iPhone 13 has largest share for a new line-up since iPhone X

Apple will host its Q2 2022 earnings call April 28, and it’s looking good to beat consensus, according to both Morgan Stanley and the latest CIRP data. The latter claims iPhone 13 models have the largest share for a new line-up for years, which chimes with other recent analysis.

A big success

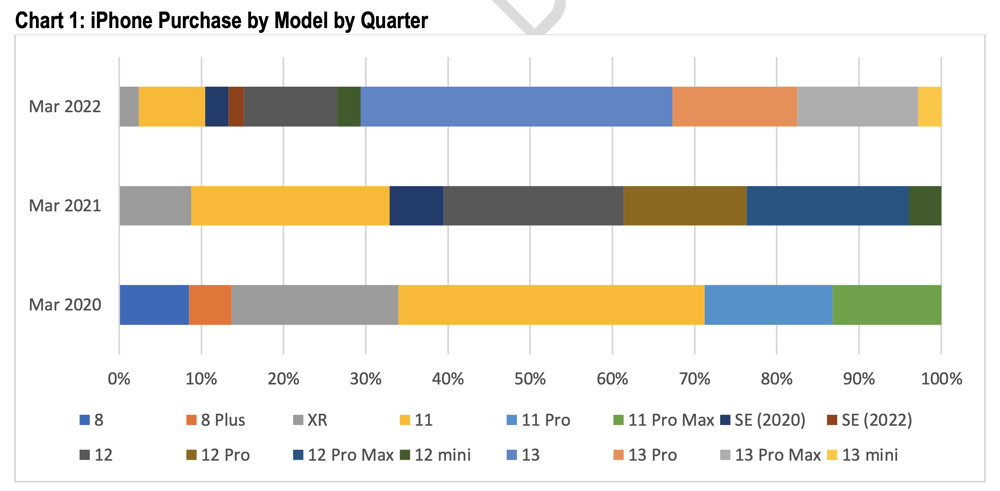

What this means is that Apple’s latest iPhone 13 range has managed a repeat performance in terms of hitting the market sweet spot. CIRP has tracked this data for years and reckons that iPhone 13 in the March 2022 quarter had 71% of total US sales

Of course, with the 5G iPhone SE selling slowly right now but likely to sell consistently for years, this is all good news for Apple. CIRP does say that iPhone mini remains the least popular model in the US.

Looking back, iPhone 12 achieved just 61% of share.

Older models also attract sales. iPhone 11, introduced over two years ago, and iPhone XR, from over three years ago, are still available. Along with iPhone SE, these models accounted for 15% of sales.

A faster upgrade cycle driving sales

CIRP also notes that people seemed more willing than they did last year to upgrade more recent devices, though this may reflect the move to 5G.

CIRP data

In the March 2022 quarter 47% of buyers had their previous phone for two years or less, compared to 35% in the March 2021 quarter. Though what seems more interesting about this data is that we have to go right back to 2018 (during the iPhone X, 8, and 8+ release cycle) to see this kind of upgrade enthusiasm. I can still remember how much interest there was in FaceID and the whole iPhone X release cycle.

Morgan Stanley’s Katy Huberty earlier this week told clients:

“In the US, our carrier checks indicate that the iPhone was the top selling smartphone model across all 3 carriers in the March quarter (with iPhone 13 the top model), which also reads positively for March quarter results.”

With this in mind it’s probably for the good that Apple continues to improve its recycling facilities. I would be quite interested in picking up data from the second user market to find out where all those still quite young iPhones are going. I assume the trade in market is also booming.

Expect an outperforming Q2

She added

“As a result, we believe the iPhone likely outperformed our initial shipment forecast and we increase our March quarter units by 2.5M to 57.5M units (+4% Y/Y), slightly ahead of consensus at 57.4M units, while leaving our June quarter iPhone shipment forecast of 46.5M units (+5% Y/Y) unchanged.”

While this might mean (and probably won’t mean) slower sales for the next couple of years, this must be tempered with understanding that each person Apple succeeds in selling an iPhone too becomes someone more likely to sign up to an Apple service, an Apple accessory, or to take an interest in another product the company creates.

“Apple has a multi-year long runway ahead to sustain elevated shareholder returns before approaching its net cash neutral target,” Huberty wrote.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.