interest in the industry want to do?

During Apple’s financial call this week, Apple CEO Tim Cook gave us some of the reasons for the direction, telling us:

- iPhone 13 attracted record levels of upgraders in the quarter.

- The number of customers switching from Android to iPhone also climbed.

- 451 Research claims iPhone customer satisfaction of 99%.

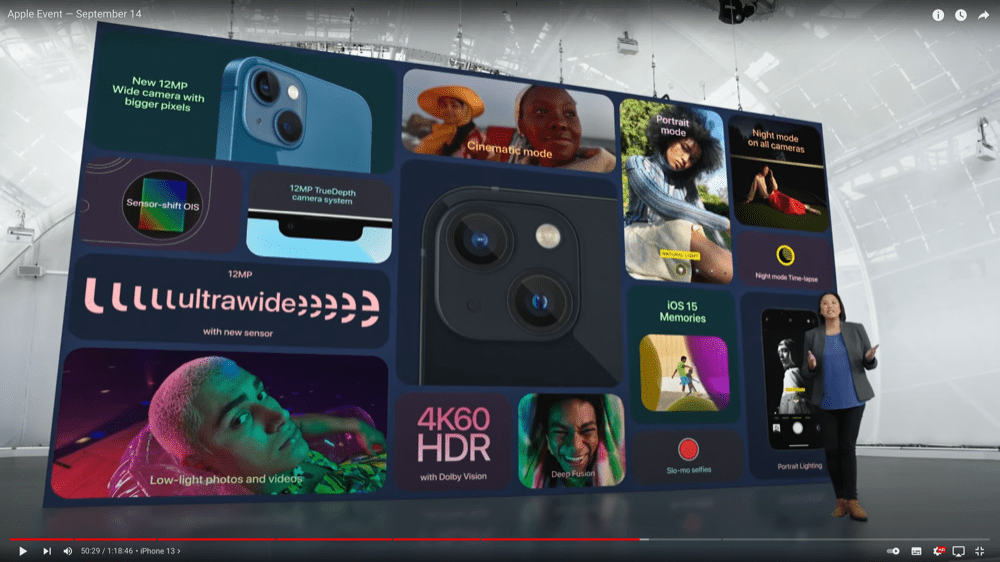

iPhone 13 Pro slide

My take?

Quality counts. Consumers are actually more discerning than cynical people think.

They have seen that iPhones last longer, albeit for a larger initial outlay *though that division is eroding as other vendors strike for similar price targets*. They are investing in equipment today to get them through the long haul of the current set of crises.

Consumers also know the second use value will hold. They have friends praising the user experience (good old Net Promoter Scores), and are interested in getting prepared for 5G. Mobile broadband is a particularly attractive prospect to those on unlimited data deals which turn iPhones into essential broadband hubs for remote workers with connection challenges.

I also think people are beginning to understand the limitations of slightly more affordable, non-Apple devices, They may not be as durable and may not hold value. They may not be as secure. They may not be as recyclable, and may contain conflict minerals. And we know that for every reactionary who rejects environmentalism, there are at least three who have become more concerned at the planet we are leaving our children.

iPhone environment slide as used during iPhone 13 launch

It does seem strange IDC skipped consideration of a narrative in favor of the following set of statements:

“Despite the challenging environment, vendor positioning was not altered much during 1Q22. Samsung led the vendor race with the top spot and 23.4% share, its largest share in any given quarter since the first quarter of 2018. Apple came in second with 18.0% share, while Chinese vendors Xiaomi, OPPO, and vivo followed in the next three positions with 12.7%, 8.7%, and 8.1% share respectively.”

These say very little about the why.

While global shipments fell, Apple was the only bright spark in the industry

The rest of IDC’s news follows:

From IDC:

“Although some decline was expected in Q1, due to the ongoing supply and logistical challenges and a difficult year-over-year comparison, things seemed to have taken a turn for the worse,” said Nabila Popal research director at IDC.

“Consumer sentiment across all regions, and especially China, is broadly negative with heavy concerns around inflation and economic instability that have dampened consumer spending. This is now coupled with the rising costs of components and transportation and the recent lockdowns in Shanghai, which are exacerbating an already difficult situation.

On war in Ukraine

“On top of all this is the Russian invasion of Ukraine, which immediately impacted that region and continues on an unknown trajectory. Given all these uncertainties, most OEMs are adopting a more conservative growth strategy for 2022.”

From a regional standpoint the obvious focus has been on Ukraine, Russia, and the rest of Eastern Europe. The Central and Eastern Europe (CEE) region was down close to 20% during the quarter, and the outlook for many of those markets remains uncertain. However, from a volume standpoint CEE only accounts for 6-7% of global shipments and about 5% of market revenue. The biggest draw down on global volumes came from China and other parts of Asia/Pacific, which account for nearly half of all shipments worldwide and declined 12.3% (combined) in 1Q21.

On the supply chain

“It goes without saying that the world continues to face numerous challenges, whether it be geopolitical, pandemic related, or macroeconomic,” said Ryan Reith, group vice president with IDC’s Worldwide Mobile Device Trackers.

“Almost everything that’s happened in recent months has been a headwind on the smartphone market, and realistically many other technology segments. Our research tells us Samsung and Apple have navigated the supply chain situation a bit better than their competitors, and as a result we have seen reduced orders from the next set of top OEMs. We remain of the opinion that any diminished demand will not be lost, but rather pushed forward. It’s just a matter of when that demand resumes.”

One more thing

Now, none of this means we are escaping the doldrums.

I really think we’ll be waiting some time with a lot of rivers to cross before then.

Despite which, it seems fair to point out that Apple’s overall strategy – to focus on consumers, try to do the right thing where it can, and to develop user experiences that resonate in market leading devices that last – have given it solid foundations from which it can navigate the current crisis.

That’s assuming stupid regulatory decisions don’t force the company to reduce itself to everyone else’s level, of course.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.