Just another Apple Q1 FY2021 earnings call transcript

Girl buys iPhone 12

Here’s my small offering to the Apple brains trust in the form of a free to access Apple earnings call transcript.

It may be important to note that Apple achieved a record setting quarter in the middle of a pandemic without needing to surveil its customers to build its business. Which may be historically relevant one day.

I’ll be pruning it of errors if I find any and hope it comes in useful to investors, writers, and anyone else who might find it so.

What happened?

Apple announced its first quarter 2021 results after markets closed on January 27 2021.

You can read its results announcement here and scan its published data here, but I’ve put some top line figures before the transcript below. You can also explore a summary of what is below here.

- Revenue up 21 percent and EPS up 35 percent to new all-time records.

- Apple posted all-time record revenue of $111.4 billion, up 21 percent year over year.

- International sales accounted for 64 percent of the quarter’s revenue.

Now on with the summary, skipping some elements. Forgive every error and do make sure you double check any fact you’re not certain of. I have done my best to make this as accurate as possible – and shoved it all on a single page so you can search for specifics, too!

Tejas Gala, Apple Director Corporate Finance & Investor Relations

“Thank you. Good afternoon and thank you for joining us. Speaking first today is Apple CEO Tim Cook, and he’ll be followed by CFO Luca Maestri. After that we’ll open the call to questions from analysts.

Please note that some of the information you’ll hear during our discussion today will consist of forward-looking statements, including, without limitation. Those regarding revenue gross margin operating expenses, other income and expense, taxes, capital allocation and future business outlook, including the potential impact of COVID-19 on the company’s business and results of operations. These statements involve risks and uncertainties that may cause actual results or trends to differ materially from our forecast.

Also read: Apple’s Mac sales surge on WFH, home schooling and M1 boost

For more information, please refer to the risk factors discussed in Apple’s, most recently filed annual report on form 10 K, and the form eight k filed with the SEC today, along with the associated press release. Apple assumes no obligation to update any forward looking statements or information which speak as of their respective dates. I’d now like to turn the call over to Tim for introductory remarks.

Apple CEO Tim Cook’s introductory remarks

“Thank you to Tejas. Good afternoon, everyone. Thanks for joining the call today. It’s with great gratitude for the tireless and innovative work of every Apple team member worldwide, that I share the results of a very strong quarter for Apple.

We achieved an all time revenue record of $111.4 billion. We saw strong double-digit growth across every product category. And we achieved all time revenue records in each of our geographic segments.

It is not far from many of our minds that this resolve caps off the most challenging year any of us can remember. And it is an understatement to say that the challenges it poses to Apple as a business paled in comparison to the challenges posed to Apple as a community of individuals to employees to their families and to the communities we live in and love to call home.

These results show the central role that our products played in helping our users respond to these challenges. We are doubly aware that the work ahead of all of us to navigate the end of this pandemic to restore normal life and prosperity in our neighbourhoods, and local economies, and to build back with a sense of justice is profound and urgent.

We will speak to these needs, and Apple’s efforts throughout today’s call. But I want to first offer the context of a detailed look at our results this quarter, including why we outperformed our expectations.

Let’s get started with hardware. We hit a new high watermark for our installed base of active devices with growth accelerating as we passed 1.6 5 billion devices worldwide.

During the December quarter. iPhone grew by 17% year over year, driven by strong demand for the iPhone 12 family, and our active installed base of iPhones, is now over 1 billion.

The customer response to the new iPhone 12 models unprecedented innovation from World Class cameras to the great and growing potential of 5g has been enthusiastic, even in light of the ongoing COVID-19 impact at retail locations, iPad and Mac grew by 41 and 21% respectively, reflecting the continuing role these devices have played in our users lives during the covid 19 pandemic.

During this quarter availability began for both our new iPad Air, as well as the first generation of backs to feature our ground-breaking in one show the demand for all of these products has been very strong.

We have also continued our efforts to bring the latest iPads enriching content and professional support to educators, students and parents educational districts and governments worldwide are continuing major deployments, including the largest iPad deployments ever to schools in Germany and Japan wearables home and accessories grew by 30% year over year, driven by significant holiday demand for the latest Apple Watch our entire air pods line-up including the new air pods Max, as well as the new home pod mini this broad strength across the category lead to new revenue records for each of its three subgroups.

And we’re very excited about the road ahead for these products, look no further than the great potential of fitness plus, which pairs with Apple Watch to deliver real time on screen fitness data alongside world class workouts by the world’s best trainers. There are new sessions added each week, and customers are loving the flexibility challenge and fun of these classes as well as how the pairing with Apple Watch pushes you to achieve your fitness goals.

