iPhone 13 is already setting records — Morgan Stanley

Morgan Stanley analyst Katy Huberty is back with a new report that suggests iPhone 13 sales may be higher than last year, and has set new records in China but with success somewhat constrained by component supply challenges.

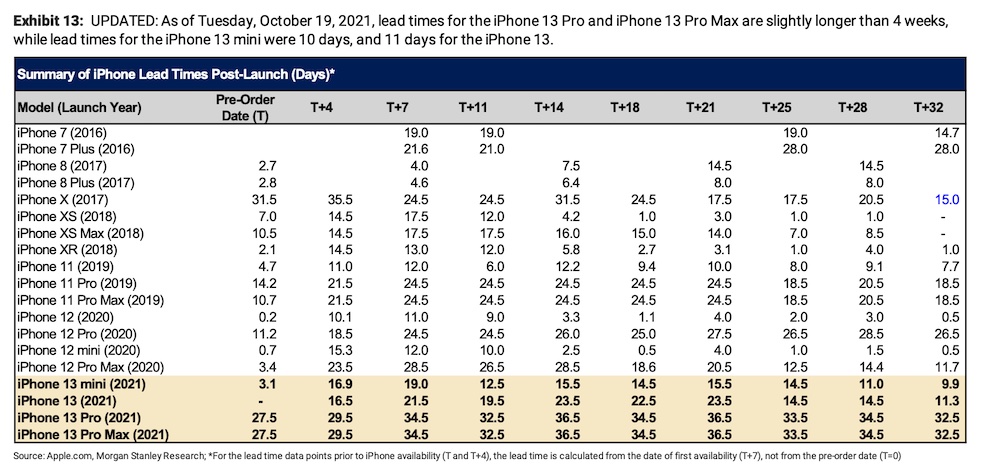

iPhone 13Pro lead times set 5-year record

The analyst writes: “iPhone 13 lead times remain ahead of their respective iPhone 12 predecessors and the iPhone is gaining installed base in China, supporting our positive early view on iPhone demand in FY22.”

Huberty notes that until October 19 data, lead times for the iPhone 13 Pro and Pro max sit at 32.5 days, “the longest of any iPhone model launched in the last 5 years at this point in the cycle (32 days after the pre-order date).” iPhone 13 and 13 mini lead times are shorter at 11 and 10 days, respectively, which would rank them 8th and 9th (of 15 models) at this point in the cycle.

But in China, Apple had c.23% share of the smartphone installed base as of September 21, the analyst said. “The strongest month of share gains for Apple since March 2019, and a new China smartphone installed base record.”

[Also read: Here is why Apple’s Steve Jobs loved to walk and so should you]

Apple’s retention rate of upgraders in China has also increased, Huberty said, reaching a 2.5-year high of 64.2% in September. At the same time, the rate of switchers from Huawei to Apple has eclipsed the rate of switchers from Apple to Huawei for the first time since June 19 as iPhone benefits from Huawei’s decline.

iPhone sales data through the ages

But there are component challenges

The analysts state that component availability “bottlenecks” in the iPhone supply chain, (primarily for iPhone 13 Pro and Pro Max camera modules manufactured by Sharp in Vietnam) serve to obfuscate the significance of these lead times.

At the same time, Huberty says:

“However, with lead times to-date for all 4 iPhone 13 models outperforming their respective iPhone 12 and iPhone 11 peers from the last 2 years (14), we believe early demand is at least in-line with internal expectations and tracking to our +4% Y/Y iPhone shipment growth forecast in FY22.”

Beyond iPhone, the analysts also note that notebook builds exceeded expectations, albeit by just 1 percent.

“Component constraints remain a major factor in the PC supply chain, caused by COVID-driven lockdowns in SE Asia and worsening logistics issues, with recent power cuts in China only having a minimal impact,” they said.

Apple, of course, introduced its powerful new MacBook Pro range this week and it remains to be seen if supplies of these machines is constrained.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.