Is Apple preparing to go global with Apple Cash and Card?

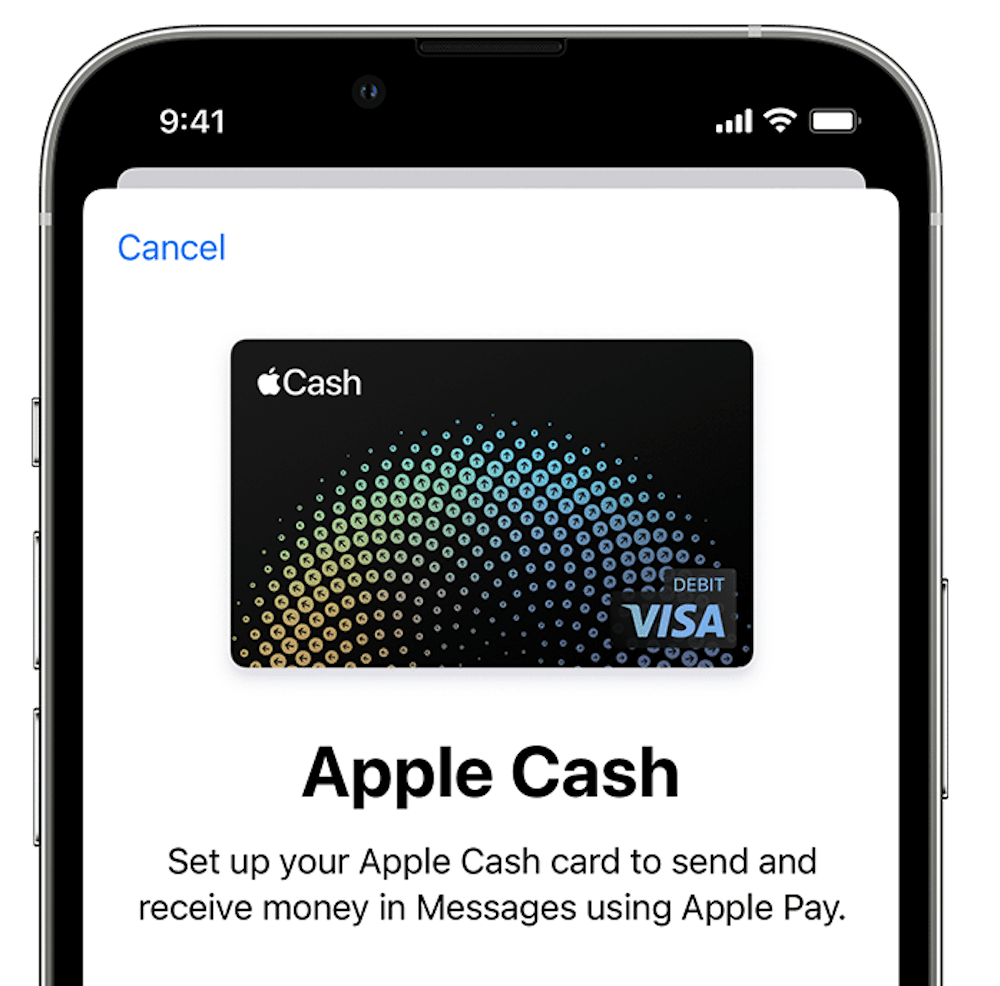

Apple shifts to Visa network for Apple Cash and sets rumour on fire

Could Apple (at last) be on the edge of extending its Apple Cash service to customers outside the US? We don’t know, but it seems a lot more possible given the company’s surreptitious move to switch to using Visa’s payment network. Apple’s plans to replace your wallet continue apace.

What’s happening?

Reports have appeared claiming some Apple Cash customers have been told of the switch from previous payment provider network, Discover (a small network available I think only in the US) to Visa, which is an international provider.

Apple has confirmed the move with some fresh images published to the Apple Cash that show the Visa branding, MacRumors claims.

How to switch to Visa

Apple has already made the transition. If you are an existing Apple Cash user all you must do is deactivate Apple Cash in Settings on your device and then reactivate it. When you do you’ll be switched to the Visa network.

What is Apple Cash?

