Intuit just made Apple the best choice for small business

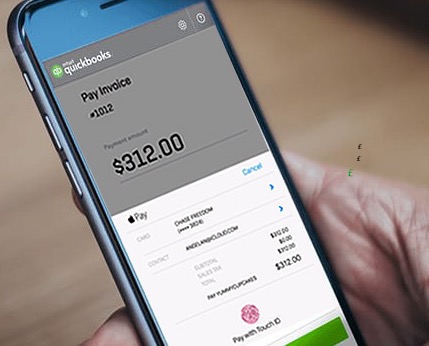

Invoice due? Pay by Apple Pay…

Apple continues to become the best solution for enterprise users, and a new integration between Intuit QuickBooks Online and Apple Pay means it is becoming tool of choice for small business too.

What’s happening is that small businesses customers can view and pay invoices with a single touch using Apple Pay. They can also have Apple Pay-enabled automatically on their invoices, which then enables their clients to pay them for the products and services provide.

These transactions are highly secure, as they require Touch ID authorization, in addition to which no actual credit or debit card details are exchanged during the transaction. It’s also handy because all transactions are automatically entered and categorized in QuickBooks Online, saving some boring bookkeeping time.

Intuit claims that on average, it takes small businesses who do not use an online payment offering 28 days to get paid, and 64 percent of small businesses have invoices that go unpaid 60 days or more.

“However, small business owners who accept payments with QuickBooks Online get paid on average 15 days sooner, almost twice as fast as those who don’t use on an online payment offering,” the company said.

Apple Pay continues to advance into new territories, with New Zealand the latest country to open for its business. Apple’s iMessages now supports third-party payment services, so Apple Pay can’t be too far behind. Apple’s overture to transform the fin tech industry has only just begun – over ten million in the US already use it weekly. The new small business integration will help make the service more useful and pervasive as Apple works to replace the wallet with an iPhone.

More information here.