iPhone is Apple’s happy little iCash machine

iPhone 13, iPad mini and iPad 9 hit stores in China

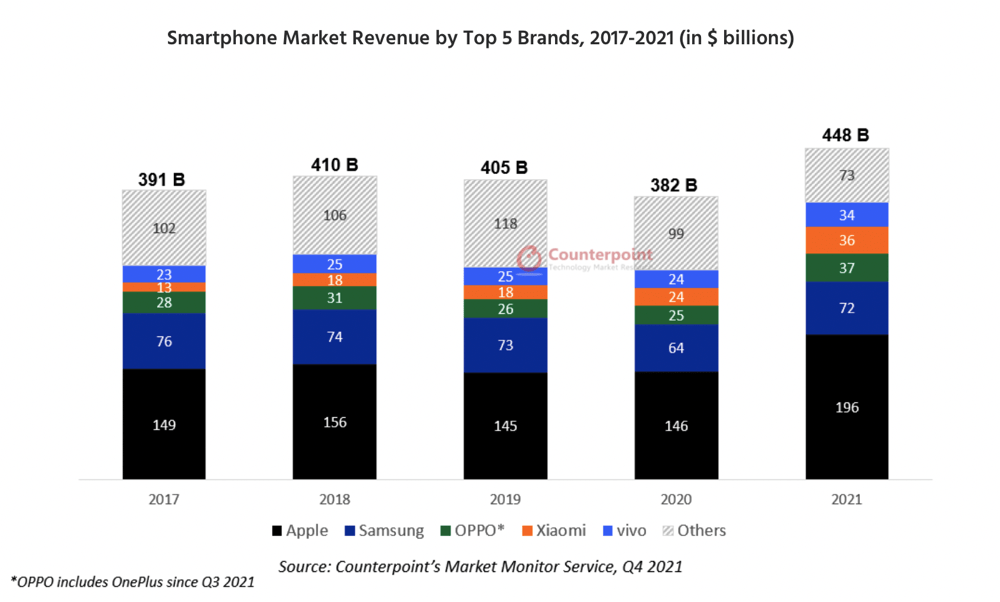

Another day, another nugget of Apple-related Counterpoint data. This time news that Apple took 44% of the value of the world’s smartphone market for $196 billion in annual revenue. The next four largest smartphone brands grabbed around 41% between them.

Apple’s happy little iCash machine

The report confirms that, as we knew, 2021 was a record year. Earth’s smartphone market revenue crossed $448 billion in 2021. Apple, realme and Motorola recorded their highest ever quarterly revenues in Q4 2021 and global smartphone ASP increased by 12% YoY in Q4 2021, driven by iPhone 13.

Strong demand for the 5G-enabled iPhone 12 and 13 devices helped Apple increase ASPs by 14%. On average, customers spent $825 on a new model. Apple also managed to increase its share in key emerging markets such as India, Thailand, Vietnam and Brazil.

Counterpoint claim the industry grew 7% YoY and 20% QoQ even as component shortages and COVID-19 restrictions disrupted global supply chains.

2021 was also the year of 5G. Four out of every ten (40%) smartphones sold in 2021 were equipped with 5G modems, up from 18% in 2020. Apple quite evidently led the expansion of the 5G market.

Consumers are also choosing mid-range phones

Interestingly, as Apple prepares to introduce iPhone SE 2022 (also with 5G), Counterpoint observed a global increase in demand for mid-range and premium smartphones.

But some manufacturers have had to increase the costs of entry and mid-range smartphones, as component shortages continue to bite. Apple, of course, has the luxury of making very big component orders, and suppliers will follow its money when they must make a choice. Though we can’t know yet what the future impact of the terrible events in Ukraine will be on component supply in future products. Or, indeed, the price of grain.

Apple maintains dominance in growing industry

What about the rest of the industry?

Samsung

- Smartphone revenue increased 11% YoY to reach $72 billion in 2021, compared to $64 billion in 2020.

- ASP grew 5% to $263.

- Samsung increased share in the mid and premium segments with the 5G Galaxy S series.

- Samsung Galaxy Z Fold3 5G and Z Flip3 also nudged the overall revenue higher. Samsung shipped three times more foldable devices in 2021 than in 2020.

Xiaomi

- Revenue up 49% YoY to reach $36 billion in 2021, compared to $24 billion in 2020.

- Increase mainly attributed to its mid and premium devices, including the Mi 11x series.

- In India, the brand’s biggest market, the smartphones priced at $250 and above grew 39% YoY to account for more than 14% of Xiaomi’s India market, compared to 8% in 2020.

[Also read: Apple is ‘the Beatles of all brands’, says Prophet]

OPPO

- Revenue climbed 47% YoY to $37 billion.

- ASP grew 15% YoY to reach $259 in 2021.

- The brand saw an increase in shipments in the $400-$599 and $600-$799 price bands, mainly owing to strong demand for the Reno 6 series, Find X3 and OnePlus 9 series.

- 5G-enabled smartphones contributed more than 50% of the brand’s yearly shipments in 2021 against 28% in 2020.

- OPPO expanded its presence in China, Japan and parts of Europe.

- OnePlus revenue grew 33% YoY in 2021 driven by the OnePlus Nord series and OnePlus 9.

Vivo

- Revenue increased 43% YoY to $34 billion.

- ASP grew 19% YoY to reach $259 in 2021.

- Performance was driven by the well-received flagship X60 and S series.

- Enjoyed exceptional performance in China.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.