This deep integration of hardware software and services have always defined our approach here, and it has delivered an all-time quarterly services record of $15.8 billion. This was the first quarter of the Apple One bundle, which brings together many of our great services into an easy subscription. And with new content being added to these services, every day. We feel very optimistic about where we are headed

The App Store ecosystem has been so important as individuals, families and businesses worldwide evolve and adapt to the covid 19 pandemic. And we want to make sure that this unrivalled engine of innovation and opportunity continues this quarter.

We also took a significant new step to help smaller developers continue to experiment, innovate and scale. The latest great app ideas, the App Store small business programme reduces the Commission on the sale of digital goods and services to 15% for small businesses earning less than $1 million a year. The programme launched on January 1, and we are already hearing from developers about how this change represents a transformation in their potential to create and grow on the App Store.

Tomorrow is international privacy day. And we continue to set new standards to protect users right to privacy, not just for our own products, but to be the ripple in the pond that moves the whole industry forward. Most recently, we’re in the process of deploying new requirements across the App Store ecosystem that give users more knowledge about and new tools to control the ways that apps gather and share their personal data. The winter holiday season is always a busy time for us and our products, but this year was unique. We had a record number of device activations during the last week of the quarter. And as COVID-19 kept us apart. We saw the highest volume of FaceTime calls, ever this Christmas. As always, we could not have made so many holidays special without our talented and dedicated retail teams who helped us achieve a new all-time revenue record for retail driven by very strong performance in our online store, particularly after the events of the last few weeks, we’re focused on how we can help a moment of great national need because none of us should have any illusions about the challenges we face as we begin a new chapter in the American story.

Hope for healing for unity and for progress begins with and depends on addressing the things that continue to wound us in our communities we see how every burden from COVID-19 to the resulting economic challenges to the closure of in person learning for students falls heaviest on those who have always faced structural barriers to opportunity and equality.

This month, Apple announced major new commitments through a $100 million racial equity and justice initiative. The propel centre launched with a $25 million, commitment, and with the support of historically black colleges and universities across the country will help support the next generation of leaders in fields ranging from machine learning to app development to entrepreneurship and design, and our new Apple developer Academy in downtown Detroit, will be the first of its kind in the United States. Detroit has a vibrant culture of black entrepreneurship, including over 50,000 black owned businesses.

We want to accelerate the potential of the app economy here knowing there is no shortage of good ideas and such a creative resilient and dedicated community.

Finally, we’re committing $35 million across to investments to investments in Harlem capital into clear vision impact fund that support accelerate and grow minority owned businesses in areas of great potential indeed.

In December we concluded an unmatched your giving since the inception of the Apple giving programme in 2011, Apple employees have donated nearly $600 million, and volunteered more than 1.6 million hours to over 34,000 organisations of every stripe through a partnership with product red, we’ve adapted our 14 year $250 million effort to support HIV and AIDS work globally, to ensure their care continues, even in the time of COVID. That includes delivering millions of units of personal protective equipment to health care providers in Zambia.

And here in the United States, even with COVID effects, we are ahead of schedule on our multiyear commitment to invest $350 billion throughout the American economy as proud as this makes us we know there is much more to be done.

Looking forward. We continue to contend with the pandemic. But we must also now work to imagine what we will inherit on the other side.

When a disease recedes, we cannot simply assume that healing follows.

Even now we see the deep scars that this period has left in our communities. Trust has been compromised opportunities have been lost. Entire portions of our lives that we took for granted. Schools for our children meetings with our colleagues, small businesses that have endured for generations have simply disappeared.

It will take a society wide effort across the public and private sectors as individuals and communities, every one of us, to ensure that what’s ahead of us is not simply the end of a disease, but the beginning of something durable and hopeful for those who gave suffered and endured during this time at Apple we have every intention to be partners in this effort, and we look forward to working in communities around the world to make it possible.

And as this chapter of uncertainty continues, so will our tireless work to help our customers stay safe connected and well without I’ll hand things over to Luca.

Luca Maestri

Luca Maestri, Apple CFO, introductory remarks

Thank you, Tim. Good afternoon everyone.

We started our fiscal 2021 with exceptional business and financial performance during the December quarter. As we said all-time records for revenue. Operating Income, net income earnings per share, and operating cash flow.

We are thrilled with the way our teams continue to innovate and execute.

Throughout this period of elevated uncertainty, our revenue reached an all time record of 111 point 4 billion, an increase of nearly 20 billion, or 21% from a year ago. We grew strong double digits in each of our product categories, with all time records for iPhone wearables home and accessories and services, as well as of December for the record for Mac. We also achieve double digit growth and new all time records in each of our five geographic segments, and in the vast majority of countries that we track products revenue was an all time record of 95 point 7 billion, up 21% over a year ago. As a consequence of this level of sales performance and yet met and match loyalty of our customers, our installed base of active devices, past one point 65 billion during the December quarter and reached an all time record in each of our major product categories. Our services to an all time record of $15.8 billion growing 24% year over year. We established new all time records in most service categories, and December quarter records in each geographic segment. I’ll cover our services business in more detail later.

