India catches a little Foxconn to meet global semi shortage

![]()

Foxconn is to take a stake in a new semiconductor manufacturing venture in India with Indian conglomerate Vedanta. The news should see an eventual expansion in global semiconductor supply even as the Semiconductor Industry Association (SIA) tells us demand for chips has reached an all-time high.

India is now a growing power in tech

India continues to boost the tech industry in the nation. In part it has achieved this through negotiation, offering tech firms an opportunity to set up shop in the highly educated country, so long as they play nice locally. In December 21, India set aside cash to support development of semiconductor and display manufacturing in India

Among other top tech firms, Apple has taken its own stake in India. It maintains r&d centres there, continues to build market share and actively encourages its suppliers to consider India as a manufacturing center.

The new semiconductor manufacturing plant will take some time to come online. When it does, it will enter a market in which awareness of the human rights challenges inherent in the supply of conflict minerals continues to grow. In 2021, Apple removed 12 smelters and refiners from its supply chain for failing to meet its standard requirements for the responsible sourcing of minerals. It is to be hoped the new factory will also meet those standards once it becomes operational.

We don’t know if this facility will manufacture semiconductors for Apple devices.

Boosting the Indian tech sector

In a statement, Vedanta and Foxconn say: “The targeted project plans to invest for manufacturing semiconductors. It will provide a significant boost to domestic manufacturing of electronics in India. Discussions are currently ongoing with a few State Governments to finalize the location of the plant.

“The collaboration between Vedanta and Foxconn follows the India Government’s recent policy announcement for Electronics Manufacturing & PLI scheme for incentivizing organizations to contribute towards development of this sector. This will be the first joint venture in the electronics manufacturing space after the announcement of the policy.”

Vedanta says it intends investing around $15 billion in display and semiconductor manufacturing in India across the next 5-10 years.

Three chips together: M1, M1 Pro, M1 Max

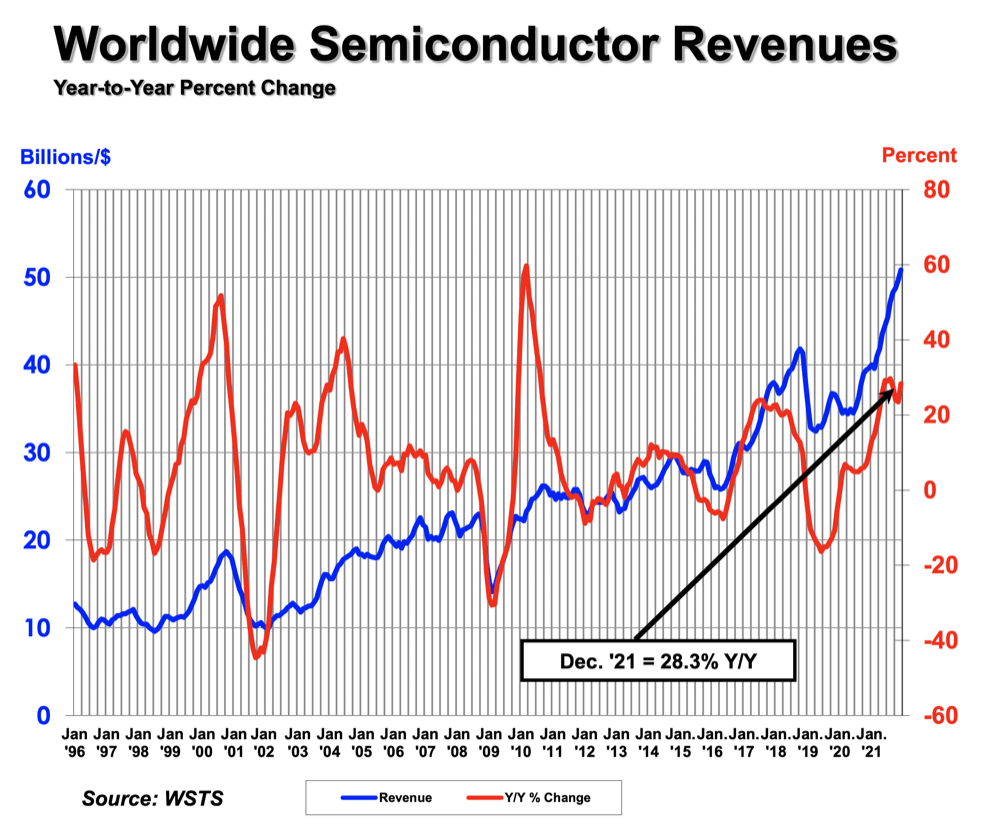

Semiconductor demand has reached a record high

The semiconductor shortage has impacted the tech sector since the beginning of the pandemic. That shortage has caused some product delays, forced some car firms to miss manufacturing targets and continues to generate difficulties in terms of access to what Apple CEO Tim Cook calls “legacy nodes”

But this shortage likely also reflects the scale of demand for these products. The Semiconductor Industry Association (SIA) recently announced global semiconductor sales totaled $555.9 billion in 2021, the highest-ever annual total and an increase of 26.2% compared to the 2020 total of $440.4 billion. The industry shipped a record 1.15 trillion semiconductors in 2021, as chip companies ramped up production to address high demand amid the global chip shortage.

“Demand for semiconductor production is projected to rise significantly in the years ahead, as chips become even more heavily embedded in the essential technologies of now and the future,” said John Neuffer, SIA president and CEO.

This is a new tech space race

What this means, in effect, is a new tech arms race. Nation states are vying to ensure they have sufficient processor supply and most want to gain a dominant leadership position in the space. SIA data reveals the following:

On a regional basis, sales into the Americas market saw the largest increase (27.4%) in 2021. China remained the largest individual market for semiconductors, with sales there totaling $192.5 billion in 2021, an increase of 27.1%. Annual sales also increased in 2021 in Europe (27.3%), Asia Pacific/All Other (25.9%), and Japan (19.8%). Sales for the month of December 2021 increased compared to November 2021 in the Americas (5.2%), China (0.8%), Europe (0.3%), and Asia Pacific/All Other (0.1%), but fell slightly in Japan (-0.3%).

Global semiconductor demand as noted by SIA

It also notes that logic ($154.8 billion in 2021 sales) and memory ($153.8 billion) were the largest semiconductor categories by sales. Annual sales of logic products increased by 30.8% compared to 2020, while sales of memory products were up 30.9%. Sales of micro-ICs — a category that includes microprocessors — increased 15.1% to $80.2 billion in 2021. Sales of all non-memory products combined increased by 24.5% in 2021. Sales of automotive ICs increased 34.3% year-over-year to a record high of $26.4 billion. Analog, a type of semiconductor that is commonly used in vehicles, consumer goods, and computers, had the highest annual growth rate of 33.1%, reaching $74 billion in 2021 sales

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.