Morgan Stanley ‘bullish’ that iPhone 13 sales will climb

In her latest client note, Morgan Stanley analyst, Katy Huberty, says Apple’s iPhone 13, iPad and other announcements renewed her confidence to expect strong iPhone sales over the next year.

Many catalysts for growth

She pointed to several catalysts to justify her expectation of such growth:

- iPhone pricing remains unchanged

- The new 1TB storage should drive growth

- Higher iPhone trade-in values along with more aggressive carrier promotions will make iPhone 13 “more affordable for consumers”.

- 5G remains a key driver with just 5% of Apple’s installed base of iPhone users now in possession of a 5G device.

“When combined with iPhone replacement cycles that remain elongated, 5% 5G adoption within the iPhone installed base, fully reopened retail stores, and elevated iPhone backlog entering FY22, we remain bullish on the prospects for iPhone growth in FY22, with the potential for upside vs. our current iPhone ASP forecast (-1% Y/Y).

Check demand this weekend

Huberty will now be monitoring early iPhone demand trends as Apple begins taking pre-orders for iPhone 13. “We also expect international retailer/carrier reports on iPhone 13 pre-orders to begin trickling in over the weekend.

“Should early reports indicate elevated iPhone demand vs. low buy-side expectations, we’d expect Apple shares to outperform in the near-term,” she said, “Especially given the iPhone’s stronger inventory/supply chain positioning vs. smartphone peers.”

What consumers want

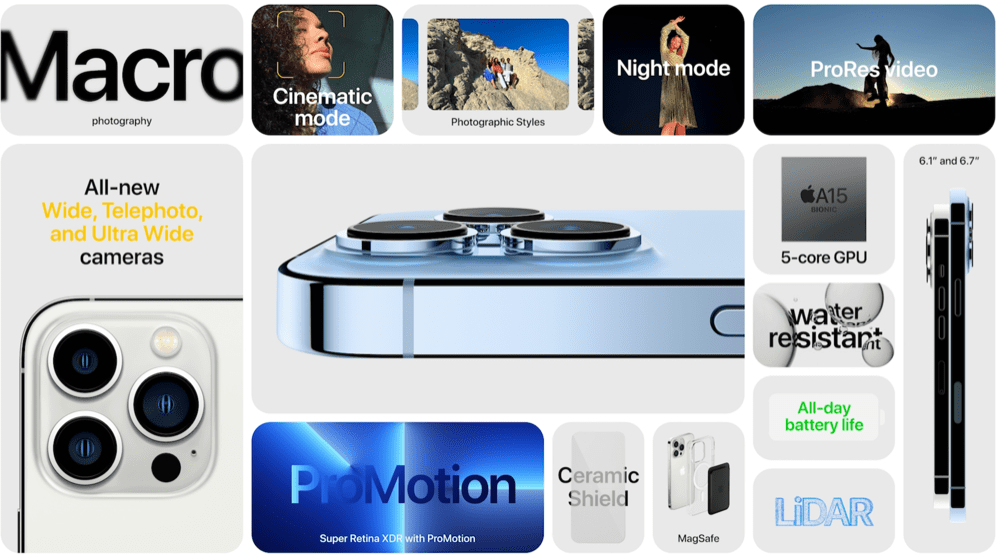

The analyst took now of how Apple’s improvements to the iPhone 13 have met the enhancements consumers most wanted to see. To support this argument she shared proprietary survey data that showed the top three improvements they most wanted were (in order of priority): 5G, a better camera and increased battery life.

Apple delivered all three.

“While none of the upgrades were unprecedented, we think it is notable that these improvements focus on the features consumers care about most,” she said.

Many camera improvements

Some prices even fell

Huberty also had insight on pricing:

“While other consumer hardware companies are raising prices to offset component cost inflation and rising freight and logistics costs, Apple kept like-for-like iPhone 13 pricing mostly unchanged from the iPhone 12 models launched last year, in line with our expectations.

“At the low end of the new model portfolio, the iPhone 13 mini and iPhone 13 128GB/256GB SKUs are $50 cheaper than their predecessors, while at the high end, the iPhone 13 Pro and iPhone 13 Pro Max are priced the same as their comparable iPhone 12 Pro/Pro Max SKUs.”

Covid-19 is not over

On Covid-19’s impact on the supply chain, the analyst notes claims that production delays had cropped up during manufacture of the Apple Watch Series 7. Unfortunately, COVID-related travel restrictions slowed down Apple’s ability to respond to these last minute challenges. “The lack of immediate availability or a concrete Series 7 ship date seems to confirm a slower production ramp, but it is unclear how exactly this will impact shipment timing,” she said.

I’ve been tracking analyst responses in this report here. Please let me know if you have more you wish to add.

Please follow me on Twitter, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.