Company gross margin was 39.8% up 160 basis points sequentially. Thanks to leverage from higher sales and a strong mix products gross margin was 35.1% growing 530 basis points sequentially, driven by leverage and mix services gross margin was 68.4% up one other 50 basis points, sequentially, mainly due to a different mix. net income diluted earnings per share, and operating cash flow, where all time records, net income was 28 point 8 billion of 6.5 billion or 29% over last year, diluted earnings per share were $1.68 up 35% over last year, and operating cash flow was 38 point 8 billion and improvement of 8.2 billion.

Let me get into more detail for each of our revenue categories:

iPhone revenue was a record 65 point 6 billion growing 17% year over year as demand for the iPhone 12 family was very strong. Despite COVID-19, and social distancing measures which have impacted store operations in a significant manner, our active installed base of iPhones, reached a new all time high, and has now surpassed 1 billion devices.

Thanks to the exceptional loyalty of our customer base is strength of our ecosystem. In fact, in the US. The latest survey of consumers from 451 research indicates iPhone customer satisfaction of 98% for the iPhone 12 family.

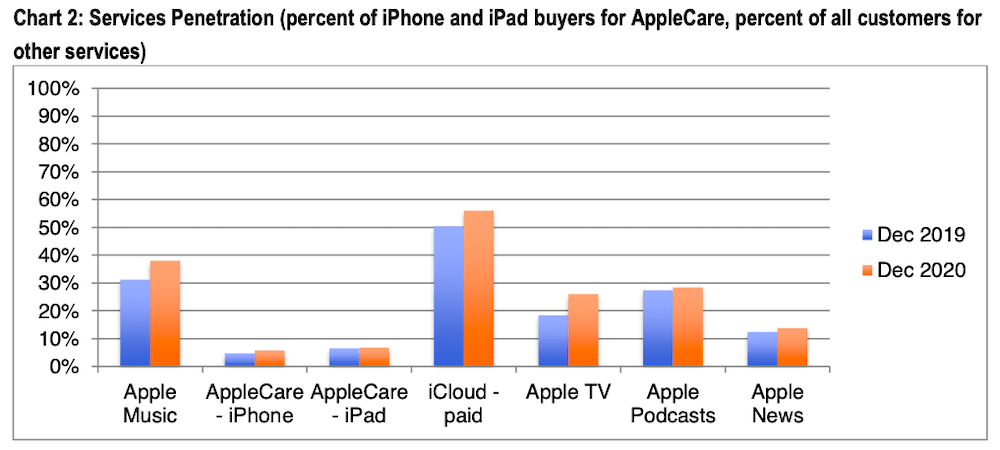

Moving to services as I said we reach an all time revenue record of $15.8 billion and set all time records in App Store cloud services music, advertising, Apple Care and payment services. Our new service offerings, Apple TV+, Apple Arcade, Apple News+, Apple Card, Apple Fitness+, as well as the Apple One bundle are also contributing to overall services growth and continue to add users content and features. The key drivers for our services growth, all continue to move in the right direction.

- First, our installed base growth has accelerated and an all time high across each major product category.

- Second, the number of both transacting and paid accounts on our digital content stores reached a new all time high.

- Subscriptions continue to grow nicely and we exceeded our target of 600 million paid subscriptions before the end of calendar, 2020. During the December quarter, we added more than 35 million sequentially…. we now have more than 620 million paid subscriptions across the services on our platform up 140 million from just a year ago.

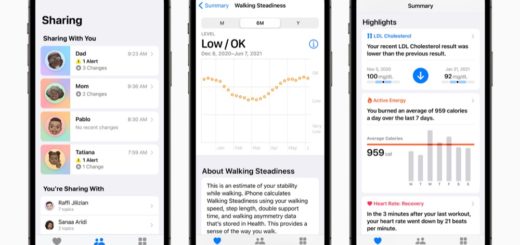

- Finally, we continue to improve the breadth and quality of our current services offerings and are adding new services that we think our customers will love. For example, Apple Music recently released its biggest product update ever with features like listen now, or new search personal radio stations and autoplay — 90% of Apple Music users on iOS 14 have already used these new features.

- In payment services we continue to expand our coverage, with nearly 90% of stores in the United States now accepting Apple Pay so that customers can easily have a touchless payments experience.

Wearables home and accessories grew 30% year over year to 13 billion, setting new longtime revenue records in every geographic segment. As a result of that strong performance our wearables business is now the size of a Fortune 120 company.

Importantly, Apple Watch continues to extend its reach, with nearly 75% of the customers purchasing Apple Watch during the quarter, being new to the product.

