Mac v. PC: Apple up, market down — Counterpoint

Slowly the flowers are coming out

Counterpoint Research is out the block with its own data, which supports a previous IDC PC market analysis that Apples Mac sales have climbed even as the market declined.

Mac v. PC: Apple up, market down — Counterpoint

The report claims PC shipments slipped 4.3% YoY in Q1 22 to hit 78.7 million units. Apple’s M-series Macs, however, continue to push company fortunes higher, shifting 7.1 million units in the period, up from 6.6m the year before.

There are headwinds impacting most of the industry, the data shows, not least components shortages, logistics challenges and continued intermittent COVID-19 lockdowns

“Order backlog from 2021 continued to contribute substantially to PC shipments in the beginning of 2022,” they said.

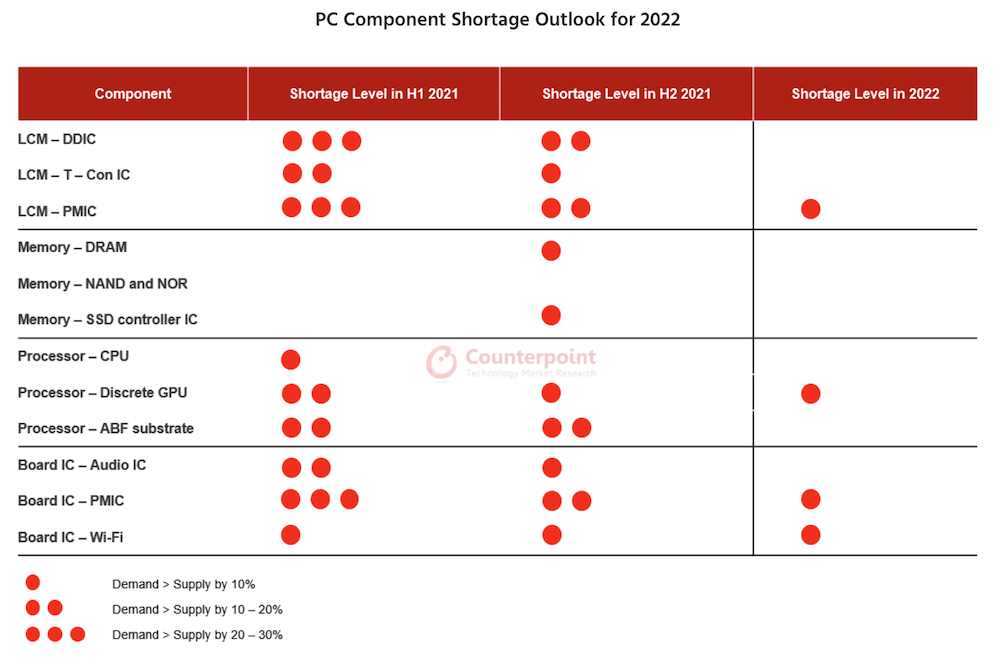

Component shortages are improving

“Our checks suggest the PC supply chain turned relatively conservative on shipment outlook in the middle of Q1 2022, largely dragged by global inflation and regional conflict, which brought uncertainties to PC demand and blurred the overall PC shipment momentum ahead. The overall PC shipments in 2022 are expected to be shy of our forecasts made at the end of 2021.”

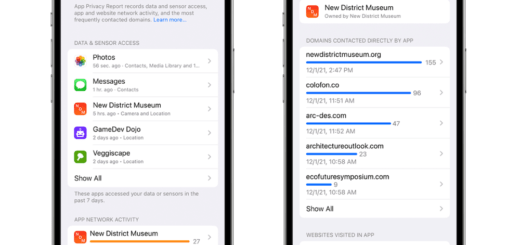

Analysts claim component shortage is abating

There is good news in that Counterpoint think component shortages will abate this year. The supply gap for the most important components such as power management ICs, Wi-Fi and I/O interface IC has narrowed, they said. They also see the supply chain building up component inventory to help manage logistical challenges.

Some vendor specific highlights

- With 18.2m units, Lenovo kept 23.1% share, which was down 9.5% compared to 2021.

- HP retained second position with 20.2% share but saw a 16% YoY decline as Chromebook shipments waned.

- Dell went up 1% to sell 13.8m PCs.

- Apple saw 8% YoY shipment growth in Q1 2022.

- Acer struggled due to Chromebook sales losing momentum and ended the quarter with a 1% shipment decline.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.