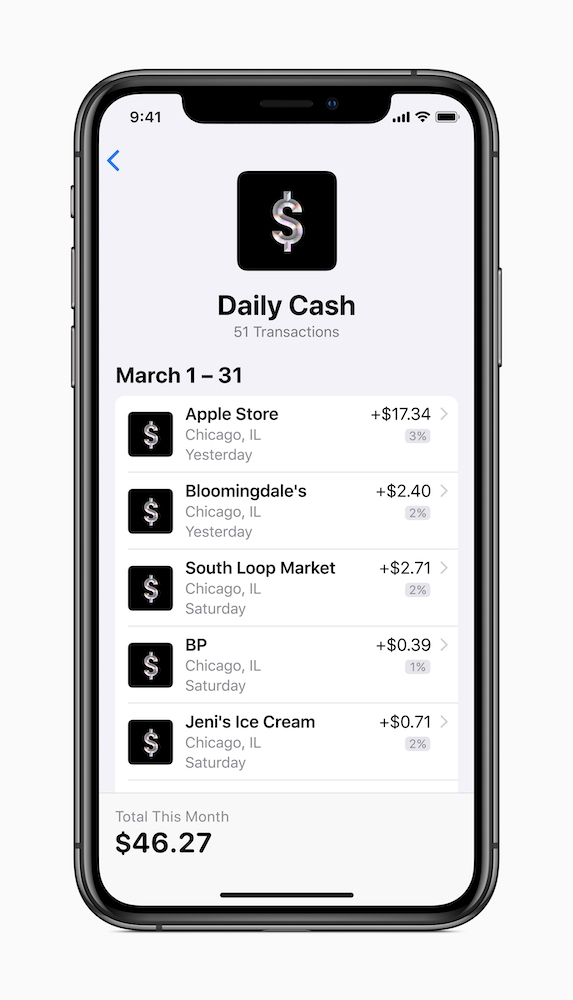

Apple Cash is kind of like an Apple virtual currency. It lets you send and receive real money using Messages and Apple Pay, and the money can be used in the same way as it can be via any preloaded debit card.

Apple Card owners earn their bonuses in Apple Cash, which makes the two services very important to one another. Money can also be taken from the Cash account and poured back into your actual bank balance.

It’s a little like all those prepaid cards you can get and use that are compatible with Apple Pay, except there is no card and the service is virtual.

What could this mean?

What could this mean? Well first of all it is important to temper your enthusiasm. All of this could mean nothing.

Apple may simply have chosen to move to a different payment provider to underpin the service.

Nothing else may have changed and the company may continue to only offer Apple Cash in the US. The company launched the service five years ago and it has never made it outside that nation yet. Why should that change?

But it seems plausible to think it could change, and one thing Apple would need to do to make that change would be to move to an international payments network – and Visa offers that.

[Also read: A Few Things About The Apple Credit Card Might Surprise You]

Image c/o blocks on Unsplash

In addition to that thought, here’s another:

The generous Apple Cash rewards are part of the success model of Apple Card.

And while there are many who say one of the reasons Apple has been unable to extend that mission to Europe is the difference in payment models between here and the US, the demand for that card in America certainly seems strong enough to nurture negotiation – particularly among the younger users bank and credit companies yearn to tempt to their services.

Apple has also spent years and billions of dollars designing customer-centric platforms that deliver an easy user experience – perhaps there’s room for a deal?

And even if that is not the case, Apple will need to ensure Apple Cash is available in any nations it hopes to one day offer its card to.

Tap to Pay for retailers large and small

Apple already tipped us to expect some news

Apple has already flagged up that we should watch what it does with Apple Pay this year.

Speaking in January, Apple CEO Tim Cook said: “I would say that I think Apple Card has a great runway ahead of us. It was rated to the No. 1 midsized credit carding customer set by J.D. Power and is getting — has fast become people’s main credit card for many, many people.

“And the growth of Apple Pay has just been stunning. It’s been absolutely stunning. And there’s still obviously a lot more there to go — and because there’s still a lot of cash in the environment. And so I think that both of these and whatever else we might do have a great future ahead.”

If you’ve been paying attention, you will know Cook doesn’t waste words and this seemed to me to be a definite warning of market activity of some kind.

What might Apple be planning?

At the time he made this statement, speculation that came to mind included:

- Apple Cash going international

- A foray into Buy Now Pay Later market

- Apple Card outside the US (this has been anticipated for an aeon).

- Apple Pay for payment terminals.

Given Apple has since then already announced the last option, it’s got to be fairly plausible to imagine the move to Visa gives Apple a chance to deliver on one or all of the other three predictions, surely?

I think it is. In addition to which, Apple recently increased the size of its Apple Pay offices in London, UK, so perhaps that means something? The company’s recent purchase of Credit Kudos also feels significant – particularly when you consider this extensive set of statements from Apple’s VP Internet Services, Jennifer Bailey in 2019.

Put it all together and it’s hard not to see a little fire inside this set of smoke.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.