We’re very excited about the future of this category and believe that our integration of hardware software and services uniquely positions us to provide great customer experience in this category.

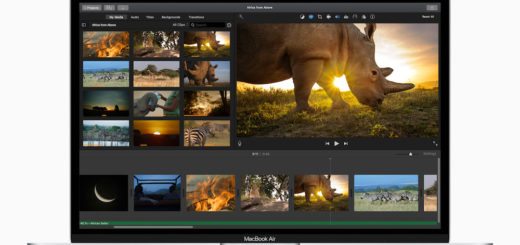

Next, I’d like to talk about Mac, which set a December quarter record for revenue of 8.7 billion, up 21% over last year. We grew strong double digits in each geographic segment and said all time revenue records in Europe, and rest of Asia Pacific, as well as December quarter records in the Americas, whether China and Japan. This performance was driven by strong demand for the new MacBook Air MacBook Pro and Mac Mini all powered by our brand new M1 chip.

iPad performance was also very impressive with revenue of 8.4 billion at 41% with real strong, very strong double digits in average and graphics segment, including an all time record in Japan during the quarter. The all new iPad Air became available… Customer response has been terrific both Mac and iPad are incredibly relevant products for our customers in the current working and learning environments. And we’re delighted that the most recent surveys of consumers from 451 Research measured customer satisfaction at 93% for Mac and 94% for iPad with this level of customer satisfaction and with around half of the customers purchasing Mac and iPad during the quarter, being new to that product. The active installed base for both products continues to grow nicely and reach new all time highs in the enterprise market. We have seen many businesses shifting their technology investments in response to COVID.

Tell everyone in your home some stuff.

One example is how businesses are handling their hundreds of millions of office desk phones while more employees are working remotely last quarter, Mitsubishi UFJ bank one of the largest banks in the world, announced that it will be replacing 75% of its fixed phones with iPhones. By doing so it expects to realise significant cost savings by providing a secure mobile platform to employees. We’re also pleased with the rapid adoption of the Mac employee choice programme among the world’s leading businesses. We’re seeing improved productivity increase employee satisfaction and talent retention.

With the introduction of M1 Macs. We’re excited to extend these experiences to an even broader range of customers and employees, especially in times of increased the remote working.

Let me now turn to our cash position.

We ended the quarter with almost $196 billion in cash, plus marketable securities and retire(? – check) $1 billion are maturing …. leaving us with total debt of $112. billion. As a result, net cash was $84 billion at the end of the quarter. We returned over $30 billion to shareholders during December quarter including $3.6, billion in dividends and equivalents and $24 billion through open market repurchases of 200 million Apple shares as we continue on our path to reaching a net cash neutral position over time.

As we move ahead into the March quarter, I’d like to provide some colour on what we have seen, which includes the types of forward looking information, the pages referred to, at the beginning of the call. Given the continued uncertainty around the world in the near term, we will not be guiding to a specific revenue range.

However, we are providing some directional insights, assuming the COVID related impacts for our business do not worses and from our current assumptions for the quarter for total company revenue. We believe growth will accelerate on a year by year basis, and in aggregate follow typical seasonality on a sequential basis. At the product category level, keep in mind two items first. During the March quarter last year, we saw elevated activity in our digital services as lock downs occurred around the world. So, our services business faces a tougher year over year comparison. Second, we believe that year over year growth in the wearables home and accessories category will decelerate compared to q1. As you know, we were chasing demand on AirPods last year, as we expand the channel inventory from q1 to q2. This year we plan to decrease channel inventory, as is typical after the holiday quarter. We expect gross margin to be similar to the December quarter… Finally, today our board of directors has declared a cash dividend of 20.5 cents per share of common stock payable on February 11, 2021 to shareholders of record as of February 8, 2021.

With that, let’s open the call to questions.

This is the hugest pile of iPhones you can imagine — think how many hours of work and development it represents.

Questions from analysts

Katie Huberty, Morgan Stanley

Congratulations on a really strong quarter. First question for Lucca, the gross margin was particularly strong versus your outlook. Can you talk about whether you recognise the full impact of the weaker dollar in the December quarter, given your typical currency hedges, and then how are you thinking about the headwinds and tailwind and gross margins as you go into the march quarter, and I have a follow up for Tim.

Luca, CFO

Gross margin was better than we had anticipated at the beginning of the quarter. The reason for that was obviously we had very strong leverage from higher sales and the mix, was strong, both the mix within products and the mix of services. And that was only partially offset by cost, as you know, we’ve launched, many new products during the fall and that always comes with new cost structures, but so in total was very good.

On from the FX standpoint, really, at the gross margin level effects didn’t play a role. Neither sequentially, nor on a year by year basis for the December quarter, partially because of the hedges that you’ve talked about, but also because some currencies are still weaker against the dollar … than a year ago. Look, specifically to emerging markets in Latin America and Russia and Turkey and so on. Clearly, if the dollar remains weak or continues to weaken that can become a tailwind for us as we get into, into the March quarter at current rates, we expect some level of benefit around 60 to 70 basis points for the march quarter.

Katie Huberty, Morgan Stanley

That’s great. Thank you and Tim, one of the challenges with valuing Apple is just a limited visibility that investors have into the roadmap, and any new categories that you might enter over time. Without Of course commenting on any given opportunity. Can you talk about the framework that you use internally to evaluate new markets that might be attractive and what you believe will determine your success as you look to enter new markets?

Apple’s retail teams invented a new way to shop the still feels good, rather than compromised…

Cook, CEO

Thanks Katie for the question and thanks for not asking me anything any specifics. The framework that we use is very much around… We ask ourselves if this is a product that we would want to use ourselves or a service that we would want to use ourselves.

And, (and that’s a pretty high bar) we ask ourselves if it’s a big enough market to be on unless it’s an adjacency product which we’re looking at from a customer experience point of view. … So the way that we’re looking at it. You know that no formula, kind of thing.

But, but we’re taking into account all of those things and the kind of things that we love to work on, are those where there’s a requirement for hardware software and services to come together because we believe that the magic really occurs at that intersection. And so, hopefully that gives you a little bit of insight into how we look at it, and I think we have, you know, some good really good opportunities out there. And I think if you look at our current portfolio of products.. we still have relatively low share in a number of cases in very big markets and so we feel like we have really good upside there and we feel like we have really good upside in the services area to that we’ve been working on for quite some time with, you know, four or five new services just coming online in the last year, year plus.

Wannsee Mohan, Bank of America

Luca, the iPhone growth exceeded your expectations despite late launch Can you maybe share some colour on what drove that was it more on the unit side or the ASP side you’ll refer to two very strong mix a couple of times on the call and how does this change your view on the on the march quarter. And if you can share it in colour or if you’re still supply constrained and I will follow up with him.

Luca

Yes, certainly iPhone was one of the major factors why we exceeded our own internal expectations at the beginning of the quarter. We have a fantastic product lineup and we know that and it’s been fantastic to see the customer response for the four new models, particularly the pro models. The Pro and the Pro Max. So we’ve done very, very well both on units, and on pricing, because of the strong mix. And we’ve had some level of supply constraints as we went through the quarter, particularly on the pro and the and the promax, as you said correctly. We launched these products in the middle of the quarter, two models after four weeks. The other two models after seven weeks and so obviously, we had a very steep ramp which fortunately went very well. The products are doing very well all around the world I think you’ve seen that our performance has been particularly strong in China, where we seeing phenomenal customer response that probably there was also some level of pent up demand for 5g, iPhones, given that, you know, the market is moving very quickly to 5g. And so as we look ahead into the march quarter we’re very optimistic. We believe we’re going to be able to be in supply demand balance for all the models at some point during the quarter. And it’s, you know, the product is doing very well all around the world.

Wannsee Mohan, Bank of America

Tim, you mentioned about the strength of the instal base performance which continues to grow very impressively at this scale. Can you maybe help us think through how the switcher versus upgrade activity has been tracking in recent quarters I would love to get your thoughts on that.

Tim Cook, CEO

Yeah, thanks for the question, if you look at this past quarter, which, you know, has, we started selling to the iPhones four weeks into the quarter, and the other two seven weeks of the quarter and so I would caution that this is an early going, but in looking at the iPhone 12 family. We saw both switchers and upgraders increase on a year to year basis. And in fact we saw the largest number of upgraders that we’ve ever seen in in a quarter. And so we were, you know, very thrilled about that.

Shannon Cross, Cross Research.

Tim, can you talk a bit about what you’re seeing in China, clearly significant sequential growth which I think has a lot to do with iPhone but I’m curious, both from an iPhone as well as you know your other product categories what you’re seeing and you know how much back to normal you think the Chinese market is. And then I have a follow up. Thank you.

Tim Cook, CEO

Yeah. China was more than an iPhone story iPhone didn’t do very well there and sort of sort of liked the world if you look at both switches and upgraders we were up year over year and China also had a record number of upgraders during the quarter, the most we’ve ever seen in a quarter. I think probably some portion of this was that people probably delayed purchasing in the in the previous quarter as rumours started appearing about an iPhone. Keep in mind 5G in China is well established and the overwhelming majority of phones being sold are 5G phones and so I think there was some level of anticipation for us.

…iPhone did extremely well. However, the other products did as well I mean we could not have turned in a performance like we did with only iPhone. iPad did extremely well, far beyond the company average; Mac was above the company average, Wearables home and accessories was above the company average.. so if you really look at it we did really well across the board there in terms of COVID. I think they’re, at least for last quarter they were sort of beyond COVID, very much in the, in the recovery stage. There are different reports about some cases in (this quarter). In some places, and lockdowns occurring but we have not seen in our businesses.

Shannon Cross, Cross Research

I guess the other thing I was curious about with regard to the services business. You know, if we could dig a little bit more I think this is one of the first times when Luca you talked about Apple TV plus arcade Apple Pay some of the smaller services actually kind of moving the needle and then I was also curious you had a number of stores closed. At least later in the quarter and that typically has impacted some of your AppleCare revenue, and yet you outperform so maybe if you could talk about a bit more about the drivers of the services revenue.

Luca

There are two businesses during COVID that have been impacted negatively. One is AppleCare, obviously when the stores are closed it’s tough for, of course for customers to have the interaction with us, and advertising which is, you know, it’s in line with the overall level of economic activity what happened during the December quarter.

…We grew, we didn’t grow as much as company average but we grew in Apple care set an all time record there (Must listen in to this bit again). In spite of the fact that yes we are running particularly in December we started, closing a few stores particularly here in the United States but also in Western Europe. But, in total we were able to serve to support more customers than in past quarters. And we also saw a sequential acceleration in advertising and so that also helped the overall growth rate. Clearly the strength was in digital services in the app store in cloud services in music. Those were the services that really delivered very, very strong performance, and it’s something that we’ve seen happen in the corporate environment.

Tony Bernstein.

I was wondering if we could just probe a little bit more into iPhone maybe you can just, you talked about a drawdown in channel inventory last quarter or iPhone channel inventory is sort of at normal levels now exiting Q1. And should we be thinking about above seasonal iPhone growth, given that you’re still not in supply demand balance in the fewer selling days in fiscal q1 should we be thinking about sort of above seasonal iPhone growth, looking and into q2?

Luca

So on the, on the December performance. As you know, Tony. This was a very different cycle because we launched at a different time than usual. And so, we had an initial part of the quarter where obviously we didn’t add the new phones. And then, as we launched the new phones, we also did the channel fill that typically happens to certain extent in the in the September quarter at the end of the quarter, and the demand has been very strong and so we’ve been constrained as I said — especially in the pro models. At the end of December we exited with a level of iPhone channel inventory which was slightly below, a year ago. So we still had some level of supply constraints which we believe we’re gonna be able to solve during the March quarter, in terms of the sequential change.

We talked about, you know, during the prepared remarks we talked about total company average and we said that we expect that sequential progression to be similar to the typical seasonality that you’ve seen in past years, certainly last year is not typical because of COVID. But if you go back, you know, fiscal 17, 18, 19, you know that that’s our typical seasonal progression. And we mentioned a couple of product categories, services and wearables, where we’re going to be having a slightly more difficult compare. And so I think you can draw your conclusions around the iPhone.

Tony Bernstein.

Okay, thank you for that. And then, Tim. I was wondering if he could just comment more broadly around growth for Apple and sources of growth. The company you know this year is can be well over $300 billion in revenue. Historically, you’ve issued acquisitions. And I’m wondering if you could comment whether you still feel confident that Apple has organic growth opportunities. And that you don’t believe acquisitions are an important source of growth. And then I think perhaps most importantly as you look out let’s say over the next five years. What do you think is a realistic revenue growth rate for Apple going forward? Thank you.

Cook

Yeah, Tony as you know we give some colour on the current quarter but not beyond that.

In terms of growth rates all that part of your question… if you back up and look at the sort of the ingredients that we have at this point: We have the strongest hardware portfolio that we’ve ever had; We have a great product pipeline for the future, both in products and services; We have an installed base that is hitting new highs that we just talked about earlier in our opening comments; we’re still attracting a fair number of switchers and upgraders and just set an all time services record. And we have that installed base to compound that, and particularly with the added services that we’ve had over the last year so that as they grow and mature will contribute even more to the, to the services revenue stream.

On the wearable side, we’ve bought this thing from zero to a Fortune 120 Company, which was no small feat. But I still think that that we’re in the early stages of, of those products.

If you look at our share in some of the other products, whether you look at iPhone, or Mac or iPad, you find that the share numbers leave a fair amount of headroom for market share expansion. And this is particularly the case in, in some of the emerging markets where we’re proud of how we’ve done. But there’s a lot more headroom in those markets like if you take India as an example, we doubled our business last quarter compared to the year ago quarter, but our absolute level of business there is still quite low relative to the size of the opportunity and you can kind of take that and go around the world and find other markets that are like that as well.

Of course the other thing from a market point of view is we’re we’ve been on a multi year effort in the enterprise and have gained quite a bit of traction there. You’ve heard some of the things and Lucas comments today and we comment some on at each quarter, we’re, you know, very optimistic about what we can do in that space. And then of course we’ve got new things that we’re not going to talk about that we think will contribute to the company as well. Just like other new things have contributed nicely to the company in the past. So we see lots of opportunity. Thank you for the question.

Amit Daryanani, Evercore

Perfect, thank you. I have two questions as well. I just started with you, Luca, I just wanted to go back to the gross margin discussion and you know we really haven’t seen gross margins at this level I think since 2016. …What are the key drivers to get you there, and you know it’s commodity tailwinds in sourcing of some components so the big part of this slide to understand the durability of the gross margin at these levels and what are the big drivers that got us here.

Luca

Well, I mean, of course when, you know, when you grow, the way we’ve grown this you know this quarter 21% and it’s obviously, we have a certain level of fixed costs in our product structures right and so you know high level of sales helps margin expansion without a doubt. And so that has been probably the biggest factor to be honest and then as I was saying earlier, we had across the board in services in every product category we’ve had a very strong mix of products right which, you know, we were talking about the iPhone, the pro and the promax and, you know, and that’s been pretty much the case in every product category so the mix, as also being very good, the commodity environment is fairly benign. And the one thing that has not affected us this time around is the effects that it’s true, it has not been a tailwind yet for the reasons that I was explaining to Katie, but at the same time, it has not been a negative. And the reality is that FX for us has been a negative over the last five or six years, almost, almost every quarter. And so that is that has changed and that obviously makes a difference.

Amit Daryanani, Evercore

When I look at the growth rates on Mac and iPads you know they’ve been in the 20 to 40% range for the last three quarters and I suspect some of this is just folks contending with the pandemic, but what I’d love to understand that when you look at these growth rates how much of this do you think is replacement cycle driven force upgrading whatever or new customers and folks coming into the Apple ecosystem? What sort of growth rates, do you think is more durable and predictable as you go forward?

Tim Cook, CEO

If you look at the new to Mac and new to iPad these numbers are still about at a worldwide level about half of the purchases are coming from people that are new and so the install base is still expanding with new customers. And so that’s true on both iPad and Mac.

If you look at Mac, the M1, I think, gives us a new growth trajectory that we haven’t had in the past – certainly if q1 is a good proxy there’s lots of excitement about M1-based Macs, As you know we’re partway through the transition we’ve got more a lot more to do there were, you know, early days of a two year transition but we’re excited about what we see so far.

The iPad as we went out with the iPad Air…we now have the best iPad lineup we’ve ever had. And it’s, it’s clear that some people are using these as laptop replacements, ohers are using them as, as complimentary to their to their desktop, but the level of growth there has been phenomenal you look at it at 41%.

And yes, part of it is work from home and part of it is distance learning. But I think I wouldn’t underestimate how much of it is the product itself in both the case of iPad and, and Mac, and of course our share of the Mac is quite low in … the total personal computer market and so there’s lots of, lots of headroom there.

(Inaudible) JP Morgan

Thanks for taking my question and congrats on the record quarter from my side as well. I guess I want to start off with iPhone sales, I think, in general, a general impression we have is China and North America have more robust 5G infrastructure. I just wabted to see kind of what you’re seeing in terms of customer engagement or velocity of sales for iPhone in Europe where I think the general impression is that service providers haven’t rolled out robust 5G services is that something that’s impacting customer interest in the latest line-up in the region?

Tim Cook, CEO

If you look at the 5G rollout in Europe it’s true that Europe is not in the place of … certainly nowhere close to where China is. And nowhere close to the US either. But there are other regions have very good coverage, like Korea. So the world I would describe it right now is more of a patchwork quilt. There are places with excellent coverage, there are places within a country that that is very good but not the, not from a nation wide point of view. And then there were places that really hasn’t gotten started yet. Latin America is more closer to the last one there’s lots of opportunity ahead of us there. And I think Europe is where there are 5g implementations there. I think most of the growth is probably in front of us there as well

(Inaudible) JP Morgan

As a follow up if I can just ask you, I think you mentioned the momentum you’re seeing for the Apple One bundle, which I think has been a couple of months now since you launched it any metrics to share in terms of what are you seeing for conversion rate of customers or even insights into which services are turning in that bundle or turning out to be the anchor services, that’s driving adoption of that bundle.

Tim Cook, CEO

It’s really too early to answer some of those questions. As you know, we just got started in the into the quarter, so we have less than a quarter on this right now. What we wanted to accomplish with it we’re clearly accomplishing, which is making our services very easy to subscribe to — our customers clearly told us that they wanted to subscribe to several services or in some cases all of our services. And so we’ve made that very simple and it’s clear from the early going that it’s working. But we’ve just gotten started on it.

Krish Sankar, Cowen

Thanks for taking my question and congrats on the very strong results. My first question is with Tim; Tim, I want to talk a little bit about your search and advertising business, how do you think of the long term growth opportunities in advertising? How long can it grow two to three times the App Store growth rate. And also, are there any applications where your fundamental search technology (AI infused? I that right?) can be adapted for other parts of the services business? That’s the first question and another quick follow up from Luke after that.

Tim Cook, CEO

The search advertising business is going well it’s a, you know, there’s lots of intent from search. And we do it in a very private kind of manner, observing great privacy and policies and so forth. And I think people see that and are willing to try it out and we have been growing nicely in that area. It’s a part of the advertising area that Lucas spoke of earlier.

Krish Sankar, Cowen

Thanks Tim, I’m going to follow up for Lucas. In the March quarter in China, we typically see a bump into gaming downloads during Chinese New Year. So, should we see a similar trend this time around that we think that the pandemic and people seeing permanent home. That kind of seasonal bump might not happen in China for gaming numbers.

Lucas, CFO

Yeah, I mean, I think I was mentioned it during the prepared remarks. …clearly in China the March quarter is typically the strongest quarter for our services business and for the App Store, because the Chinese New Year, as you mentioned, and last year. What, what we saw was an increased level of activity because after Chinese New Year the whole country went into lockdown for several weeks and so that propensity for playing games continued for several weeks more than a typical cycle. So, we expect, you know, to have a great quarter in China but at the same time, you need to keep in mind that you know the compare is going to be particularly challenging because, because what happened a year ago.

Chris Caso, Raymond James

First question is on iPhone ASP. And I know you don’t disclose the numbers there but I wonder if you could speak about it, qualitatively. You spoke about the richer mix but there were also some price differences as compared to a year ago, iPhone 12 came in at a higher price point. The Pro established a new price point. Can you speak to how that you know the level of benefit that you just saw there? And going forward are you confident that you can continue to improve the mix in iPhone going forward?

Luca Maestri, CFO

So, as I said earlier, we grew iPhone revenue 17%, and that growth came from both unit sales and ASPs, because, because of the strong mix that I mentioned before, so I think that answers your question for the December quarter.

What we’ve seen so far, it’s very early because we launched the new products only a few weeks ago, what we’ve seen so far is a very high level of interest for the Pro and the Pro Max. We worked very hard to ramp up our, our supply. We had some supply constraints during the December quarter, we think we’re going to be able to solve them during the March quarter. But so far the mix has been very, very strong on iPhone.

Chris Caso, Raymond James

As a follow up question, if you could talk a bit to the benefits that you may have seen from some of the carrier active actions. some very aggressive trade ins during the quarter. Did that provide a benefit in your view on units or mix or perhaps both? And what would be the level of permanence that you would see in some of those actions such that, you know, if those subsidies were removed could that potentially be a headwind going forward?

Tim Cook, CEO

I think subsidies always help. Anything that reduces the price to the customer is good for the customer and obviously good for the carrier that’s doing it and good for us as well and so it’s a win across the board. I

believe that at least based on what I see right now is that there would be probably continuing to have quite a bit of competition in the market if you’re talking about the US market for customers as the carrier’s work to get more customers to move to 5G.

Outside of the US, subsidies are not used in all geographies and so it really varies greatly by country, you know, some of them separate completely the handset and the service and in those areas we don’t have subsidies.

Jim Suva, Citigroup

Thank you very much. It’s amazing how your company has pivoted and progressed through this uncertain time in society. A lot of the pushback we get on our view on Apple is that everyone around them or that they know in developed countries has an iPhone or Apple product in the market is kind of being saturated some, but when I look at other countries like India I believe statistically you are materially below that, in market share. So are you doing active efforts there? It seems like there’s been some news reports of maybe supply chain there, or opening up an Apple Stores. How should we think about that and it just seems like really not full market share equally around the world.

Tim Cook, Apple

There are several markets as I alluded to before, India is one of those, where our share is quite low: it did improve from the year ago quarter, (when) our business roughly doubled over that period of time and so we felt very good about the trajectory. We are doing a number of things there, we put the online store there for example and last quarter was the first full quarter of the online store and that has gotten a great reaction and has helped us achieve the results that we that we got to last quarter. We’re also going in there with retail stores in the future, and so we look for that to be another great initiative, and we continue to develop the channel as well. And so there’s lots of things, not only in India, but in several of the other markets that you might name, where our share is lower than we would like. Again, I would also say, even in the developed markets — when you look at our share, definitely everybody doesn’t have an iPhone, not even close, and so we really don’t have a significant share in any market. There’s headroom left, even in those developed markets where you might hear that.

Meeting ends.

If you enjoyed this transcript feel free to send me a cup of coffee via PayPal. It’s tough here at the moment. It’s tough everywhere, if we’re honest. Though not, by the looks, at apple.

Please follow me on Twitter, or join me at the Apple Discussions group on MeWe.